Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 42, 19/10/2022 - 25/10/2022)

Aave released GHO technical paper and first audit findings. MakerDAO voted in favour of founder’s ‘Endgame Plan’. NEAR Foundation to end USN stablecoin.

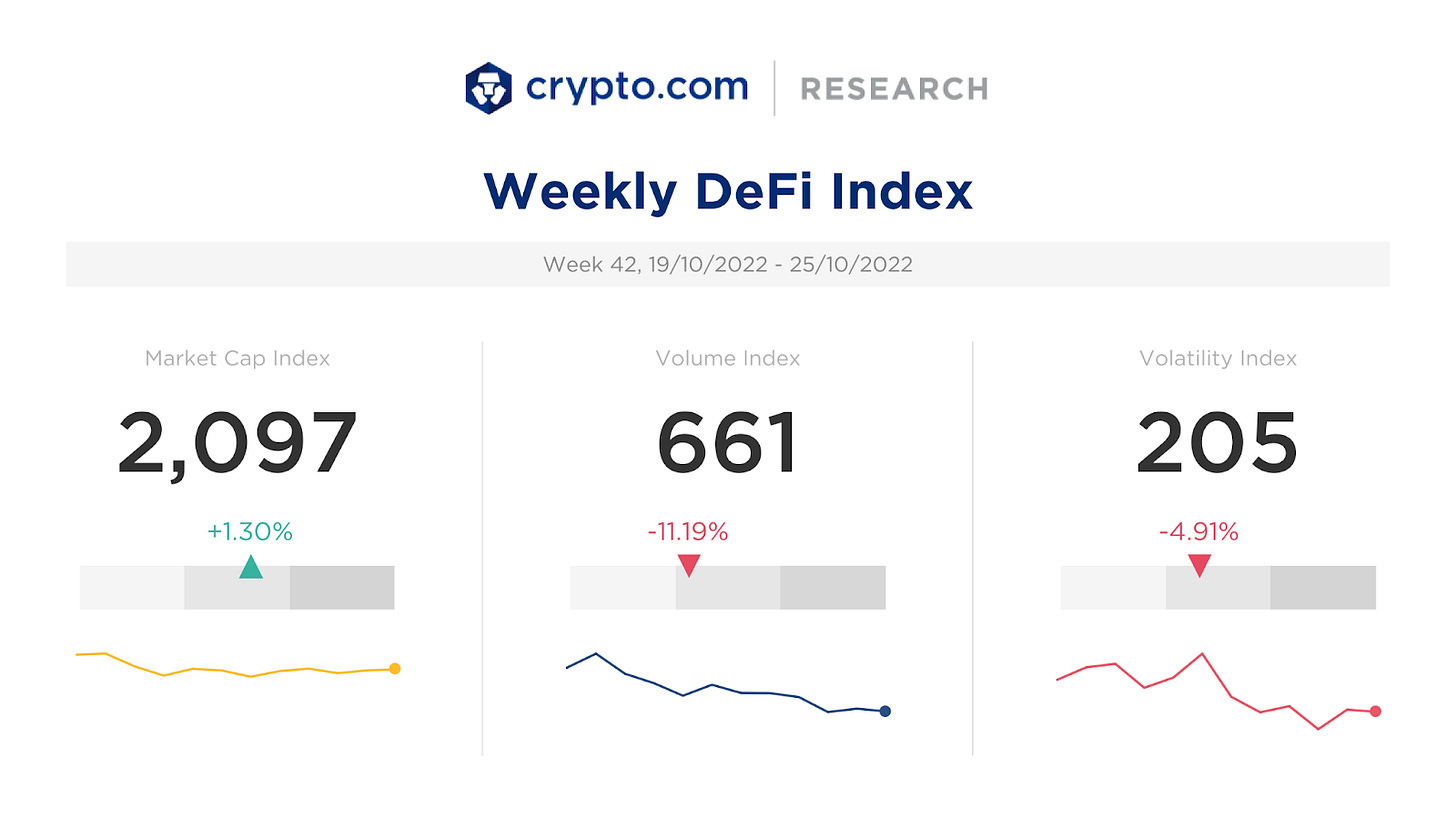

Weekly DeFi Index

This week's market cap index was positive at +1.30%, while volume and volatility indices were negative at -11.19%and -4.91%, respectively.

