Crypto.com Weekly DeFi Update (Week 20, 16/05/2022 – 22/05/2022)

65.90% of voters favour a $LUNA hard fork. South Korean parliament summons Do Kwon. $USDT and $USDC boost transparency efforts. $DEI loses peg.

Key Takeaways

The Terra (LUNA) blockchain is heading for version 2.0, with 65.90% of the voters favouring a hard fork at the time of writing. The Luna Foundation Guard plans to compensate UST holders with its remaining funds.

Do Kwon is summoned to a parliamentary hearing as politicians inquire further details about the LUNA incident and its aftermath.

Tether (USDT) shrinks the portion of commercial paper in its reserves by 17%, while Circle commits to transparency with weekly USDC reports.

Deus Finance’s DEI became the latest algorithmic stablecoin to lose its dollar peg, and plummeted to 55 cents. As of 22 May 2022, DEI is trading at about US$0.70.

This week’s price, volume, and volatility indices are negative at -1.40%, -52.00%, and -56.92%, respectively.

Highlights

Terra’s amended revival plan would decrease the allocation for post-attack UST holders

Fantom’s SCREAM Falls 50% After Algorithmic Stablecoins Cause Bad Debt

Anchor saw $1 billion of liquidations during UST and Luna's death spiral

Crafting Finance brings synthetic asset issuance and trading on NEAR

Curve Finance community initiates proposal to stop incentivising UST pools with CRV

Institutional DeFi enabler? Data firm Kaiko probes DEX liquidity with new product

Justin Sun still thinks algorithmic stablecoins are a good idea

SWIFT, Capgemini team up to test using the international network for CBDC transfers

Check the latest prices on Crypto.com/Price

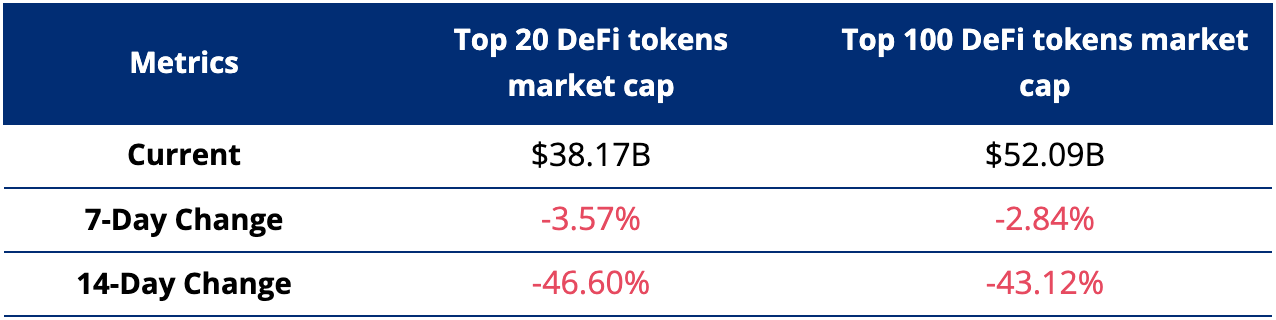

Top Token Metrics

*Top DeFi tokens based on CoinGecko

Source: CoinGecko

DeFi Index Tokens

*DeFI index tokens: AAVE, BAL, CAKE, COMP, CRV, CVX, FXS, JOE, LDO, LINK, MKR, OSMO, REN, SNX, SPELL, SUSHI, UNI, VVS, YFI

DEX Metrics

* % change is based on the difference between two consecutive weekly periods

** Omitted due to incomplete source data

Sources: CoinGecko, DeFi Llama, Nomics

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!