Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 41, 05/10/2023 - 11/10/2023)

FRAX to offer Treasury yields with new staking vault, sFRAX. New BitVM proposal brings Ethereum-style contracts to Bitcoin. Friend.tech and its competitor Stars Arena suffers attack.

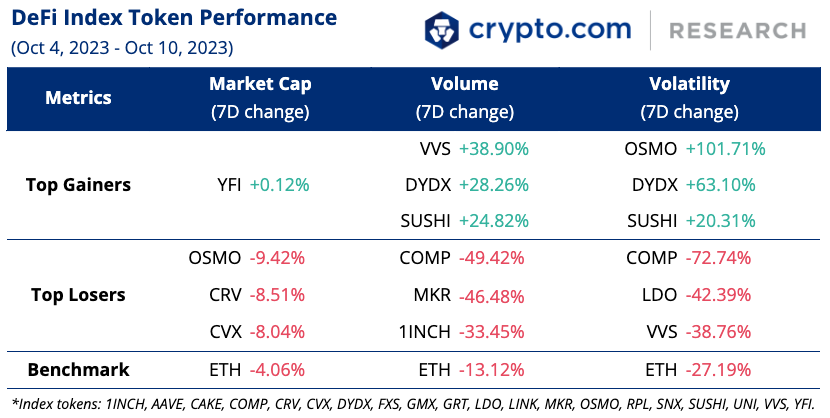

Weekly DeFi Index

This week's market cap, volume, and volatility indices were negative at-4.82%, -25.36%, and -40.76%, respectively.

Chart of the Week

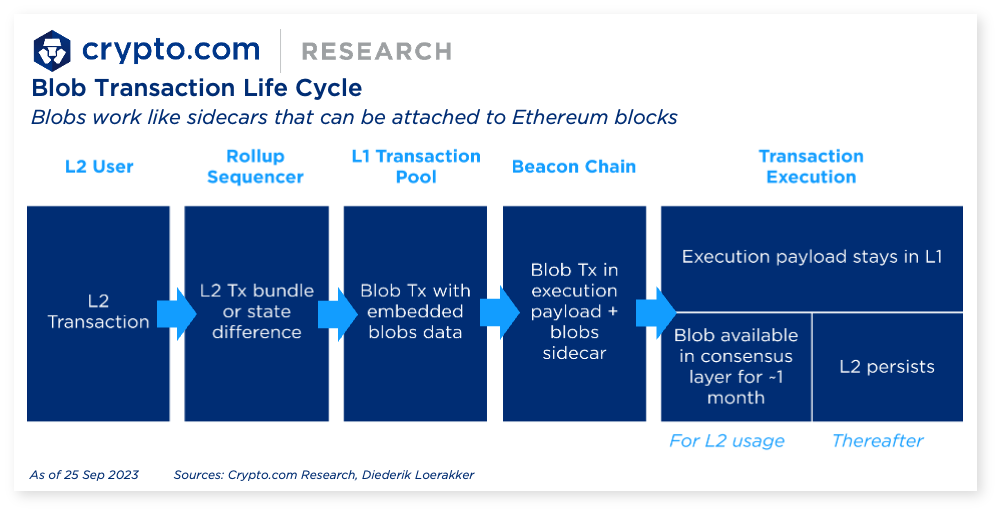

Likely to launch in 2024, Dencun is the next significant upgrade to Ethereum. It is expected to be a major step towards achieving scalability for the network. In Ethereum's roadmap, it is considered the beginning of “The Surge”, which aims to enhance 'rollup-centric' scaling in Ethereum via data sharding (Danksharding).

The most anticipated feature of the upgrade is EIP-4844, or Proto-Danksharding. It introduces a new transaction type known as 'blob-carrying' transactions, which provides a cheaper way for L2 rollups to add data to blocks and expand storage for Ethereum blocks.

