Crypto.com Weekly DeFi Update (Week 1, 04/01/2020 - 10/01/2020)

MKR price skyrocketed +148%, volume +469%; Top 100 DeFi tokens market cap surpassed $28B

Market Recap

According to CoinGecko, the market capitalization of the top 100 DeFi tokens rallied from $23.1B on Monday to the highs of $28.3B on Sunday. Meanwhile, from Wednesday to Sunday, their dominance in the crypto space shrank from 2.72% to 2.57%, thanks to the relatively strong performance of Bitcoin and Ethereum.

According to DeFi Pulse, the total value locked (TVL) in DeFi surged from $18.4B to new record-highs above $23.1B; around 6.7M ETH and 25K BTC were locked in DeFi by the end of the week.

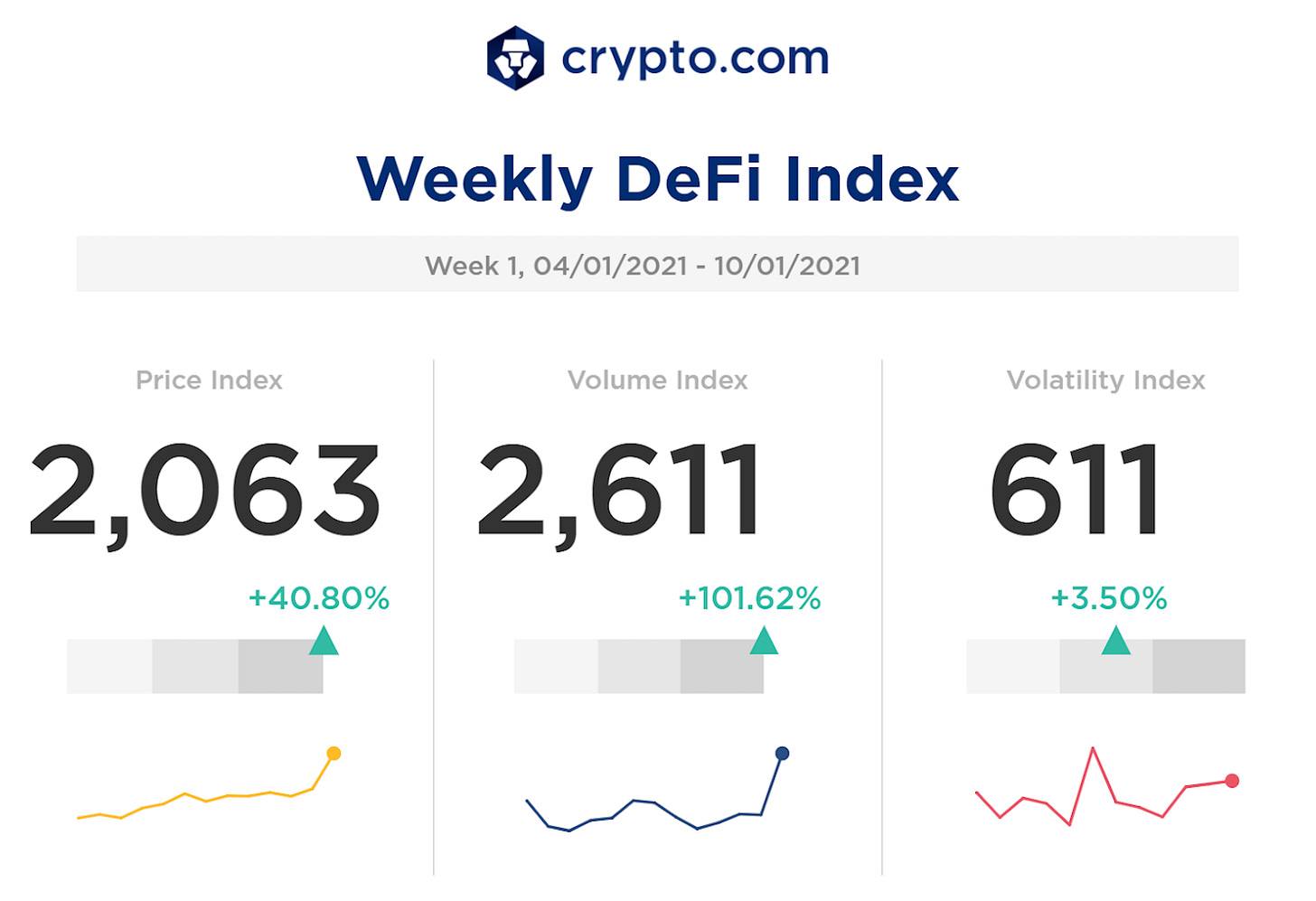

Overall, the price index and the volatility index surged by 40.8% and 101.62% respectively, while the volatility index increased by 3.50%.

Spotlight of the Week

Investment Fund Augmentum Fintech Launching DeFi Investment Strategy

Augmentum Fintech, an investment fund listed on the London Stock Exchange, announced that they will start investing in DeFi protocols through a new partnership with ParaFi Capital. The portfolio of Augmentum Fintech covers numerous fintech disruptors, such as Tide, Monese and Zopa. Meanwhile, ParaFi Capital is a San Francisco-based investment firm and they have invested in a number of prominent DeFi protocols, including Uniswap, MakerDAO and Compound. They will co-invest in DeFi development teams in Europe and the United States prior to public launch. The CEO of Augmentum Fintech disclosed that the investment would be in the range of “low single-digit millions”, which might further expand over time.

Crypto exchange ShapeShift Integrated Decentralized Exchanges and Removed KYC Rules

The Colorado-based non-custodial exchange ShapeShift announced that it has integrated decentralized exchange (DEX) protocols into its platform. Users of ShapeShift will be able to trade directly with the external protocols, rather than trading with ShapeShift as an intermediary. As a result, their users will no