DeFi & L1L2 Weekly - 💧Ethereum Liquid Restaking Drives DeFi TVL to 2-Year Highs

Ethereum liquid restaking drives DeFi TVL to 2-year highs. Cronos unveils Spring Odyssey campaign powered by Galxe. Runes launch fueled Bitcoin miners’ earnings to surge.

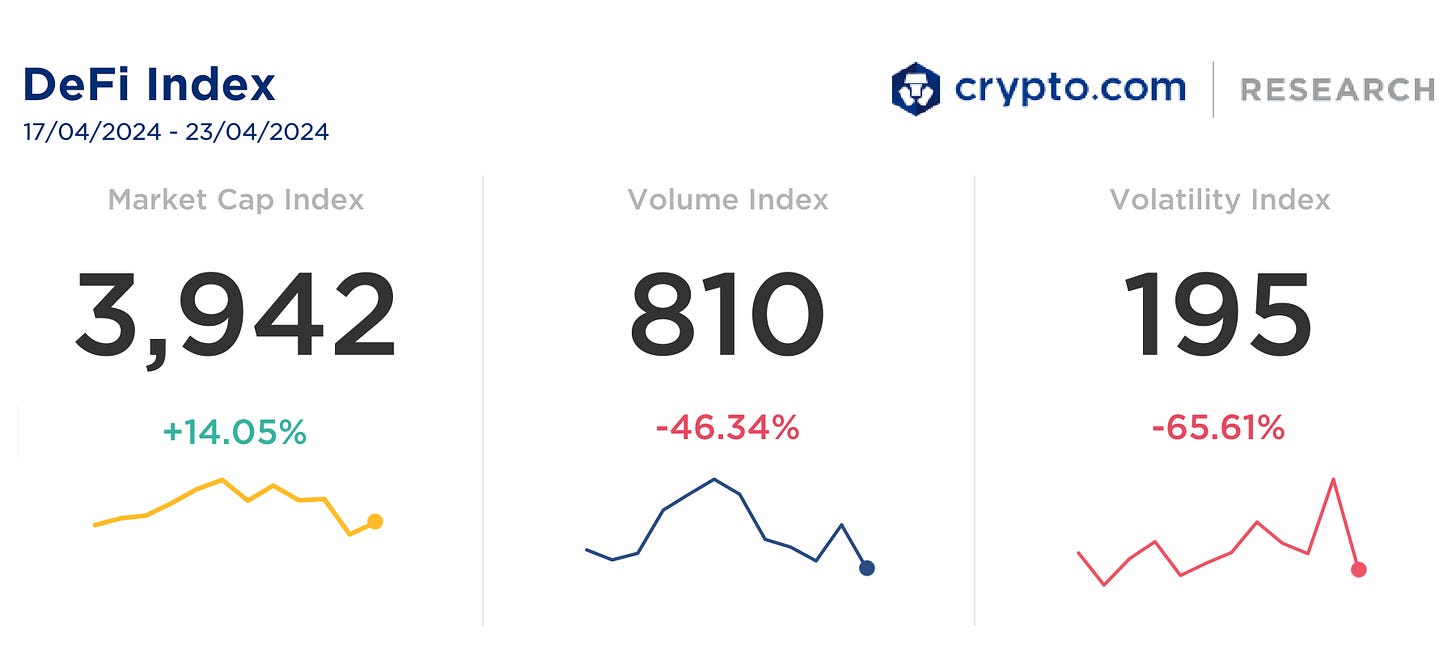

Weekly DeFi Index

This week's market capitalisation index was positive at +14.05%, while volume and volatility indices were negative at -46.34% and -65.61% respectively.

Chart of the Week

The total value locked (TVL) of the DeFi sector almost doubled in the first quarter of this year compared to the previous quarter, surging from a Q4 2023 low of US$36 billion to a peak at nearly $97 billion in Q1 2024. To date, it has increased by 138% year-to-date to a two-year high of $104.21 billion.

DeFi’s recent explosive growth has been partially driven by Ethereum liquid restaking initiatives during the period. This has been echoed by other sources, attributing it to several catalysts in the sector including increased activities within restaking and liquid restaking. Staking and liquid restaking have also reached the top ten DeFi categories, with liquid restaking representing approximately $10.35 billion of DeFi’s TVL – led by Ether.fi and Renzo protocols.

News Highlights

Cronos announced its integration with the community-building platform Galxe, launching the Spring Odyssey campaign. The campaign will reward users with $35,000 in prizes across various tasks, with the aim to highlight the diverse projects and use cases on Galxe while encouraging interaction with a wide range of blockchain projects, focusing on Web3.

Bitcoin mining operations achieved record daily revenue levels of approximately $107 million in transaction fees and block subsidies, surpassing the previous record of $77 million from April 2021. The surge is attributed to the heightened minting activity of the newly launched Runes protocol, which facilitates altcoin creation through an "etching" process directly on the Bitcoin network.

Stablecoin issuer Tether expanded its offerings on Telegram’s The Open Network (TON) with USDT and XAUT stablecoins. This strategic expansion aims to simplify peer-to-peer payments for Telegram’s monthly active users, which surpasses 900 million.

After an extensive evaluation process, Celo has chosen Optimism's OP Stack for its Layer-2 network transition, aiming to enhance performance and maintain compatibility with Ethereum's ecosystem.

Bitcoin scaling layer Stacks initiated the rollout of its major Nakamoto upgrade, which aims to address congestion issues by decoupling the Stacks block production schedule from Bitcoin's.

Worldcoin, a project co-founded by Sam Altman of OpenAI, has unveiled World Chain, a Layer-2 network built on Ethereum and designed for human users. World Chain is set to launch this summer, with verified users receiving priority block space and a free gas allowance, aiming to limit the presence of bots and enhance scalability for Worldcoin.

Cosmos successfully patched a critical security bug in its Inter-Blockchain Communication (IBC) protocol, which could have potentially allowed a reentrancy attack and enabled potential hackers to mint infinite tokens on IBC-connected chains. The bug, which existed in ibc-go since 2021, became exploitable after the launch of a new third-party application called ‘IBC middleware’.

Token infrastructure platform Hedgey Finance faced two simultaneous exploits resulting in a total loss of $44.7 million, with over $42.8 million in Arbitrum (ARB) tokens exploited on the Arbitrum network and $1.9 million on the Ethereum network. The platform is actively investigating the vulnerabilities behind the attacks while cautioning users against potential scam accounts impersonating the protocol and urging them to cancel active claims to mitigate risks.

Recent Research Reports

Crypto.com Visa Card Consumer Spending Insights 2023: A full breakdown of what our community across the globe likes to spend on in 2023.

Decentralised Compute for AI Development: This report explores the subsectors of the decentralised compute networks and their representatives, and how they contribute to the development of AI.

Bitcoin Ordinals Development and Introduction to Runes: We explore Bitcoin Ordinals‘s development, from BRC-20 to Runes, as well as the significance and controversies surrounding them.

Recent University Articles

What Is dYdX and How to Buy DYDX: What is dYdX? Learn about this decentralised crypto exchange that specialises in perpetual swaps and its native token, DYDX.

What Are Bitcoin Runes and Why Is Everyone Talking About Them?: With Runes, Casey Rodarmor is aiming to “make Bitcoin fun again.” Here’s how they work.

What Is ERC-404? Pandora’s Hybrid Token: The Pandora project introduced a new Ethereum-based token, ERC-404, that fuses ERC-20 with NFT features. Here’s how it works.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!