Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 6, 01/02/2024 - 07/02/2024)

EigenLayer TVL surges after staking cap is temporarily removed. Solana network resumes operations after 5-hour outage. dYdX unveils 2024 roadmap with software enhancements and Permissionless Markets.

Weekly DeFi Index

This week's market cap, volume, and volatility indices were positive at +4.75%, +45.82%, and +10.74%, respectively.

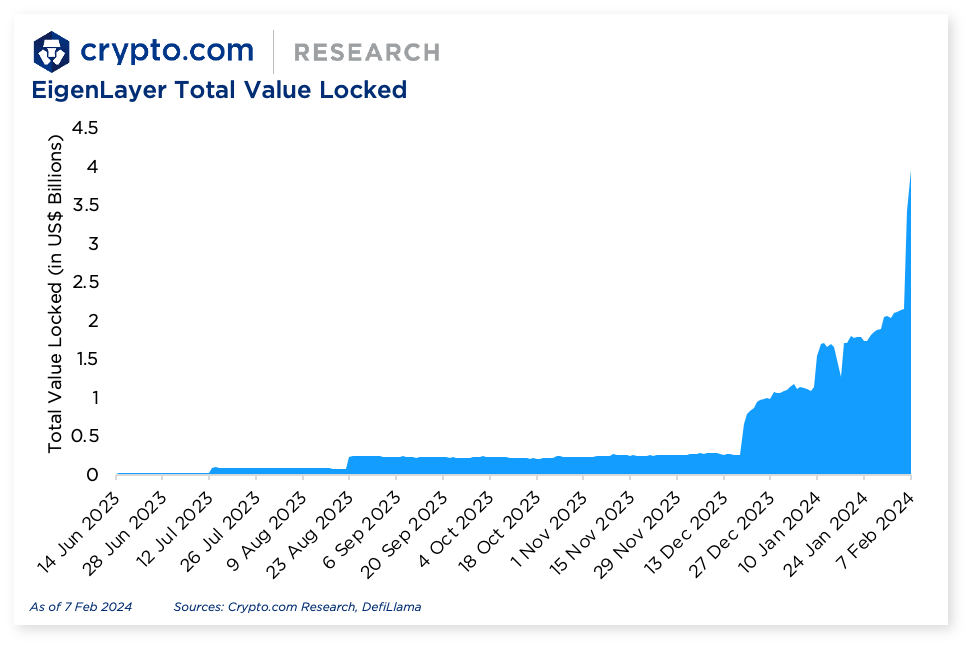

Chart of the Week

EigenLayer, an Ethereum-based liquid restaking protocol, saw a significant surge in its total value locked (TVL) hours after temporarily removing its staking cap. On 5 February, the protocol announced that it would lift the per-protocol staking cap of 200,000 ETH until 9 February to “invite organic demand” to the network.

EigenLayer is pioneering restaking, allowing users to simultaneously earn Ethereum staking rewards while securing Actively Validated Services (AVSs) to generate additional yield. It introduced the caps last year to ensure security and decentralisation, mainly as a way to prevent any single token from dominating the network.

The protocol’s TVL saw a US$1.9 billion (92%) increase from last week following the announcement, jumping from just over $2 billion on 31 January to nearly $4 billion as of 7 February.

Chainlink unlocked 19 million LINK tokens, valued at approximately $341 million, which can be traced back to three of its non-circulating supply contracts. Of the 19 million LINK unlocked, 15.95 million LINK was deposited into a cryptocurrency exchange, while the remaining 3.05 million LINK was moved to a multi-sig wallet

https://crypto.com/market-updates/defi-l1l2-weekly-07-02-2024?utm_source=substack&utm_medium=substack&utm_campaign=rni_defi-l1l2

News Highlights

The Solana network experienced a five-hour outage on 6 February, during which block production and transactions were halted. Following a successful upgrade to v1.17.20 and a restart of the cluster by validator operators, block production on the Solana mainnet beta resumed, with engineers continuing to monitor performance. The last reported outage on the network was in February 2023 that lasted nearly 19 hours, and this latest incident has reignited criticisms over the network’s reliability.

Decentralised perpetuals exchange dYdX revealed its 2024 roadmap, which includes the launch of Permissionless Markets to enable traders to list and trade any asset without going through the current governance process. The project also focuses on enhancing core trade execution, improving user experience and onboarding, and democratise access to financial opportunities within the DeFi space.

Optimism-based decentralised social protocol Farcaster reached record highs when daily active users on the network jumped from 5,000 on 28 January to over 29,000 on 5 February. This growth was attributed to a surge of interest in an innovation called Frames on its Warpcast app, which allows users to mint nonfungible tokens (NFTs), make transactions, claim tokens, read external blog posts, and create polls without having to sign a transaction or leave the app.

Delegate, in collaboration with LayerZero, is set to launch ‘Clusters’, a cross-chain naming protocol designed to provide a unified identity layer across multiple blockchains, including Ethereum, Solana, and other EVM-based chains.

Stride, a liquid staking protocol in the Cosmos ecosystem, launched support for Celestia (TIA) and allocated 5 million STRD tokens (worth $18.5 million) to an airdrop for early adopters of its stTIA liquid staking token.

The Astar Network is set to launch its zkEVM mainnet this month, which will be powered by Polygon Network's Chain Development Kit (CDK) and allow seamless interoperability with the Ethereum network.

Alpha Navigator: Quest for Alpha [January 2024]: Fed signals rate cut in March unlikely. Asset class performance was mixed in January, with crypto and equities up slightly.

Research Roundup Newsletter [January 2024]: We present to you our latest issue of Research Roundup, featuring trending market insights in January, charts of the month, and our deep dive into the world of crypto ETFs.

Crypto ETFs: This report explores what crypto ETFs are, providing an overview of the current crypto ETF market and looking into how they work as investment vehicles. Plus, we explore their features, significance, advantages, and drawbacks.

The History of Money, Part 1 — From Barter to Currency: A short lesson on the history of money and how society evolved from barter to currency to help you understand the roots of cryptocurrency.

Liquid Staking vs Traditional Staking — What Are the Differences and How Do They Work?: Staking and liquid staking are popular ways for cryptocurrency holders to earn rewards. Here’s how the two approaches differ.

How to Buy Bitcoin: Learn the basics of buying and holding Bitcoin with this step-by-step guide.

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!