Crypto.com Weekly DeFi Update (Week 19, 09/05/2022 – 15/05/2022)

$USDT briefly loses peg. Celsius Network reportedly removes $500M from Anchor. Do Kwon publishes a ‘Terra Ecosystem Revival Plan’.

Key Takeaways

Tether (USDT) briefly lost its dollar peg this week, dipping as low as US$0.95 on Thursday as the collapse of LUNA and UST shook the market’s confidence. However, the $1 peg was restored by Friday. At the time of writing, USDT is trading slightly under $1, at $0.9989.

Celsius reportedly removed at least $500M from Anchor during the recent UST turmoil. Founder Alex Machinsky took to Twitter to deny recent rumours of losses as a result of market volatility.

UST’s depegging continued this week, with LUNA falling to below $0.01. Do Kwon published a Terra Ecosystem Revival Plan over the weekend which aims to lay out the way forward for the ecosystem.

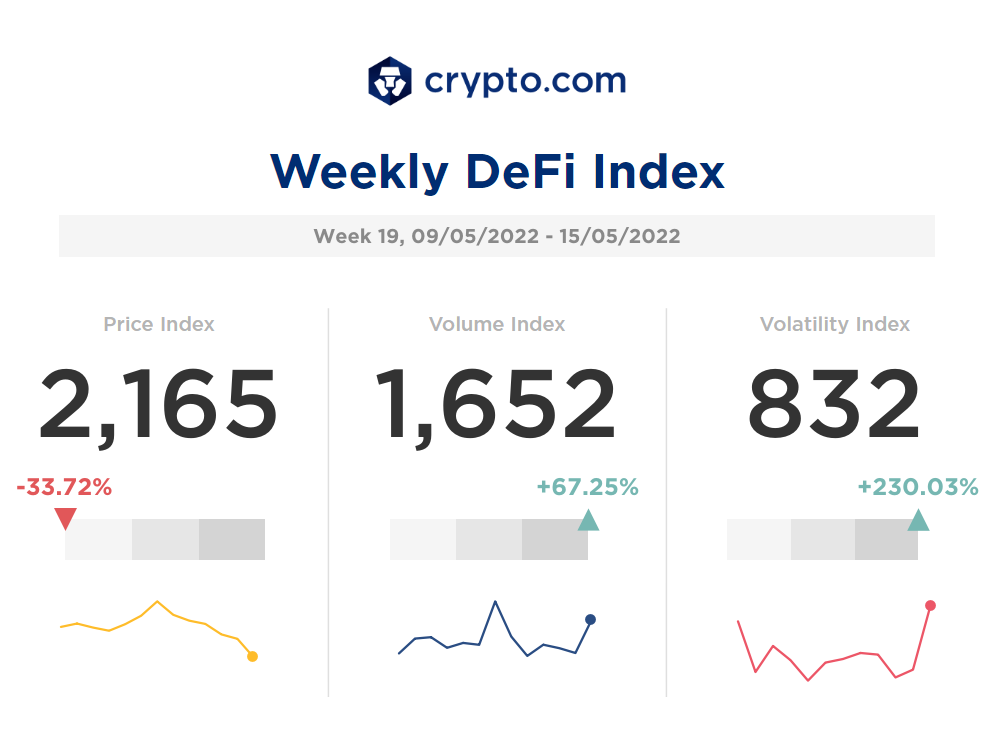

This week’s price index was negative at -33.72%, while the volume and volatility indices were positive at +67.25% and +230.03% respectively.

Highlights

Lido Warns Leveraged Traders at Risk of Liquidation as 'Staked Ethereum' Loses Peg

Lido Deploys Additional Curve Pool to Improve Liquidity Around Bonded ETH Peg

UST’s Do Kwon was behind earlier failed stablecoin, ex-Terra colleagues say

Tether to move over 1B USDT from Tron to Ethereum and Avalanche

Blockchain analytics provider Nansen integrates and invests in DeFi data app APY.vision

Aurora launches $90 million developer fund to boost DeFi on NEAR Protocol

Over $1.2 billion in bitcoin reserves remains unaccounted for by Luna Foundation Guard

Blizz Finance protocol drained after Chainlink pauses LUNA oracle

Check the latest prices on Crypto.com/Price

Top Token Metrics

*Top DeFi tokens based on CoinGecko

Source: CoinGecko

DeFi Index Tokens

*DeFI index tokens: AAVE, ANC, BAL, CAKE, COMP, CRV, CVX, FXS, JOE, LDO, LINK, MKR, OSMO, REN, SNX, SPELL, SUSHI, UNI, VVS, YFI

Notable Events

Anchor contributors consider cutting UST yield to 4% from 19.5%

Lido Increases Liquidity Incentives as stETH Trades at Discount to ETH

DEX Metrics

* % change is based on the difference between two consecutive weekly periods

** Omitted due to incomplete source data

Source: CoinGecko, DeFi Llama, Nomics

Notable Events

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!