Learn more about the upcoming upgrade and Proto-Danksharding from our latest research report: Ethereum: Dencun Upgrade and Proto-Danksharding

News Highlights

Decentralised stablecoin project FRAX has launched a new staking vault called sFRAX, which aims to offer users Treasury yields and is meant to tap the yields’ corresponding hikes. Similar in motivation to MakerDAO's DAI Savings Rate, the sFRAX savings vault allows users to deposit sFRAX and receive a 10% yield. This rate will adapt over time to reflect the Fed's IORB rate, which currently stands at 5.4%.

Bitcoin developer Robin Linus has proposed BitVM, a new way to bring more expressive off-chain smart contracts to Bitcoin without the need for a soft fork. BitVM's architecture is based on fraud proofs and a challenge-response model, enabling the execution of Bitcoin contract logic off-chain while verification is done on Bitcoin. This works similarly to Ethereum's optimistic rollups.

New lending protocols have been unveiled in the market recently. Morpho has released the whitepaper and code for its new lending protocol dubbed Morpho Blue. It aims to enable the trustless and efficient lending and borrowing of assets in the DeFi space. DeFi platform Instadapp has also introduced a new lending protocol called Fluid. Developed over 1.5 years and currently in its testing phase, Fluid aims to address the issue of liquidity fragmentation in the DeFi sector by integrating functionalities from Aave, Compound, Uniswap, Maker, and Curve.

In a recent surge of SIM swap attacks, four Friend.tech users had their accounts drained, resulting in the theft of approximately 234 ETH (equivalent to about US$385,000 at the time of reporting) within a 24-hour period. The attacks were carried out by a single scammer who also reportedly managed to execute a string of attacks in the weeks prior, stealing around 109 ETH. As a response to these security breaches, Friend.tech has implemented enhanced security measures, allowing users to add and remove various login methods from their accounts.

Avalanche-based Friend.tech competitor Stars Arena has suffered two separate attacks in one week. On 5 October, it confirmed it suffered a vulnerability that allowed the hacker to transfer $2,000 worth of AVAX. Two days later, it was hit by a smart contract exploit which allowed the attackers to transfer 266,103 AVAX (worth almost $3 million) using the FixedFloat exchange service, and cited a DDoS attack on the platform. Stars Arena confirmed it had secured funding to cover the assets stolen, and will reopen the smart contract following a full security audit.

THORSwap, a decentralised exchange running on the THORChain network, has paused its trading operations and shifted into maintenance mode after a series of illicitly-linked funds were passed through the platform. This includes transactions originating from the ‘FTX Exploiter’ wallet that drained funds from the FTX exchange last year.

After reporting that its website went offline, Web3 community platform Galxe Protocol confirmed it experienced a DNS attack on 6 October, resulting in losses of over $396,000 as per its preliminary estimate. The firm later on announced that it will make users whole by 110% if they have been affected by the recent hack.

Bitcoin Ordinals marketplace Ordswap has experienced a domain hack, urging users to recover their private keys. The website was temporarily redirected to a competing marketplace, RelayX. During the breach, it reportedly featured a button that appeared to be a phishing attempt. An Ordswap team member also claimed that user private keys and assets had not been impacted, but users could be compromised if they interacted with the site.

Recent Research Reports

Research Roundup Newsletter [September 2023]: We present to you our latest issue of Research Roundup, featuring trending market insights in September, charts of the month, and our insights on the Ethereum Dencun upgrade.

Ethereum: Dencun Upgrade and Proto-Danksharding: Ethereum’s next major upgrade is Dencun, which introduces Proto-Danksharding. We explore what it is and its benefits.

Alpha Navigator: Quest for Alpha [September 2023]: Risk assets end 3Q 2023 mostly down on a QoQ basis, but YTD paints a more positive picture. Inflation retreats. The US avoids a government shutdown.

Recent University Articles

What Is MakerDAO (DAI)?: Learn about the DAO of DAOs and its stablecoin, DAI — including how to use, trade, and create it.

What Is Bitcoin Cash?: Learn about Bitcoin Cash, the 2017 hard fork from the original Bitcoin blockchain, and how this alternative measures up to BTC.

Recruitment Scams - How to Know if a Job Offer Is Fake: Received a job offer out of the blue that sounds too good to be true? It might be a recruitment scam. In this article, learn all about fake job offers in the crypto space and how to recognise them.

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!