Crypto.com Weekly DeFi Update (Week 47, 22/11/2021 - 28/11/2021)

Price index is down, volume & volatility indices are up. Vitalik Buterin proposes EIP-4488

Key Takeaways

SpookySwap and Trader Joe outperform their peers, posting triple-digit average volumes during the 7-day period, and engaged in continued collaboration with various other DeFi protocols to provide a range of yield opportunities for their users.

Cronos has surpassed $1Billion TVL 3 weeks since the Mainnet Beta launch

Vitalik Buterin proposes EIP-4488 which lowers gas fees for L2 solutions in the short term to “incentivize an ecosystem-wide transition to roll-up centric Ethereum”. (ref)

The total value locked (TVL) across all Ethereum DeFi platforms has grown to $106.59B, according to DeFi Pulse, up from $104B last week. According to DeFiLlama, the TVL for all DeFi platforms reached $265.9B, up from $261B last week.

Overall, DeFi price index was negative at -10.45%, while volume and volatility was positive at +23.18% and +24.50%, respectively.

Highlights

Tether, Circle hit with information requests from U.S. Senator

Elrond leapfrogs into DeFi’s top 10 as users chase ridiculously large incentive program

Celsius (CEL) announces massive $750 million funding for its ecosystem

Moonbeam wins the second Polkadot Parachain Auction contributing 35 million DOT

Botto partners with Ohm Protocol to offer BOTTO-ETH Bonds on Olympus Pro

Flurry Finance deploys on Polygon after hitting $3 million TVL in just a month of launch

Check the latest prices on crypto.com/price

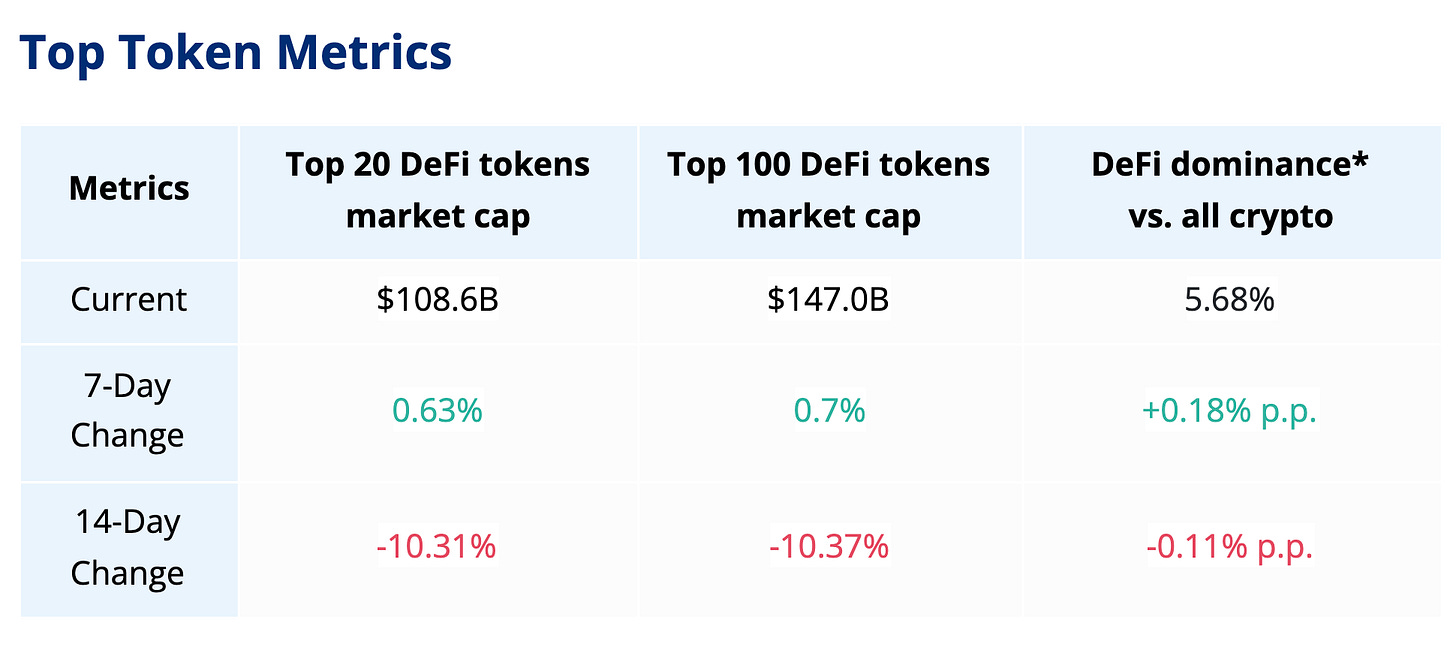

*DeFi dominance is defined as the total market capitalisation of DeFi coins as a percentage of that of all currencies (including DeFi coins), based on Coingecko’s data. See Coingecko’s definition of dominance for more information. Source: CoinGecko

Notable Events

DeFi protocol Moonbeam wins Polkadot’s second parachain auction with $1.4B pledged. (ref)

C3 Protocol raises $3.6M for cross-margining layer led by Arrington Capital and Jump Capital. (ref)

DeFi Privacy project Panther raises $22M in its 1.5-hour public sale. (ref)

Source: CoinGecko, StakingRewards, DeFi Llama

Notable Events

The TVL and market cap of all DEXes decreased between -36.64% (SushiSwap) and -13% (Raydium) this week, except for Trader Joe, which outperformed the market with an +18.86% TVL increase.

Raydium and PancakeSwap are the only two DEXes that show negative numbers across all metrics, with Raydium underperforming compared to its peers.

SpookySwap and Trader Joe posted exceptional 7-day average volume percentage changes at 397% and 104%, respectively. This week saw continued collaboration between the two DEXes with yield farms for $BOO, $JOE and $wFTM, as well as new vaults in collaboration between SpookySwap and Beefy Finance.

0xMaki announced that he will be joining decentralised liquidity provision and market maker Tokemak. (ref)

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!