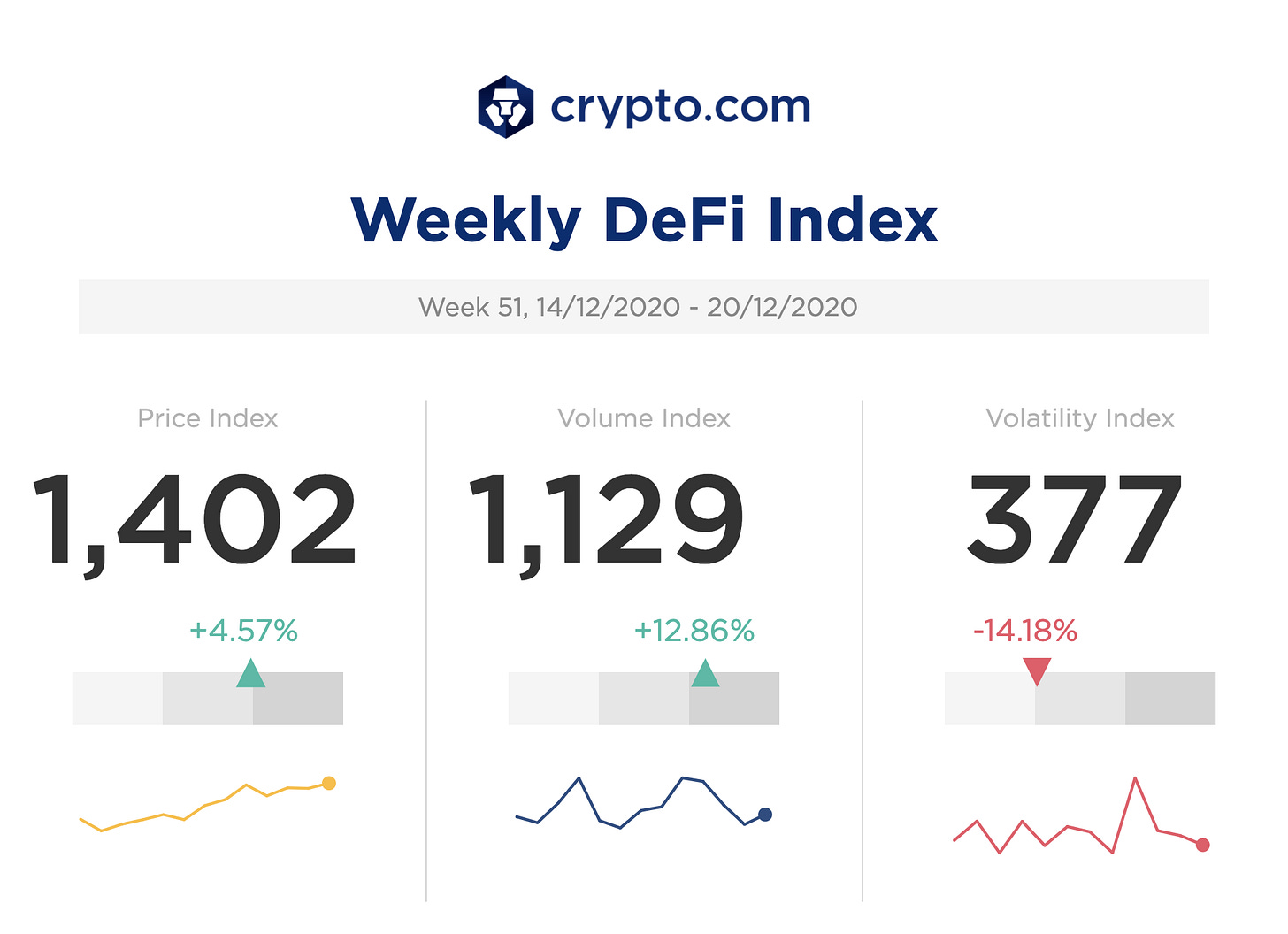

Crypto.com Weekly DeFi Update (Week 51, 14/12/2020 - 20/12/2020)

Top 100 DeFi tokens market cap surged to $19.9B; SNX up almost 30%

Market Recap

The DeFi market had been burgeoning alongside the bullish trends of Bitcoin and Ethereum. According to DeFi Pulse, the total value locked (TVL) in DeFi climbed to new highs of $16.8B on Sunday. As stated on CoinGecko, the market capitalization of the top 100 DeFi tokens amounted to the record highs of $19.9B, while its dominance in the crypto space dipped from 3.23% on Monday to 2.98% on Saturday, reflecting the relatively strong performance and capital inflows regarding Bitcoin and Ethereum.

Overall, the price index and the volume index increased by 4.57% and 12.86% respectively, while the volatility index plunged by 14.18%.

Spotlight of the Week - Compound Announcing New Cross-Chain Protocol

Compound has released a white paper on its new cross-chain project, Compound Chain, which is described as "a distributed ledger capable of inexpensively transferring value and liquidity between peer ledgers." It allows users to lend and borrow cross-chain assets from different blockchains. Some commentators suggest that “peer ledgers” would involve the participation of Central Bank Digital Currencies (CBDC). A new cryptocurrency, CASH would be used to pay for transaction fees on the Compound Chain. The team says it is building a testnet version, which is expected to be released in early 2021.

Price Index

Top 3 gainers: SNX (+28.97%), COMP (+5.98%), MKR (+5.89%)

Top 3 losers: NXM (-7.53%), REN (-1.04%), YFI (-0.37%)

The bullish price action of SNX was supported by strong demand as its trading volumes soared by 78.80%. The TVL locked in Synthetix also reached a new local high of $952M. Some analysis attributed SNX’s surge to its new listing on Coinbase Pro.

The TVLs in Compound and Maker respectively recorded new highs at $1.96B and $2.9B.

The CEO of Nexus Mutual lost 370,000 NXM tokens, an equivalent of over $8 million in a targeted hack (ref), and the hacker demanded a $2.6M Ethereum ransom (ref).

Volume Index

All tokens’ volumes, except for COMP (-22.15%) and MKR (-7.95%), increased.

Top 3 increase: SNX (+78.80%), BAL (+61.21%), KNC (+58.67%)

Volatility Index

Top 3 increase: NXM (+73.28%), SNX (+16.07%), BAL (+12.89%)

Top 3 decrease: COMP (-55.17%), YFI (-37.42%), REN (-36.92%)

Do I pay for any subscription?