Crypto.com Weekly DeFi Update (Week 44, 1/11/2021 - 7/11/2021)

Volatility index down, price & volume indices up. MakerDAO integrates with Aave to launch D3M module against volatile assets.

Key Takeaways

The total value locked (TVL) across all Ethereum DeFi platforms has grown to $105B, according to DeFi Pulse, up from $100B from last week. According to DeFiLlama, across all platforms DeFi TVL reached $250B this week.

All dexes increased in TVL, with the exception of Trader Joe. Activity on Raydium and SushiSwap jumped this week, as 7-day average volume increased 83.31% and 104.05% respectively.

SushiSwap surged to reach $13.35 on the 4th of November, with its new NFT/metaverse platform Shoyu and Moonbeam integration finally going live.

MKR integrates with Aave to launch the ‘D3M’ module against volatile assets. (ref)

Aave set to launch V3 with new features announced such as cross-chain bridges, risk management and L2 specific features among others. (ref)

Popsicle Finance confirms ‘relaunch’ after $25M hack in August 2021. (ref)

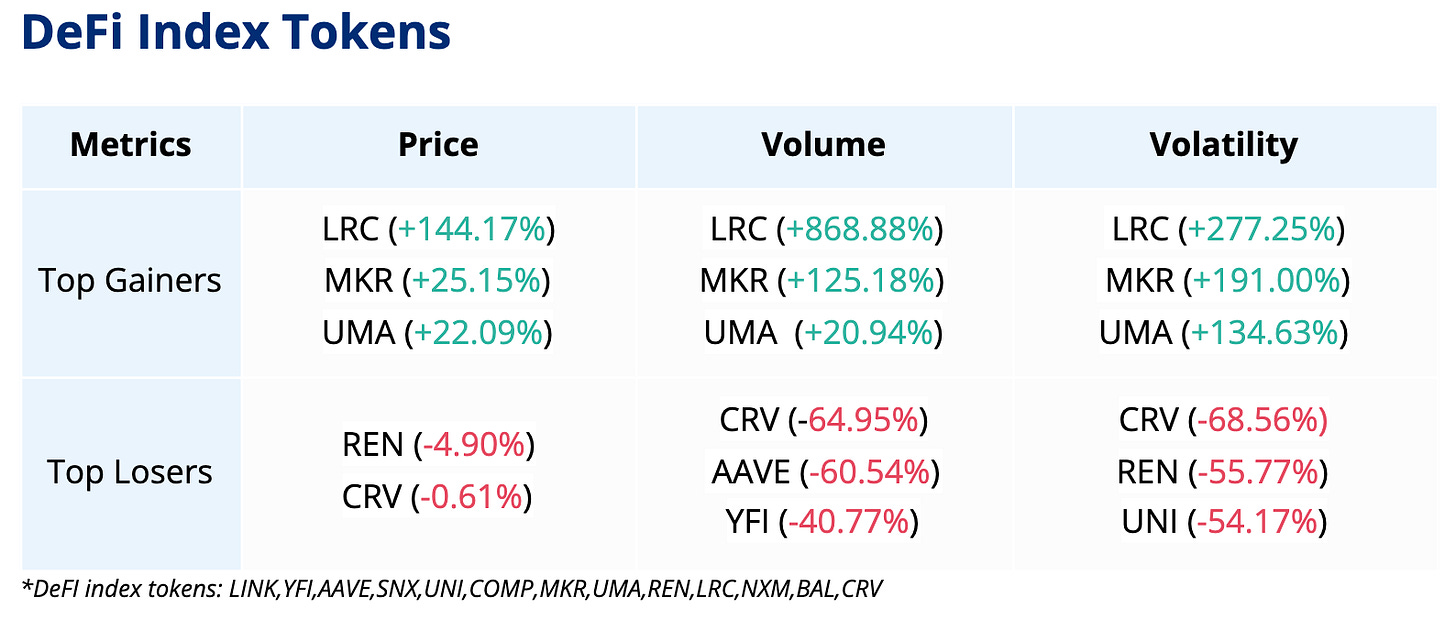

Overall, volume and prices indexes were positive at 9.32% and 5.09% respectively, while the volatility index decreased by 25.7%.

Highlights

Cronos, Crypto.org’s EVM compatible chain, readies for mainnet beta launch on November 8

Ethereum’s third Proof of Work network upgrade, Arrow Glacier, estimated to arrive in December 2021

The Graph integrates with Cosmos, setting sight on a multi-chain future

Ardana, a stablecoin ecosystem build on Cardano, raises $10M

Check the latest prices on crypto.com/price

*DeFi dominance is defined as the total market capitalisation of DeFi coins as a percentage of that of all currencies (including DeFi coins), based on Coingecko’s data. See Coingecko’s definition of dominance for more information. Source: CoinGecko

Notable Events

MakerDAO partners with Aave to release ‘D3M’ to normalise volatile interest rates, MKR also rallied this week amid this news, reaching a 7-day high of $3532.65. (ref)

DeFi exploits total $680M in 2021: Report. (ref)

Polkadot’s first parachain, Shell, has been added to ensure block production, inclusion and finalisation. The Shell parachain has limited functionality and can be upgraded if a proposal is passed to do so. DOT surged to reach a 7-day high of $54.96 with the news. (ref)

Loopring ($LRC) has surged 193% from 0.65 to $1.26 in the last week, with speculation that its rumoured collaboration with GameStop may be driving the price rally. (ref)

Curve EUR/USD forex pools are now live. Curve’s TVL reached $20B this week on 3rd of November. (ref, ref)

AcrossProtocol, a new bridge solution on Ethereum that uses UMA Optimistic Oracle will go live on 8 Nov. (ref)

Source: CoinGecko, StakingRewards, DeFi Llama

Notable Events

TVL generally increased across the board, with only Trader Joe decreasing 9.09%. 7-day average volume increased across the board for all except for UniSwap, (-4.98%). Most impressive growth this week was Raydium on Solana, which saw an increase of 104.05%.

Solana’s $SOL hit ATH on the 6th of November ($259.96), failing to break through $260. In a Twitter post dated 5th of November, Solana Ventures announced a fresh $100M fund to develop the Solana gaming ecosystem alongside FTX and Lightspeed Ventures. (ref)

SpiritSwap briefly rallied this week as new product features were released such as expert trader page and Chainlink oracle integration. (ref, ref)

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!