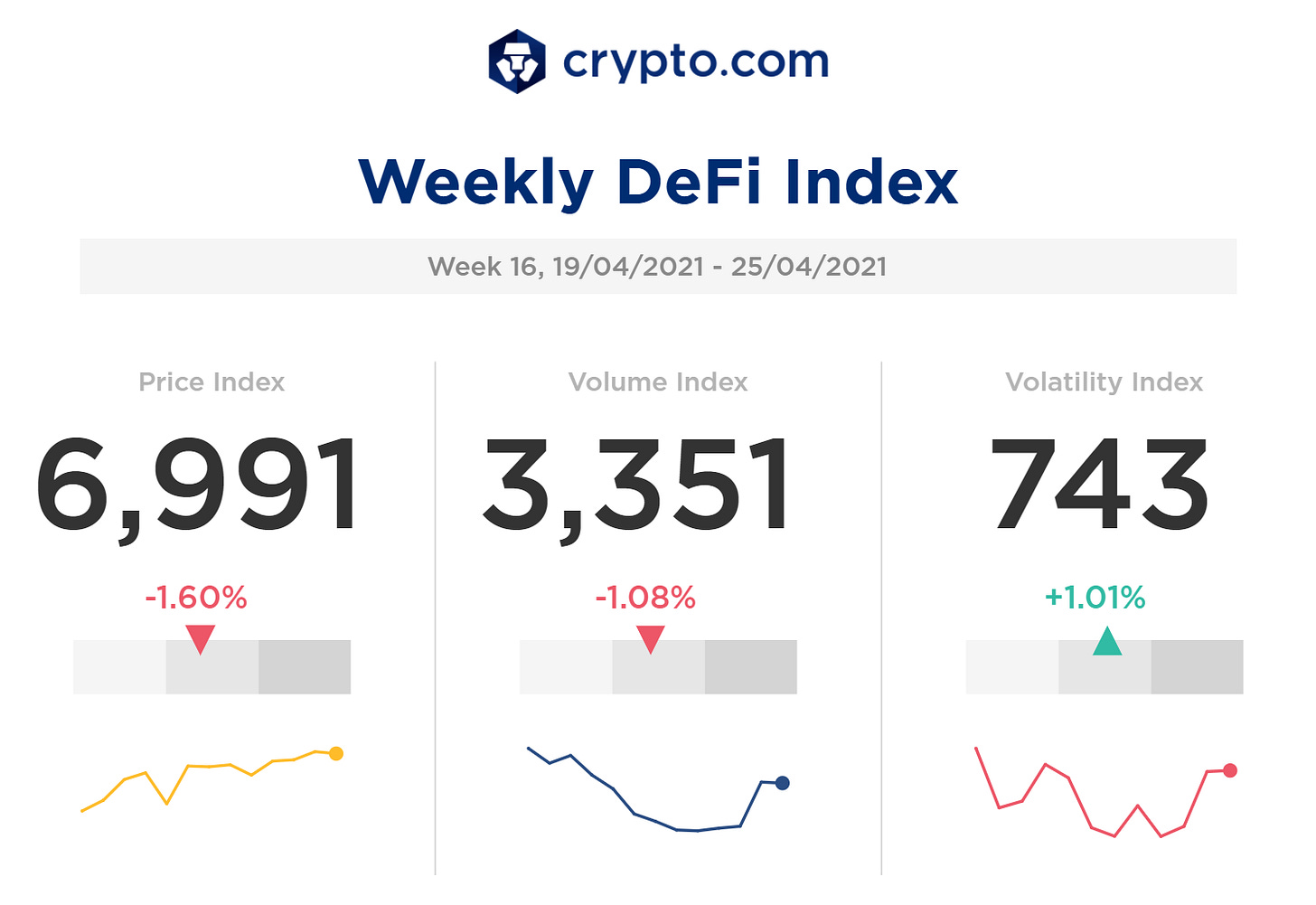

Crypto.com Weekly DeFi Update (Week 16, 19/04/2021 - 25/04/2021)

MKR and YFI recorded ATH of $4,921.2 and $56,847.7 respectively.

Market Recap

According to CoinGecko, the top 100 DeFi tokens’ market capitalization stopped declining after the price dump on 18 Apr. It stayed above $100B last week, ranging from $103.4B to $114.6B. At the time of writing, the top 100 DeFi token’s market cap sits at $106.9B. Their dominance in the crypto space increased to 5.7%.

According to DeFi Pulse, the total value locked (TVL) in DeFi dropped slightly from $57.6B on Monday to $53.5B on Sunday. At the time of writing, the TVL is back to $57.0B, and around 10.7M ETH and 147.7K BTC were locked in DeFi.

Overall, the price and volume indices decreased by 1.60% and 1.08% respectively, while the volatility index increased by 1.01%.

Check the latest prices on crypto.com/price

Spotlight of the Week

Lending Protocol AAVE Set to Launch Liquidity Mining Program

Lending giant AAVE is set to launch its first liquidity mining program on 26 Apr, meaning that LPs and borrowers in AAVE’s USDC, DAI, USDT, GUSD, ETH, and WBTC pools will earn additional stAAVE rewards (ref). Given that many of AAVE’s competitors already have liquidity mining programs, AAVE can provide more incentive to LPs and borrowers through this move and might gain more competitive strength.

Price Index

Top 3 gainers: MKR (+24.43%), COMP (+20.45%), UNI (+9.98%)

Top 3 losers: LRC (-22.37%), CRV (-21.25%), REN (-18.54%)

MKR recorded an ATH of $4,921.2 on Thursday (ref). MakerDao announced a vote on the activation of the liquidation system upgrade on Monday. This upgrade should help safeguard Dai’s stability (ref).

Uniswap successfully deployed its version 3 contracts to all four of Ethereum’s testnets, a big step towards the version 3 launch (ref).

Volume Index

Top 3 increase: MKR (+68.16%), COMP (+65.72%), YFI (+15.48%)

Top 3 decrease: LRC (-50.99%), CRV (-44.99%), REN (-44.82%)

YFI hit a new high of $56,847.7 on Monday after Yearn purchased $1.164M YFI.

Volatility Index

Top 3 increase: NXM (+50.60%), UMA (+26.71%), AAVE (+8.45%)

Top 3 decrease: MKR (-44.23%), CRV (-32.18%), YFI (-14.78%)

Nexus Mutual moves to lift KYC requirements (ref). NXM recorded a new high of $99.2 on Thursday (ref).

AAVE announced to launch a liquidity mining program on 26 Apr (ref).

Top DeFi News

Avalanche (AVAX) ecosystem introduces Avalaunch, a launchpad and Initial DEX Offering (IDO) platform

Yearn Finance picks up $1 million in YFI as part of planned buyback

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Halgurd