Check the latest prices on Crypto.com/Price

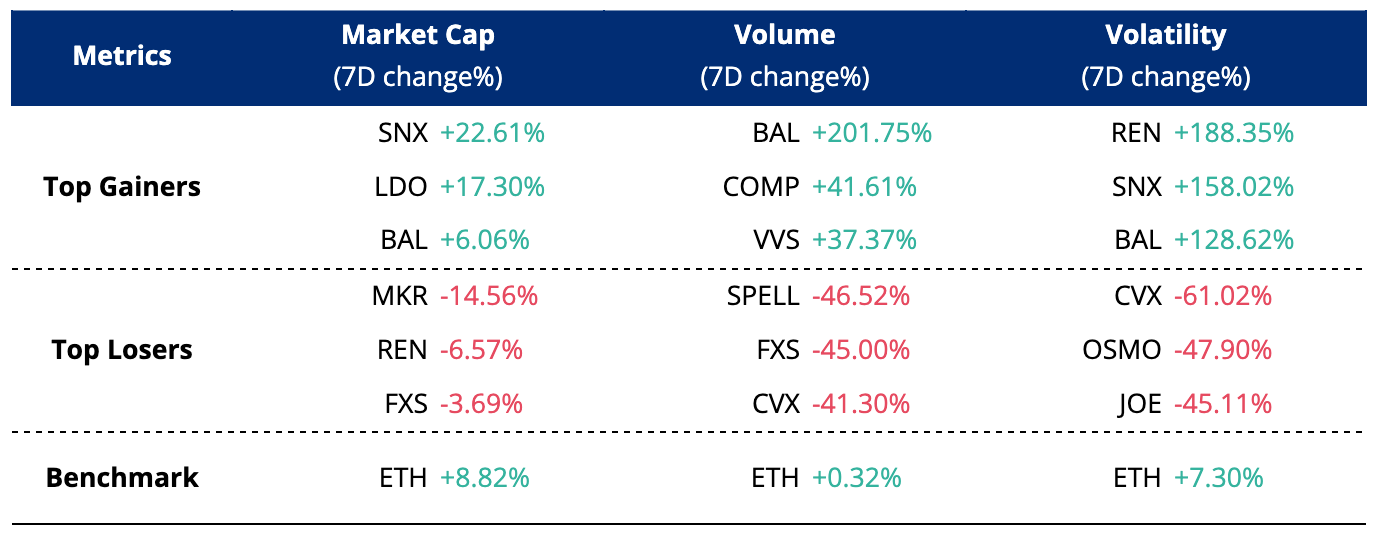

DeFi Index Tokens

*DeFI index tokens: AAVE, BAL, CAKE, COMP, CRV, CVX, FXS, JOE, LDO, LINK, MKR, OSMO, REN, SNX, SPELL, SUSHI, UNI, VVS, YFI.

News Highlight

Decentralised lending protocol Aave released a technical paper on its upcoming GHO stablecoin, along with the results of its first security audit conducted by security firm Open Zeppelin. GHO was proposed and passed in July this year, with 99.9% of community votes in favour of launching the coin. The code audit found two medium-severity bugs in the codebase; however, there were no critical or high-severity bugs found.

MakerDAO votes in favour of founder Rune Christensen’s ‘Endgame Plan’, one designed in the hopes of improving protocol governance mechanisms and making it more decentralised. It involves restructuring the DAO into smaller teams dubbed MetaDAOs, where each will have its own governing token and aligned mission.

