Crypto.com Weekly DeFi Update (Week 50, 13/12/2021 - 20/12/2021)

Top 100 DeFi token market caps climbed by 1.9%. Green light for $UNI v3 contract on Polygon, $USDC launched on AVAX.

Key Takeaways

Uniswap (UNI) v3 contract deployment on Polygon (MATIC) was approved by the DAO with 99.3% consensus this week. This will be supported by a USD20m fund for a long-term liquidity mining campaign and general adoption of Uniswap on Polygon (ref).

Circle successfully launched their USDC stablecoin on Avalanche (AVAX) this week (ref).

A report by Chainalysis revealed that investors have lost a total of $2.8B to rugpulls over the course of 2021 (ref).

This week’s price and volatility indices were positive at +0.36% and +1.66% respectively, while the volume index was negative, at -16.46%.

Highlights

Uniswap v3 contracts deployment on Polygon approved with 99.3% consensus

Polygon and Reddit co-founder's VC launch $200 million Web3 initiative

YFI Skyrockets 30% as Yearn Finance Announces Aggressive Buy-Back Program

Polygon launches Layer 2 token swap and decentralised exchange aggregator

YFI price gains 46% in just four days after Yearn Finance's $7.5M buyback

Terra Becomes Second-Biggest DeFi Platform (Behind Only Ethereum)

Check the latest prices on crypto.com/price

*DeFi dominance is defined as the total market capitalisation of DeFi coins as a percentage of that of all currencies (including DeFi coins), based on Coingecko’s data. See Coingecko’s definition of dominance for more information. Source: CoinGecko

Notable Events

Loopring (LRC) to a host trading competition this week with $600k in prizes (ref).

YFI saw a 46% price increase shortly after Yearn Finance’s $7.5M buyback (ref).

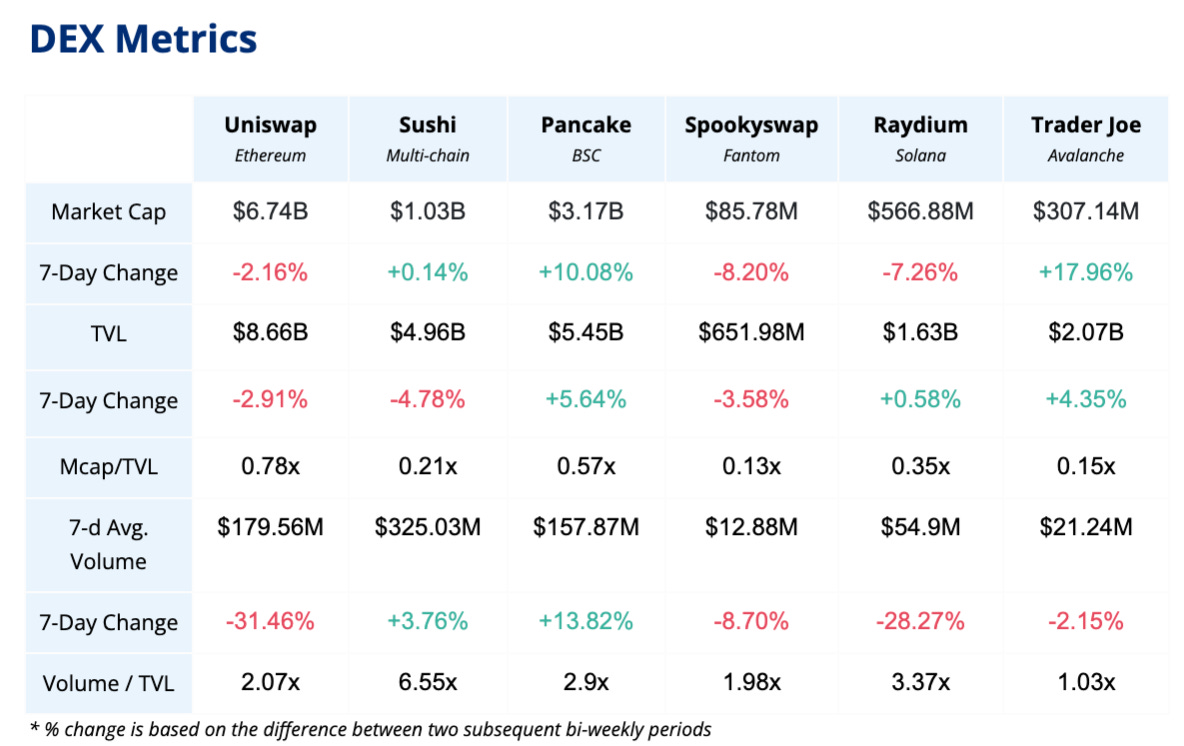

Source: CoinGecko, StakingRewards, DeFi Llama

Notable Events

TVLs held reasonably stable across different DEXes this week after last week’s declines. Trader Joe saw a +17.96% increase in market capitalisation.

Uniswap DAO votes to deploy v3 contracts on Polygon (ref).

Trader Joe’s Cultivation Club Circular #4 released (ref).

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!