Crypto.com Weekly DeFi Update (Week 45, 8/11/2021 - 14/11/2021)

Price, volume, volatility indices all up. UMA Protocol (UMA) outperforms the market and launches ‘Across Protocol’, an L2 to L1 bridge.

Key Takeaways

The total value locked (TVL) across all Ethereum DeFi platforms has grown to $111B, according to DeFi Pulse, up from $105B from last week. According to DeFiLlama, across all platforms DeFi TVL reached $273B this week.

UMA Protocol (UMA) and Loopring (LRC) outperformed the market this week. LRC continued its surge following rumours of its GameStop partnership, new insurance fund and DAO announcement. Meanwhile Across Protocol, which uses UMA’s Optimistic Oracle, went live this week.

The SEC Commissioner released an article in the International Journal of Blockchain Law this week, highlighting the need to protect investors and promote responsible innovation at the same time. The article can be found here.

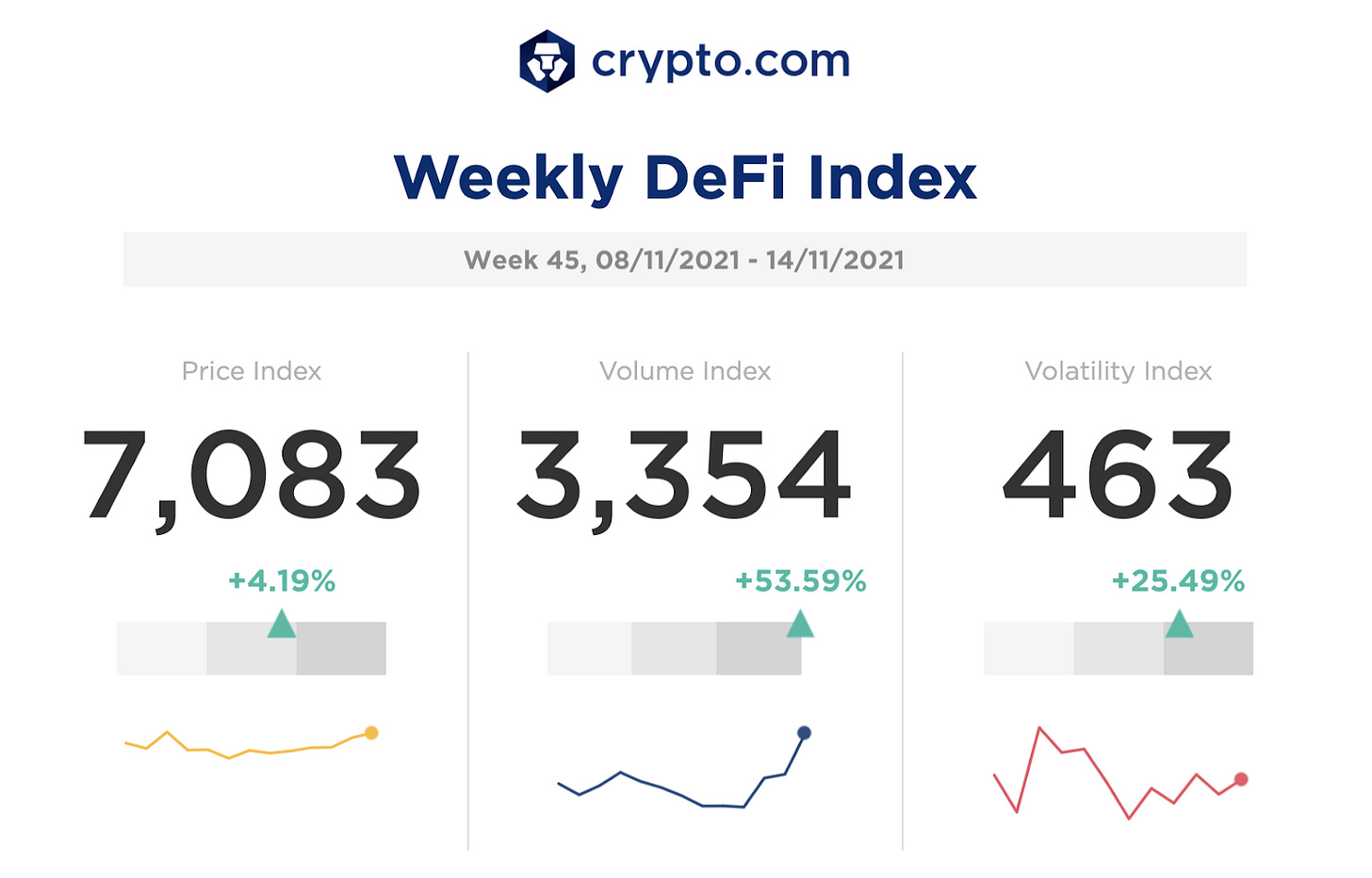

Overall all price, volume and volatility indexes were positive at 4.19%, 53.59%, and 25.49% respectively.

