Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 38, 14/09/2023 - 20/09/2023)

Ethereum’s new Holesky testnet delayed after launch failure. Cosmos Hub rolls out Gaia v12 upgrade to add a liquid staking module. Optimism announces third round of community token airdrops.

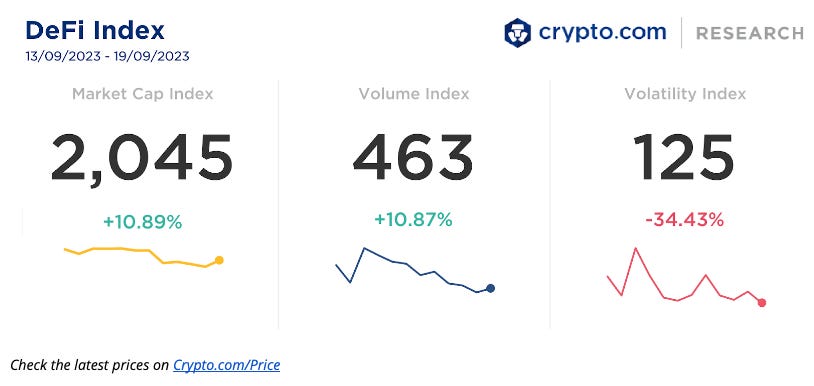

Weekly DeFi Index

This week's market cap and volume indices were positive at +10.89% and +10.87%, respectively, while the volatility index was negative at -34.43%.

Chart of the Week

On their latest AllCoreDevs call, Ethereum core developers agreed to add EIP-7514 as part of the forthcoming Ethereum Dencun upgrade, focusing on staking and validator rewards. EIP-7514 will establish a fixed Max Epoch Churn Limit for the validator activation queue, setting the upper limit to eight (this variable was previously derived from “total number of validators/65536”, which is approximately 12/epoch) and without affecting the withdrawal queue. This Epoch Churn Limit will change the validator growth rate from exponential to linear.

The proposal is intended to address concerns about the rapid growth of the Ethereum network and aims to slow down the growth of the ETH staking rate, thereby providing the Ethereum community additional time to craft an improved validator reward scheme. The latest data shows there are currently about 26.85 million ETH staked, which represents 22.32% of the total ETH supply.

News Highlights

Ethereum's Holesky testnet, which was intended to address scaling issues and celebrate the first anniversary of The Merge, failed to launch because of a misconfiguration in the genesis files. Developers are planning for another launch attempt in about two weeks.

The Cosmos Hub has implemented the Gaia v12 upgrade to integrate a liquid staking module onto the network. The upgrade allows ATOM tokens staked with Cosmos Hub validators to be swapped into liquid-staked ATOM and eliminates the 21-day locking period applied for unstaked ATOM.

Polygon Labs has begun the groundwork on an expansion that aims to include all blockchains and applications on the Polygon network as part of its Polygon 2.0 roadmap. The expansion will introduce a new governance structure focusing on the expansion of the existing Polygon Improvement Proposal (PIP) framework, the ‘System Smart Contracts Governance’, and the ‘Community Treasury’ mechanism.

Layer-2 blockchain Optimism has completed its third community airdrop, distributing a total of 19,411,313 OP tokens worth US$27 million to over 31,000 unique addresses.

Eclipse has announced the launch of its Ethereum SVM L2 mainnet, which will integrate multiple blockchain technologies to provide a powerful and efficient environment for dapps and transactions. The mainnet will utilise Ethereum for settlement, ETH as the gas token, Solana Virtual Machine (SVM) as the execution environment, Celestia for extended data availability, and RISC Zero for ZK fraud proof.

Recent Research Reports

Research Roundup Newsletter [August 2023]: We present to you our latest issue of Research Roundup, featuring trending market insights in August, charts of the month, and our latest research on decentralised stablecoins.

Alpha Navigator: Quest for Alpha [August 2023]: Asset classes dipped in August; BTC and ETH underperformed. No surprises from the central bankers summit at Jackson Hole. China intensifies economic stimulus.

Decentralised Stablecoins: Stablecoins are well positioned to facilitate broader adoption of cryptocurrencies. We explore the key decentralised stablecoin projects and their innovative mechanisms.

Recent University Articles

What Is a Rug Pull and How Does It Work?: A rug pull is a term for a scam in the crypto space where traders are left hanging with worthless assets. Here’s how to avoid it.

Pig Butchering Scams: What They Are and How To Avoid Them: This more recent type of scam appearing in the crypto space is a cross between romance and investment scams. Here’s how these scams work and the basics of recognising them.

Crypto Romance Scams: What They Are and How To Avoid Them: Your new date is talking you into a hot, new crypto project? It could be a romance scam. Here’s how they work and how to recognise them.

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!