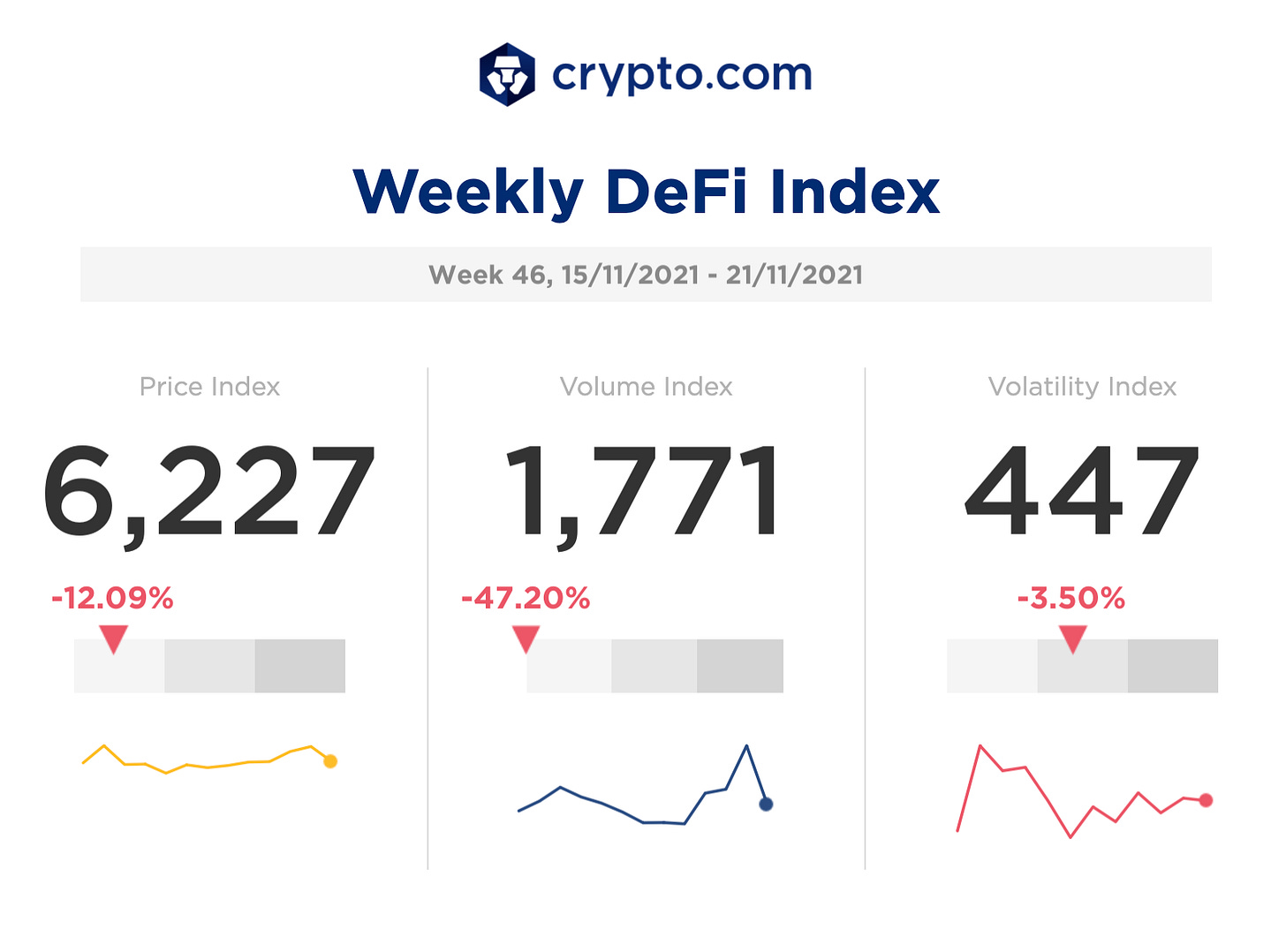

Crypto.com Weekly DeFi Update (Week 46, 15/11/2021 - 21/11/2021)

Price, volume, volatility indices all down. Aave Arc’s market was introduced, aiming for institutional participation in DeFi.

Key Takeaways

Avalanche (AVAX) outperformed its peers, reaching an ATH this week ($144.96) amid news of its Deloitte partnership and Binance US listing (ref).

Aave Arc’s first market is officially introduced by Aave, with goals to increase institutional participation in DeFi. Fireblocks is the official partner for KYC and whitelisting requirements. (ref)

Cronos achieves over 2 million transactions and 700M+ TVL in 2 weeks

Valkyrie is launching a $100M DeFi hedge fund, using its own proprietary system to move DeFi coins in and out of the system as well generating returns through staking and yield farming. (ref)

The total value locked (TVL) across all Ethereum DeFi platforms has grown to $104.2B, according to DeFi Pulse, down from $111B from last week. According to DeFiLlama, across all platforms DeFi TVL reached $261.2B, down from $273B last week.

Overall all price, volume, and volatility indexes were negative at -12.09%, -47.20%, and -3.50% respectively.

Highlights

Big Four accounting firm Deloitte forges partnership With Ava Labs to leverage Avalanche blockchain

Binance fully integrates Ethereum scaling solution, Arbitrum One

Polygon launches a zk-STARK scaling solution for DApp deployment

Ethereum Foundation is setting aside $1M for blockchain technology and advocacy

DeFi’s first syndicated loan launched by Alameda Research and Maple Finance

Twitter creates team specialising in crypto and decentralised apps

Check the latest prices on crypto.com/price

*DeFi dominance is defined as the total market capitalisation of DeFi coins as a percentage of that of all currencies (including DeFi coins), based on Coingecko’s data. See Coingecko’s definition of dominance for more information. Source: CoinGecko

Notable Events

MakerDAO’s Founder, Rune Christensen, joins venture capital firm Dragonfly Capital as venture partner. (ref)

DeFi protocol Acala has won Polkadot’s parachain auction, securing the first slot with over 31M DOT contributed by 81,000 community members. (ref)

DeFi goes institutional with Aave Arc’s first market (in partnership with Fireblocks) and Maple Finance’s first syndicated loan to Alameda Research.

Source: CoinGecko, StakingRewards, DeFi Llama

Notable Events

TVL and Market cap of all DEXes all decreased between 5-12& and 15% and 30% respectively this week, except for Trader Joe which outperformed the market with 27.64% TVL increase and 10.36% market cap increase.

However, data suggests that SpookySwap still shows sustained growth as the only DEX to show positive 7-day average volume at 48.16%.

Avalanche (AVAX) reached an ATH of $144.96 as news of its Deloitte partnership was confirmed. AVAX market cap now stands at $27B. Additionally, Benqi (QI) on the Avalanche ecosystem was launched on Binance Launchpool, allowing users to farm QI. (ref, ref)

New research studies show that 50% of LPs on Uniswap are losing money compared to HODLers due to impermanent loss. This week the UNI token hit a 7-day low of $19.87. (ref)

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!