NEAR Foundation will shut down its USN stablecoin, an update that comes after the network suffered a US$40 million ‘collateral gap’. In light of this event, it also launched the USN Protection Programme to support the digital asset’s wind-down and fully cover this collateral gap, ensuring eligible USN holders can redeem their USN on a 1:1 basis with USDT.

Polygon-based decentralised exchange QuickSwap recently announced plans to close its lending platform following a flash loan exploit. The attack took place on the Market XYZ lending market, and over $220,000 worth of tokens were reportedly stolen. QuickSwap confirmed that the hacker has returned the stolen funds and that the vulnerability exploit did not affect its smart contract.

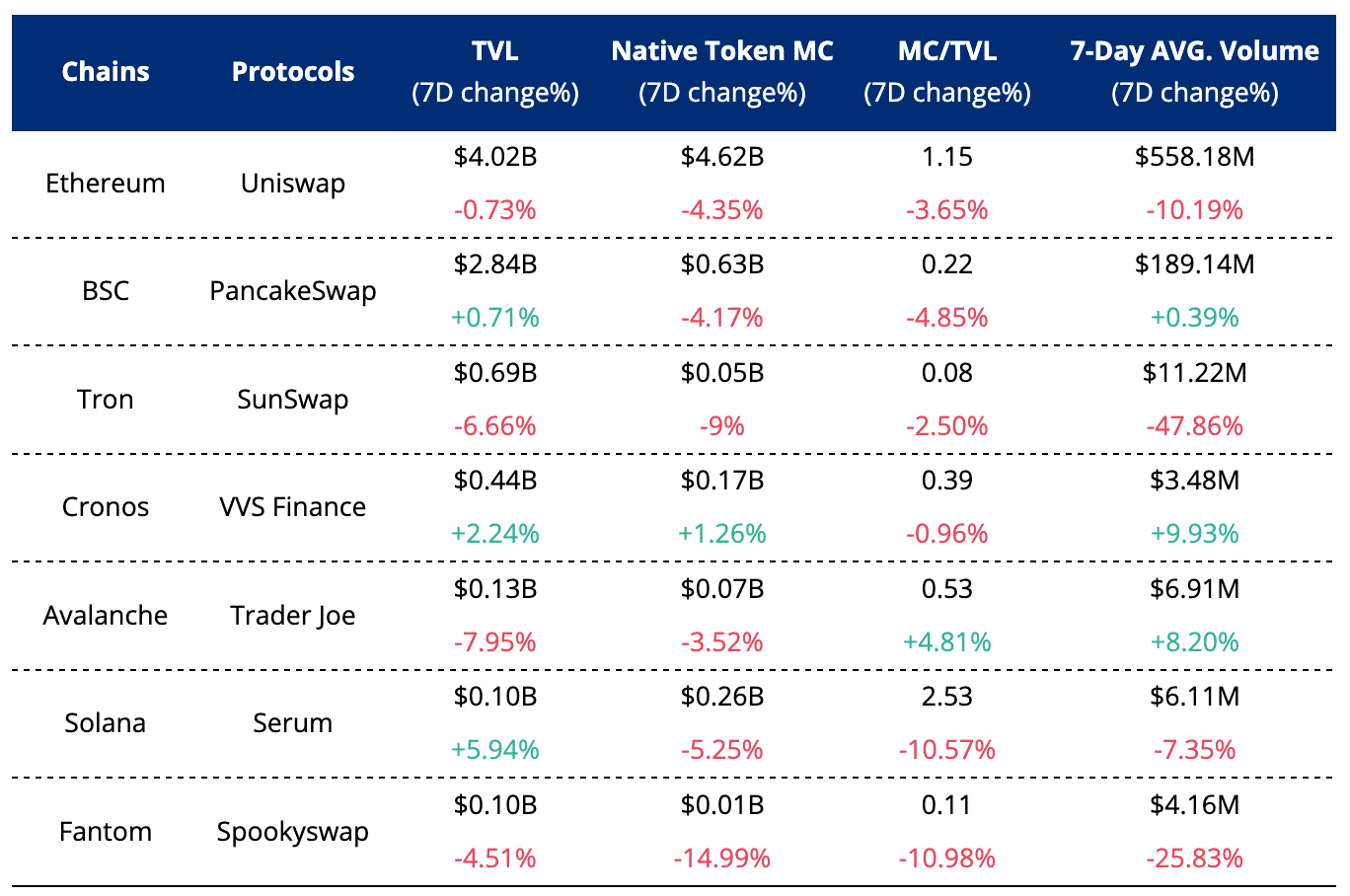

DEX Protocols Metrics

Sources: CoinGecko, DeFi Llama, Crypto.com Research

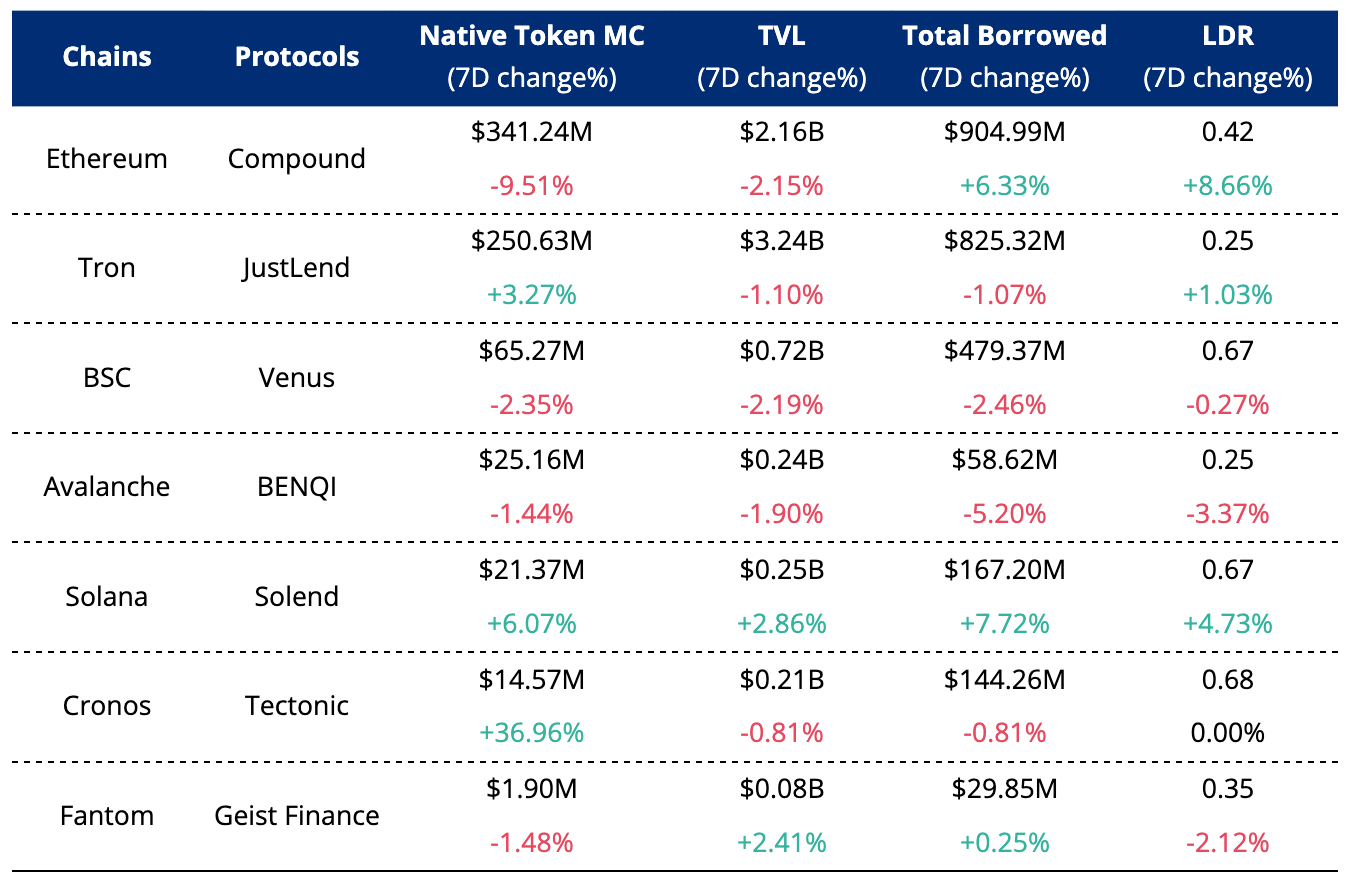

Lending Protocols Metric

*LDR (Loan to Deposit Ratio) = Total Borrowed / TVL

Sources:CoinGecko,DeFi Llama,Crypto.com Research

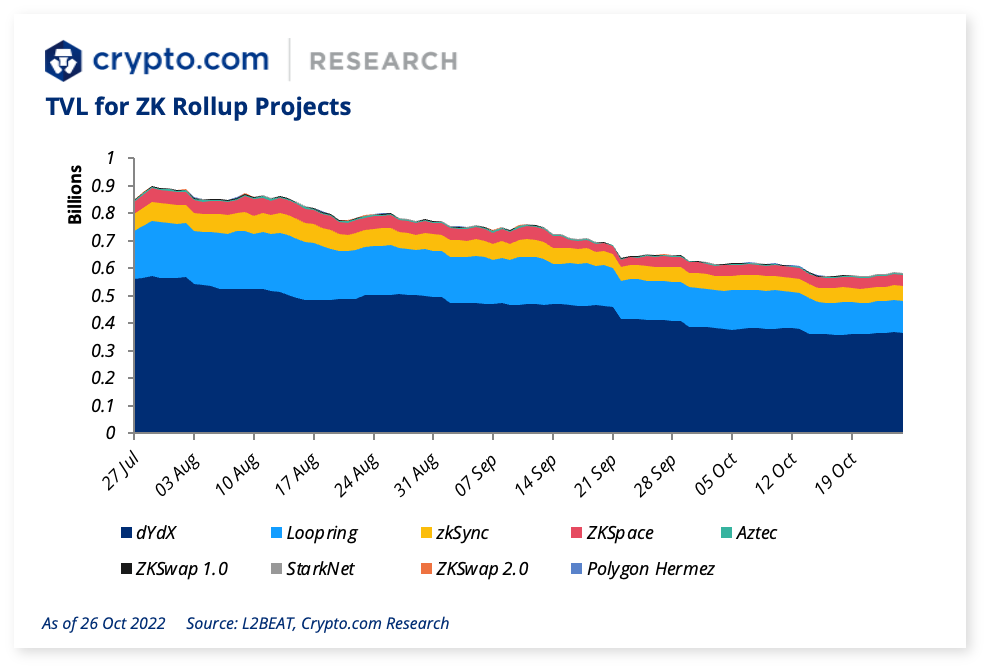

Charts on Layer-2 Projects

The overall L2 market remained at the same level last week, as its TVL rose slightly by +0.41%. Optimistic rollup and zero-knowledge rollup projects jumped +0.79% and +1.21%,respectively. Ethereum’s TVL change was positive at +4.23%.

The TVL changes for all optimistic rollup projects were all slightly positive except for Metis Andromeda (-0.86%). Optimism surged the most at +0.87%.

ZK rollup projects’ TVL movement was a mixed bag: StarkNet saw the highest growth at +34.20%, while Loopring plummeted the most at -2.57%.

Further Reading

zkSync rolls out critical testnet integration for its validity proofs ahead of mainnet

Circle partners with Axelar on cross-chain initiative for USDC

Umee: Mainnet upgrade to unlock the full potential of the Cosmos ecosystem

Q3 update: Bitcoin mining now consumes 0.16% of the global energy production

Ankr becomes one of the first RPC providers to the Aptos blockchain

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!