Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 47, 16/11/2023 - 22/11/2023)

Circle launches ‘bridged USDC standard’ on new networks. Aave Companies rebrands to Avara, acquires crypto wallet Family. EigenLayer to launch second phase of its mainnet in H1 2024.

Weekly DeFi Index

This week’s market cap and volatility indices were positive at +2.24% and +12.06%, respectively, while the volume index was negative at -17.83%.

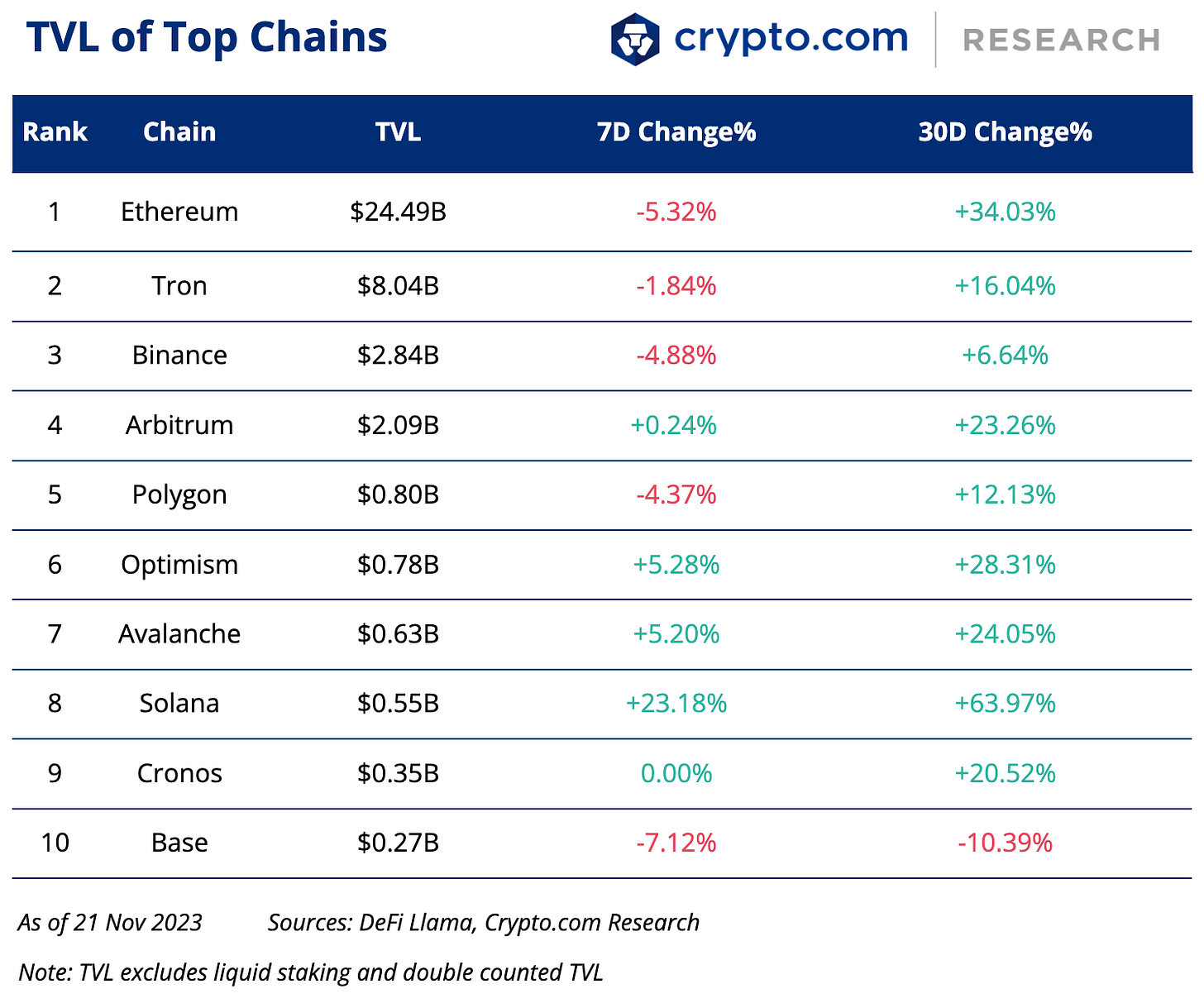

Chart of the Week

Circle introduced a new ‘bridged USDC standard’ to streamline the process of launching its stablecoin on new networks. This standard allows developers to launch the token through a two-phase process, with the first phase being controlled by a third-party developer. The second is controlled by Circle itself, enabling the token to be backed directly by the company’s reserves.