longer need to provide personally identifiable documentation to meet the “Know-Your-Customer” (KYC) regulatory requirements for trading. According to the CEO of ShapeShift, ShapeShift is no longer engaged in regulated trading activities, and they have a clear vision that centralized exchanges will be phased out in favour of DEXs.

Price Index

All tokens increased in price.

Top 3 gainers: MKR (+147.66%), SNX (+56.28%), YFI (+46.09%)

MKR was supported by strong demand as its trading volume soared by 469%. The TVL in Maker also recorded a new all-time high of $4.4B on Sunday. Some analysis attribute the surge to the sharp increase in the supply of the stablecoin Dai, which is created when users deposit their assets in the Maker Protocol and borrow against that asset. The growing revenue of the Maker Protocol is also a probable driver of the surge. During the summer in 2020, Maker charged zero interest on users borrowing Dai. They were then able to raise the interest rates and hence the revenue.

The TVL in Synthetix recorded a new all-time high of $2.2B on Sunday.

Yearn.finance will soon be available to stake on some exchanges, which might have helped boost its sharp surge.

Volume Index

All tokens increased in volume.

Top 3 increase: MKR (+468.5%), ZRX (+202.82%), KNC (+197.04%)

The 0x decentralized exchange protocol is preparing for a major upgrade to the v4 version, and the most important upgrade would be on optimizing the gas consumption of smart contracts (ref).

Volatility Index

Top 3 increase: YFI (+215.59%), ZRX(+203.99%), MKR (+151.09%)

Top 3 decrease: REN (-58.19%), NXM (-44.45%), CRV (-37.11%)

Top DeFi News

LSE-listed fintech fund Augmentum launches DeFi investment strategy

Crypto exchange ShapeShift integrates DEXes, relieves user KYC burdens

DeFi integration and layer-2 tech back Matic Network’s (MATIC) 92% rally

Oasis Protocol Adds Shyft Network in Bid to Attract Institutions to DeFi

Thank you for reading! We hope you find our Weekly DeFi Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!