Crypto.com Weekly DeFi Update (Week 5, 01/02/2021 - 07/02/2021)

Top 100 DeFi tokens’ market cap recorded new high of $68.8B; TVL hit $35.2B

Market Recap

According to CoinGecko, the top 100 DeFi tokens’ market capitalization hit new highs of $68.8B on Saturday. At the time of writing, TVL pulled back to $61.4B as the price of ETH retraced below $1,600. DeFi token dominance currently sits at 5.36%.

According to DeFi Pulse, the total value locked (TVL) in DeFi climbed from $27.0B to new highs of $35.2B from Monday to Saturday. At the time of writing, the TVL retraced to $33.6B, while the amounts of ETH and BTC locked in DeFi respectively recorded local highs of 7.6M and 50K.

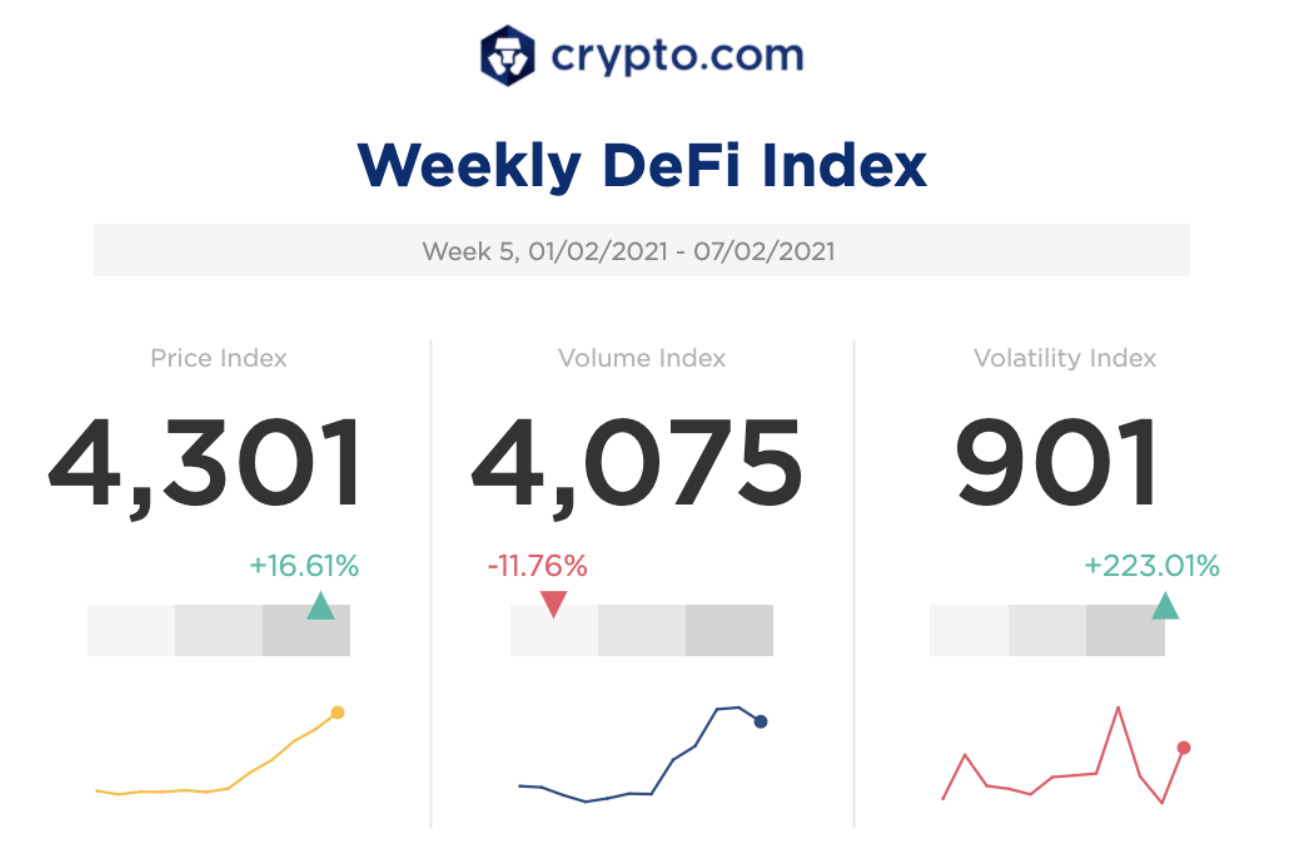

Overall, the price index and the volatility index respectively soared by 16.1% and 223.01%, while the volume index plunged by 11.76%.

Check the latest prices on crypto.com/price

Spotlight of the Week

Balancer launching V2 upgrades

Balancer, a popular Automated Market Maker (AMM), recently announced its v2 upgrade. According to the official announcement, the main architectural improvement is the transition to a single vault that holds and manages all the assets added by all Balancer pools. One potential benefit of the upgrade is to attain higher gas efficiency. In the current version, trading with two or more pools is gas inefficient since users have to send and receive ERC20 tokens from all pools. In V2, only the final net token amounts are transferred with the single vault, reducing a substantial amount of gas in the process. This new upgrade is expected to launch next month.

Price Index

All tokens, except for UNI (-4.85%), increased in price.

Top 3 gainers: UMA (+152.14%), MKR (+58.72%), NXM (+48.03%)

Universal Market Access (UMA) has announced plans for some new products. In a collaboration with Yam Finance, they are going to release a uVol-BTC product that allows traders to speculate on the increase or decrease in volatility, or hedge their Bitcoin positions. Besides, UMA is launching a new synthetic token named 'uSTONKS', which would be based on the ten most commented stocks on the r/wallstreetbets Reddit forum. It provides traders an opportunity to profit from the most popular stocks among retail investors.

According to DeFi Pulse, the TVL in Maker recorded an all-time high of $6.14B on Saturday. At the time of writing, its TVL dominated 16.83% of the DeFi space, ranking first among all DeFi protocols.

In terms of fundamentals, Nexus Mutual recorded a parabolic growth in the total premiums paid and the active cover amount, which respectively grew by around 10 times and 3 times since the beginning of 2021. It has also started offering insurance for holdings on custodial exchanges.

Volume Index

Top 3 increase: UMA (+1107.51%), MKR (+129.33%), REN (+91.14%)

Top 3 decrease: NXM (-98.64%), UNI (-62.39%), LINK (-8.22%)

Volatility Index

All tokens, except for CRV (-20.33%) and UNI (-2.64%), increased in volatility.

Top 3 increase: UMA (+1408.78%), MKR (+1058.6%), AAVE (+424.72%)

Top DeFi News

One Big Pool: Balancer’s New Version Cuts Down Transactions and Gas Fees

0x Labs Closes $15M Fundraising Round as ZRX Finds DeFi Market

FitDecentralized Exchange Volumes Hit Record Above $50B in January

Theta blockchain launches first decentralized exchange dubbed ThetaSwap

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!