Highlights

Solana surpasses Tether by market value, enters fourth place with $75B

Phantom Wallet launches mobile version to bring Solana to smartphones

SEC Commissioner: DeFi must address transparency and pseudonymity

DeFi liquidity provider WOO Network raises $30M in Series A round

Rocket Pool Eth2 staking service launches, hits stage two cap in 45 seconds

Tether’s blockchain expansion continues as USDT goes live on Avalanche

Check the latest prices on crypto.com/price

*DeFi dominance is defined as the total market capitalisation of DeFi coins as a percentage of that of all currencies (including DeFi coins), based on Coingecko’s data. See Coingecko’s definition of dominance for more information. Source: CoinGecko

Notable Events

LRC continues its rally from last week, amid rumours of its GameStop partnership, with the latter teasing on Twitter that it may enter the NFT space using Loopring’s technology. (ref)

UMA rallies as Across Protocol, secured by UMA’s Optimistic Oracle goes live, peaking at $20.11 (ATH: 41.56). (ref)

Tether launches USDT stablecoin on the Avalanche blockchain, AVAX reaches ATH of $99.77. (ref)

Acala, a DeFi liquidity network, has raised over $600M in Polkadot’s Parachain auction. It is likely that it will be the first project to win a slot. (ref)

The SEC Commissioner has released an article on DeFi risks regulations in The Journal of International Blockchain Law - with a ‘true desire to help promote responsible innovation’ in the space. (ref)

Cream Finance has released its official statement since its $130M exploit on the 26th of October. The plan details CREAM distributions to impacted users and removes the project’s remaining team token allocation. (ref)

Source: CoinGecko, StakingRewards, DeFi Llama

Notable Events

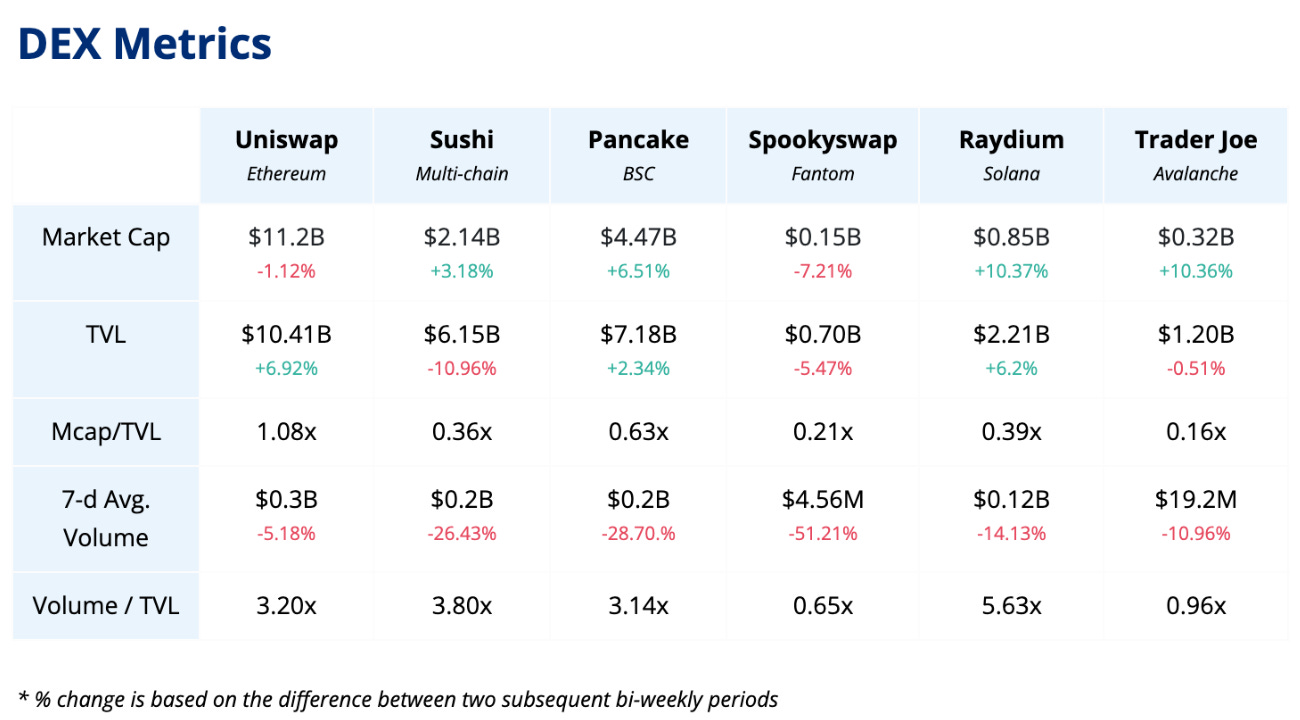

7-day average volume decreased across the board, with the biggest decrease being SpookySwap at -51.21%.

Overall, SpookySwap was the only DEX decreased across all metrics, with the highest downward change in market cap and 7-day average volume. This may be due to a bounceback following its strong rally last week as new product features were released and its Chainlink oracle integration announcement.

Solana’s Raydium announced a partnership with Serum to bring cross-chain assets previously not available to Raydium users, alongside liquidity mining rewards. Additionally, news of Nansen integration with Solana has been confirmed, alongside a partnership with Brave to make Solana the default for DApp support in the browser. (ref, ref, ref)

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!