DeFi & L1L2 Weekly – 📈 Ethereum L2 Transactions Hit Record Highs, Resulting In Fees to Drop

Ethereum L2 transactions hit record highs, resulting in transaction fees to drop. Optimism to introduce Layer-3 applications to the Superchain. Cosmos-based Osmosis is launching a Bitcoin L2.

Weekly DeFi Index

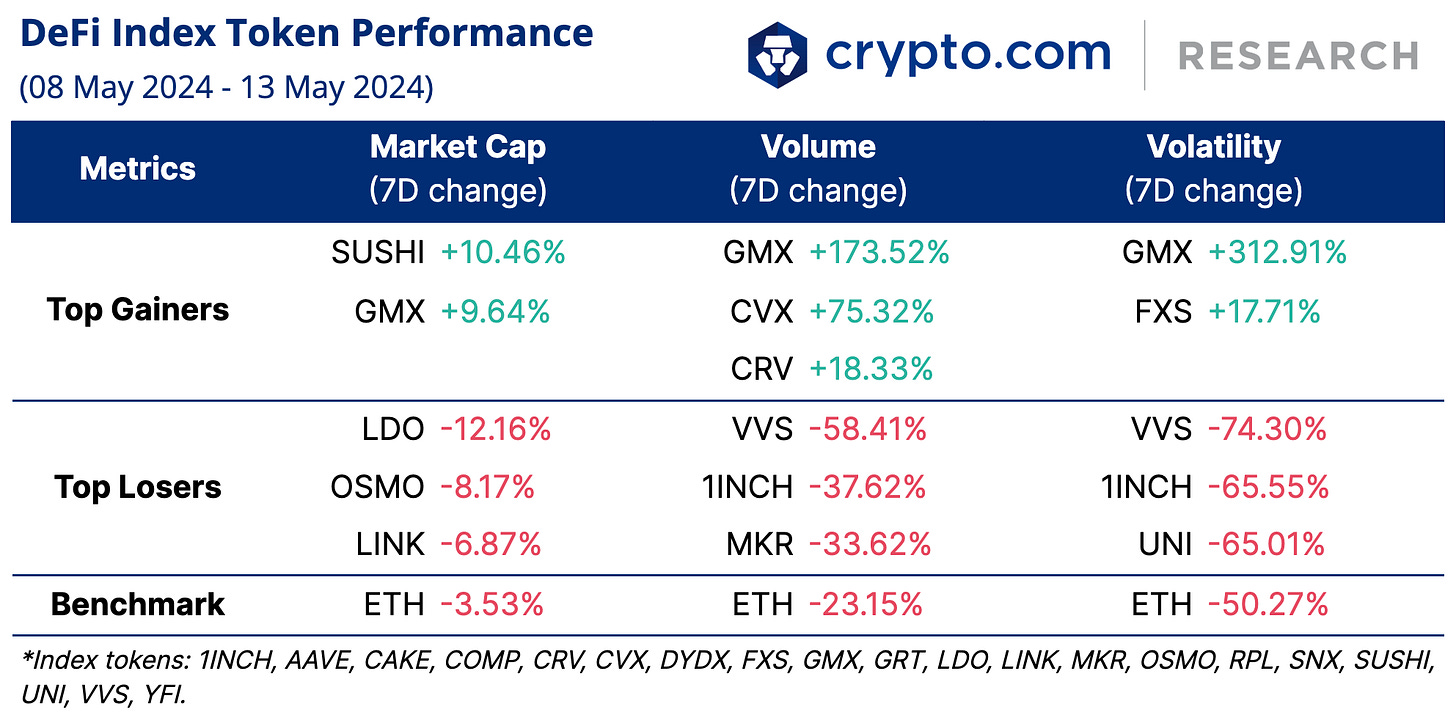

This week's market capitalisation, volume, and volatility indices were negative at -5.87%, -9.78%, and -75.71% respectively.

Chart of the Week

Ethereum Layer-2s (L2s) surged to new all-time highs, as more activity and an increasing number of transactions are being settled on L2s. L2 transactions represent about 87% of total transactions on the Ethereum network, compared to 77% before the Dencun upgrade. The number of distinct addresses interacting with L2s has also reached 5.5 million – more than double the number on the Ethereum mainnet.

The ongoing heightened activity on L2s could be attributed to the completion of the Dencun upgrade, which significantly reduced the fees for L2s and, in turn, attracted more users to L2 rollups and sidechains. Meanwhile, the lowered transactions drove the drop in transaction fees on Ethereum, as the average transaction fee hit a record low of US$1.712 as of 12 May.

GMX is proposing to bring the decentralised derivatives trading platform GMX v2 to Solana via the launch of GMSOL. GMSOL will operate as an independent project while closely working with GMX, and all value measurements and storage will exclusively utilise the GMX token.

News Highlights

Optimism is expanding its blockchain capabilities by introducing Layer-3 (L3) applications on the Superchain. The Superchain, powered by the OP Stack, aims to enhance developer accessibility by providing L3 features and functionality.

MakerDAO unveils plans to introduce two new tokens to its ecosystem, under the codenames ‘NewStable’ (NST) and ‘NewGovToken’ (NGT). NST will be the upgraded version of DAI, and NGT will replace MKR with a denomination of 24,000 NGT per MKR.

Cosmos-based DeFi hub Osmosis is launching a Bitcoin L2. Osmosis is set to roll out ‘Alloyed Bitcoin’, a product consisting of a basket of variants of BTC from throughout the ecosystem.

The Runes protocol experienced a significant decline in activity following its initial surge, with a notable decrease in new mints and wallet interactions by 10 May. The protocol's fee revenue has steadily declined, despite earning hundreds of thousands of dollars daily in fees.

L3 blockchain Degen Chain experienced a significant outage as the network stopped at block #15524774 and has not produced a block for 12 hours. The incident has rendered various applications to be inoperable and raised concerns about the stability of the platform, highlighting potential issues with its operational reliability.

Recent Research Reports

Alpha Navigator: Quest for Alpha [April 2024]: Asset classes were mostly down in April. Cryptocurrency led the drop. US fighting inflation while ECB signals potential rate cuts.

Expanding Ethereum’s Frontier: Restaking And EigenLayer’s Ecosystem (An Analysis of Restaking Dynamics): EigenLayer pioneers the ETH restaking narrative, driving the liquid restaking market to grow to $8 billion TVL. This report delves into EigenLayer’s ecosystem, its restaking mechanism, and the newly launched EIGEN token.

Tokenisation of RWAs & Yield-Bearing Stablecoins: RWA tokenisation signifies a bridge between TradFi and the digital asset space. We explore the tokenisation of securities and its application in yield-bearing stablecoins, which have both gained much attention recently.

Recent University Articles

What Is DePIN? Plus the Most Popular DePIN Crypto Tokens: DePIN is one of the hottest narratives in crypto at the moment. Learn more about what DePIN means, how it works, and the most popular projects.

Reed’s Law: Why the Crypto Space Benefits From Community: Reed’s Law emphasises exponential growth in networks with each new user. Here we explore how this affects cryptocurrency networks and traders.

Liquidity in Crypto Markets: What It Is and Why It Matters: Discover how liquidity in crypto markets affects market dynamics and trading strategies, and how liquidity pools work in DeFi.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!