Crypto.com Weekly DeFi Update (Week 4, 25/01/2021 - 31/01/2021)

Top 100 DeFi tokens’ market cap reached $51.6B; TVL in DeFi hit $27.8B

Market Recap

According to CoinGecko, the top 100 DeFi tokens’ market capitalization climbed from $45.4B to new highs of $51.6B from Monday to Sunday. Their dominance in the crypto space reached a five-month high of 5.04%, contributed by altcoins’ relatively strong performance against Bitcoin and Ethereum.

According to DeFi Pulse, the total value locked (TVL) in DeFi recorded a new all-time high of $27.8B on Sunday. At the time of writing, the amounts of ETH and BTC locked in DeFi respectively made local highs of 7.3M and 45K.

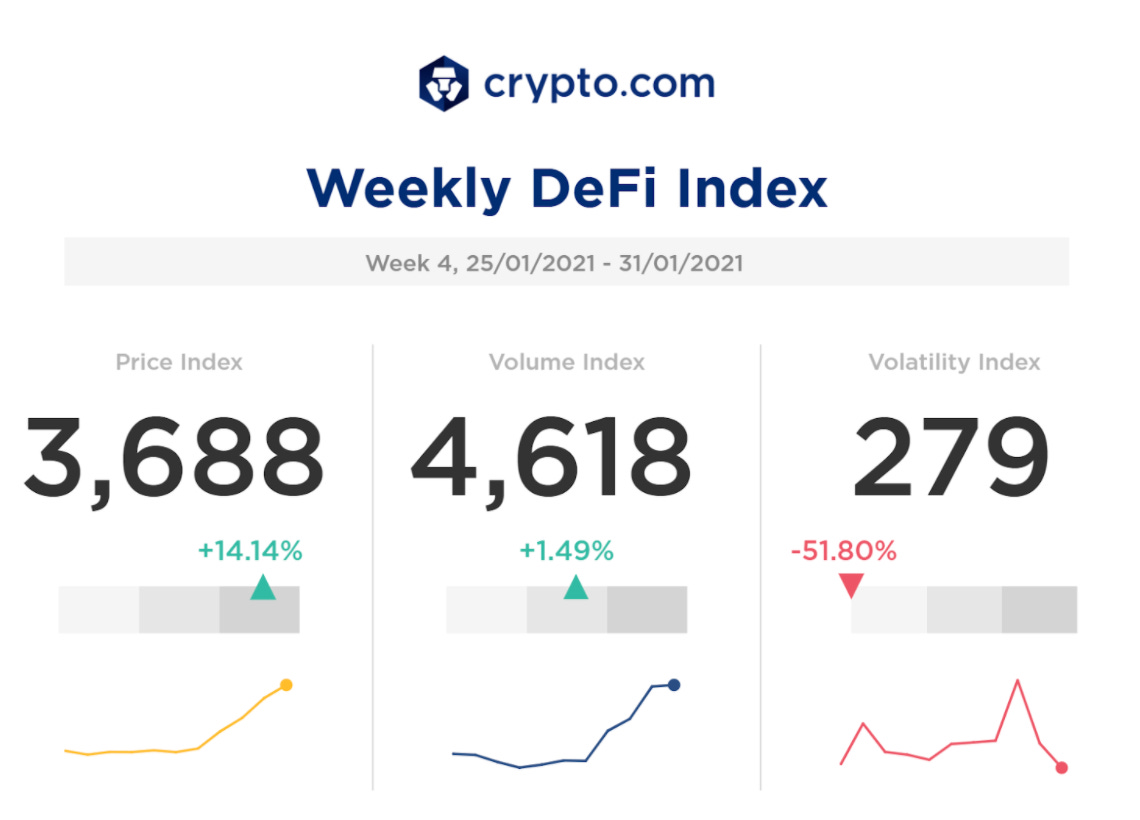

Overall, the price index and the volume index respectively increased by 14.14% and 1.49%, while the volatility index plunged by 51.80%.

Check the latest prices on crypto.com/price

Spotlight of the Week

Grayscale Investments filing for DeFi token trusts

On January 27, 2021, Grayscale Investments, the world's largest digital asset manager, registered trusts for three DeFi tokens, Aave, Cosmos, and Polkadot in Delaware, along with Monero. In late December 2020, Grayscale also filed for altcoins such as Chainlink, Tezos, and Decentraland. The filings do not imply that Grayscale will necessarily launch trusts for the four new assets. Still, it reveals that they are laying the groundwork for potential launches, which could help grow institutional investors' participation in the DeFi space (ref).

Price Index

Top 3 gainers: UNI (+69.21%), COMP (+52.50%), AAVE (+24.58%)

Top 3 losers: NXM (-18.45%), LINK (-5.18%), YFI (-4.56%)

The TVL in Uniswap recorded a new all-time high of $3.16B at the time of writing. The daily trading volume in Uniswap approached $1B per day, leading the sector of decentralized exchanges (DEXs). Its surge was also possibly related to the coming release of Uniswap v3 protocol. Another driver is the launch of its grants program, which provides funding for project proposals that could add value to the overall platform. This could help expand the exchange’s ecosystem.

The TVL in Compound also reached a new all-time high of $3.32B on Sunday. Its surge was possibly supported by some fundamental factors, such as the recent launch of a new governance module and an upgrade to the comp.vote interface.

The strong performance of AAVE was bolstered by the soaring buy volume on spot and derivatives exchanges, and also the development of Aave’s lending platform and flash loan issuance (ref). Its TVL hit a new high of $4.04B on Sunday.

Volume Index

Top 3 increase: AAVE (+66.62%), COMP (+58.61%), SNX (+33.61%)

Top 3 decrease: REN (-40.78%), UMA (-33.70%), YFI (-30.28%)

Volatility Index

All tokens, except for COMP (+50.06%) and CRV (+31.98%), decreased in volatility.

Top 3 decrease: AAVE (-64.1%), MKR (-62.15%), UMA (-57.05%)

Top DeFi News

Digital Asset Manager Grayscale Eyes DeFi Space With New Trust Filings

Uniswap (UNI) and Compound (COMP) hit new highs as DeFi TVL reaches $27.6B

Cardano's (ADA) Smart Contract Environment Plutus Goes Live in Devnet

Circle enables seamless USDC-USD transfers, providing a bridge from banks to DeFi

Aave’s Founder Invests to Grow DeFi’s Head Start on the Banks

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Israel

Israel