Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 44, 26/10/2023 - 1/11/2023)

Ethereum devs confirm Dencun upgrade ruled out for 2023. Arbitrum Orbit is now officially mainnet-ready. Lido DAO raise concerns over LayerZero’s unapproved wstETH bridge rollout.

Weekly DeFi Index

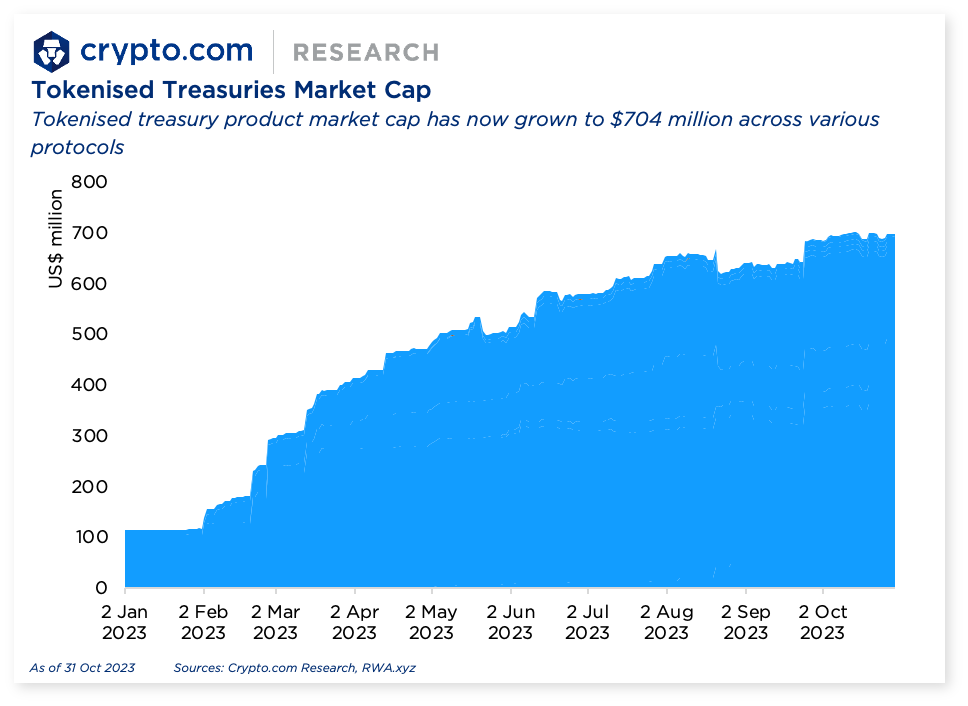

Chart of the Week

The real-world asset (RWA) tokenisation race is intensifying. Tokenised versions of US Treasuries grew sevenfold year-to-date, with the market surging to US$704 million from around $100 million at the start of the year. Protocols on the Ethereum and Stellar networks lead in the value of Treasury tokens on-chain, reaching over $300 million in market capitalisation each.

Outside treasuries, further innovations are enhancing the RWA narrative. This past week, European clearinghouse Euroclear unveiled Digital Securities Issuance (D-SI), a service which facilitates the issuance, distribution, and settlement of fully digital international securities. Developers of meme coin Floki also launched its RWA tokenisation platform TokenFi, allowing users to launch any cryptocurrency without writing code.

Learn more about RWA tokenisation in our research report: Real-World Assets: Bringing Real-World Value to DeFi

TVL of Top Chains

Top DEX by Chain

News Highlights

Ethereum core developers confirmed that the anticipated Dencun upgrade will not be implemented in a network hard fork before the end of 2023. They are currently working through problems with the next suite of upgrades featuring EIP-4844, and have pointed to “consistent consensus issues” on the ten developer networks (devnets) that have been spun up to test the upgrade as the main reason.

Ethereum scaling solution Arbitrum Orbit is officially mainnet-ready, allowing developers to create their own chains that will settle onto one of Arbitrum’s Layer-2 chains, such as Arbitrum One, Arbitrum Nova, or testnets Arbitrum Goerli or Arbitrum Sepolia.

Polygon launched its new token, POL, which will underpin its forthcoming revamped staking layer. The migration process from the old MATIC token to the new POL token has been initiated, and several prominent DeFi dapps have integrated Polygon’s migrator contract into their protocols, including CoWSwap, ParaSwap, and Kyber Network.

LayerZero rolled out its wstETH bridge, allowing users to seamlessly move Lido’s wrapped stETH tokens between Ethereum, Avalanche, BNB, and Scroll. However, LayerZero’s bridge deployment without Lido DAO’s permission has caused a backlash, with some Lido DAO members voicing concerns that the DAO is being strong-armed into approval.

The Starknet Foundation allocated 50 million STRK tokens to a new Early Community Member Programme (ECMP) to incentivise early developers and contributors to help build the network. The application process for ECMP runs through 19 November; however, the allocated tokens will be locked until at least next April.

Interchain Foundation, the core developer of Inter-Blockchain Communication (IBC) protocols, announced that Landslide — the team developing the IBC light client on Avalanche — will launch its incentivised testnet on 1 November. The development will pave the way for seamless interoperability between Avalanche, Cosmos Hub, and over 100 other IBC-enabled chains.

Blockchain infrastructure firm Fireblocks identified and assisted in addressing an Ethereum ERC-4337 account abstraction vulnerability in the smart contract wallet, UniPass. The vulnerability, which was found in hundreds of mainnet wallets during a white hat hacking operation, could have allowed a potential attacker to carry out a full account takeover of the UniPass Wallet by manipulating Ethereum’s account abstraction process.

Unibot, a Telegram-based trading tool, confirmed that it was hit by a token approval exploit that resulted in the theft of approximately $580,000 worth of crypto from users. Investigations are ongoing while Unibot tries to contain the issue, and it stated that funds lost will be compensated.

Solana introduced Firedancer, its second validator client developed by Jump Crypto, which has officially launched on the testnet. Firedancer aims to improve the throughput within the Solana network by reducing latency times and to achieve scalability by rewriting each component of the Solana architecture. In its performance demo, it showcased about 1.08 million transactions per second (with ~1kB transaction size) off just four CPU cores, surpassing Solana’s recommended 12-core setup.

Recent Research Reports

Research Roundup Newsletter [September 2023]: We present to you our latest issue of Research Roundup, featuring trending market insights in September, charts of the month, and our insights on the Ethereum Dencun upgrade.

Ethereum: Dencun Upgrade and Proto-Danksharding: Ethereum’s next major upgrade is Dencun, which introduces Proto-Danksharding. We explore what it is and its benefits.

Alpha Navigator: Quest for Alpha [September 2023]: Risk assets end 3Q 2023 mostly down on a QoQ basis, but YTD paints a more positive picture. Inflation retreats. The US avoids a government shutdown.

Recent University Articles

How Do Social Dapps Work?: Social dapps leverage blockchain to create more transparent, secure, and user-centric online social interactions — here’s how they work and which platforms are popular in 2023.

What Are Bitcoin and Ethereum ETFs and How Do They Work?: Bitcoin and Ethereum ETFs are investment vehicles that track the price of BTC and ETH — and could bring increased liquidity, stability, and mainstream adoption to the cryptocurrency market.

How Does Bitcoin Mining Work?: Bitcoin can be mined for BTC rewards — here’s how the process works in detail.

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!