USDC is currently in circulation across several blockchains. This new standard seeks to expand access to USDC and reduce fragmentation by allowing developers to deploy a bridged USDC token contract with the option for Circle to seamlessly upgrade to native issuance in the future.

News Highlights

Aave Companies has rebranded to Avara and acquired the Ethereum self-custody ‘Family Wallet,’ expanding its product suite to include a consumer wallet for sending, receiving, swapping, and holding cryptocurrencies. Avara will oversee existing portfolio brands, including liquidity protocol Aave, Lens, and GHO. Lastly, the Aave brand will continue under the umbrella of Aave Labs.

Ethereum restaking protocol EigenLayer has announced its plan to initiate the second phase of its mainnet in the first half of 2024. This will allow users to delegate their staked ETH to operators of the data availability solution EigenDA.

USDT stablecoin issuer Tether unveiled plans to invest around US$500 million over the next six months in building Bitcoin mining facilities in Paraguay, Uruguay, and El Salvador. The firm aims to grow its computing power to 1% of the BTC mining network.

Sushi has partnered with ZetaChain to explore native Bitcoin swaps across 30 different blockchains, aiming to enable trading of BTC without wrapping across several blockchains in a “native, decentralised and permissionless manner.” Sushi’s deployment of its DEX on ZetaChain is set to take place in two phases. The integration is set to include Sushi’s V2 and V3 automated market makers and Sushi’s cross-chain swap, SushiXSwap.

Blur co-founder’s Layer-2 network Blast has launched in early access mode after raising $20 million from investors. Blast aims to be the first Ethereum L2 network to introduce a native yield model, offering 4% for ETH and 5% for stablecoins. It has attracted significant attention, with nearly $30 million in bridged funds within hours of its announcement.

Decentralised derivatives exchange dYdX utilised its insurance fund to cover $9 million in user liquidations following a targeted attack on 17 November. The alleged attack affected long positions in YFI tokens, liquidating almost $38 million in positions, which led to a sharp decline in YFI’s price. Its founder Antonio Juliano believes the attack involved market manipulation and is working with partners to investigate the incident, assuring that user funds were not impacted.

Avalanche-based decentralised exchange Trader Joe deactivated its frontend following a potential exploit on 17 November. Reports have emerged indicating that a contract address on the platform was replaced with a phishing address. The Trader Joe team has urged users to refrain from trading or executing transactions while it investigates the situation.

The Fantom Foundation awarded a $1.7 million bounty to a security researcher for preventing a vulnerability that could have allowed a hacker to access and drain $170 million from the platform. The vulnerability was found to be associated with a dormant admin token for Fantom’s ERC-20 FTM contract, and has now been “quickly mitigated”.

Recent Research Reports

Research Roundup Newsletter [October 2023]: We present to you our latest issue of Research Roundup, featuring trending market insights in October, charts of the month, and our insights on friend.tech and SocialFi trends.

Friend.Tech: Explore what friend.tech is, its success factors and criticisms, and some of the competing platforms that have emerged.

Alpha Navigator: Quest for Alpha [October 2023]: US Federal Reserve holds steady on interest rates. BTC starts 4Q strong, outperforming other asset classes.

Recent University Articles

Liquid Staking With the Lido (LDO) Token: The Lido token was conceived to make liquid staking easier and more accessible to crypto users. Here’s how it works.

What Is Unibot (UNIBOT)?: In this article, we focus on a Telegram trading bot called Unibot, covering how Telegram users can trade cryptocurrencies through it.

Liquid Staking: What It Is and How It Works: Liquid staking is a revolutionary tool in the cryptocurrency space, allowing users to access staked tokens. Here’s how it works.

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!