Crypto.com Weekly DeFi Update (Week 48, 29/11/2021 - 05/12/2021)

Price & volume indices dive, volume up. TVLs & market caps of all DEXes drop, miracle recovery of 602% by PancakeSwap.

Key Takeaways

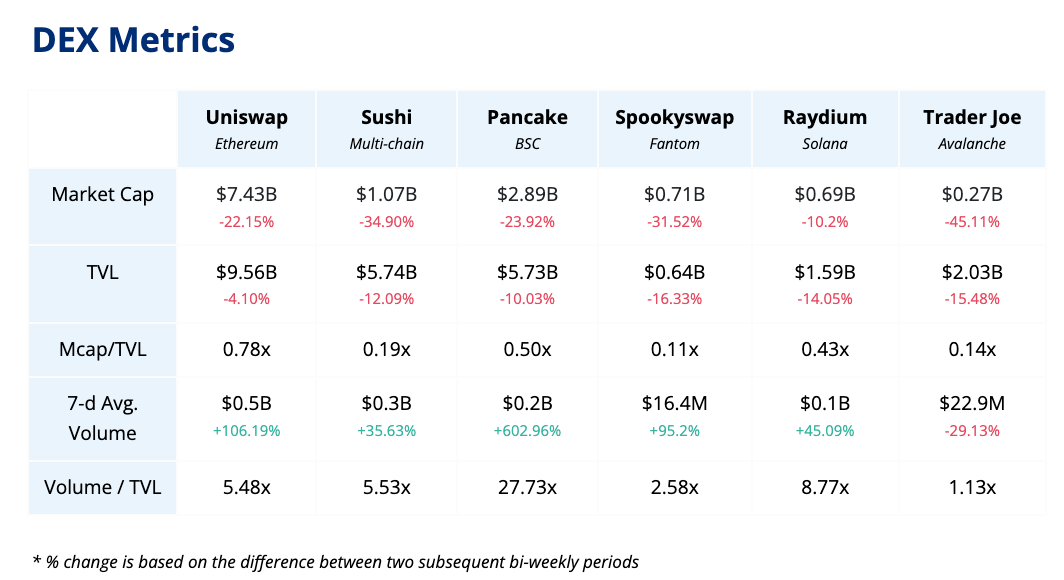

While all DEXes showed negative numbers for TVL and market cap with the exception of TraderJoe, all booked an increased 7-day average change. Uniswap and PancakeSwap even showed triple digit recovery.

On the DeFi index, only NXM showed positive price movement.

BadgerDAO has suffered a $120M exploit, with CeFi firm Celsius reportedly being affected. (ref, ref).

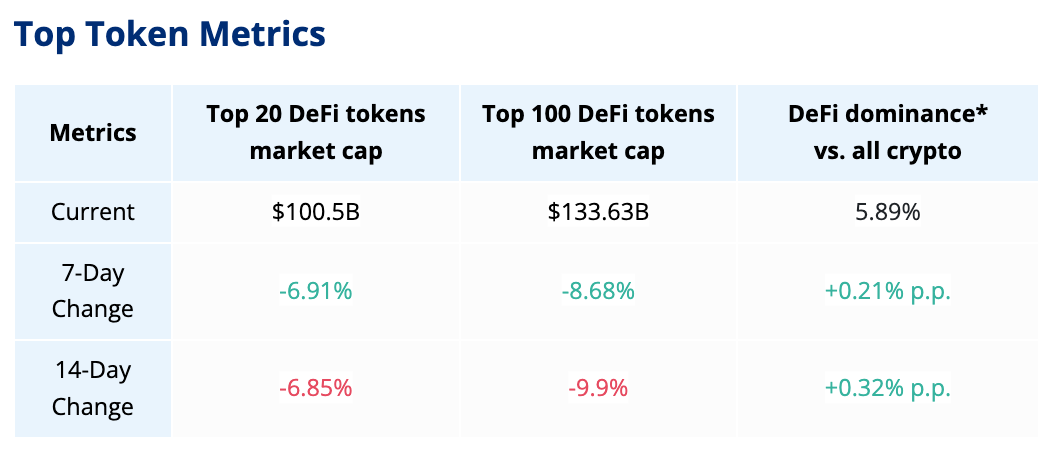

The total value locked (TVL) across all Ethereum DeFi platforms has decreased to $100.57B, according to DeFi Pulse, down from $106B last week. According to DeFiLlama, the TVL for all DeFi platforms is at $249.75B, down from $265.9B last week.

Overall, DeFi volume and price indices were negative at -16.78%and-24.73%, while volatility jumped +24.03%.

Highlights

Crypto.com to sponsor Latin America’s leading soccer competition

Crypto lending firm Celsius reportedly affected in BadgerDAO exploit

Panther Protocol raises over $22 million to unlock siloed defi value between public blockchains

Former Citi banker launches $1.5B crypto fund, taps Algorand as first partner

Borderless Capital launches half billion dollar fund for Algorand projects

Hxro raises $34M on promise of derivative trading infrastructure for Solana

Avalanche ecosystem accelerator raises $18.5M in seed funding

Neptune Mutual raises seed round led by Fenbushi Capital to build decentralised Cover protocol

Structure raises $20m to make DeFi mainstream and mobile-friendly

IOTA launches assembly, a multi-chain smart contract platform

IDEX to launch hybrid liquidity decentralised exchange on Polygon

Check the latest prices on crypto.com/price

*DeFi dominance is defined as the total market capitalisation of DeFi coins as a percentage of that of all currencies (including DeFi coins), based on Coingecko’s data. See Coingecko’s definition of dominance for more information. Source: CoinGecko

Notable Events

Badger DAO protocol suffers $120M exploit. (ref)

Orion Money now live on Polygon. (ref)

Other Internet announces $1M grant from UniSwap Grants program. (ref)

Aave’s Kulechov takes the stage at Slush HQ conference to discuss all things Web3.0. (ref)

Introducing Bancor 3. (ref)

Source: CoinGecko, StakingRewards, DeFi Llama

Notable Events

The TVL and market cap of all DEXes decreased between -45.11% (Trader Joe) and -4.10% (UniSwap) this week.

However, all DEXes aside from TraderJoe showed an increased 7-day average volume, with the most recovery shown by PancakeSwap at +602.96%.

This week, PancakeSwap completed its IFO (Initial Farm Offering) with Santos FC. (ref)

SpookySwap’s Development Update #7 launched. (ref)

Avalanche data is now available on Nansen, the L1 platform also launched support for Fireblocks and officially welcomed Alpha Finance Lab (ALPHA) to join Avalanche Rush with $6M allocation. (ref, ref, ref)

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!