Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 35, 24/08/2023 - 30/08/2023)

Tether releases reserves reports, confirming a $3.3B liquidity buffer to maintain $USDT stability. Aave suspends GHO minting to fix integration issue. Shibarium bridge token withdrawals are now live.

Weekly DeFi Index

This week's market cap index was positive at +1.91%, while volume and volatility indices were negative at -19.04% and 40.66%, respectively.

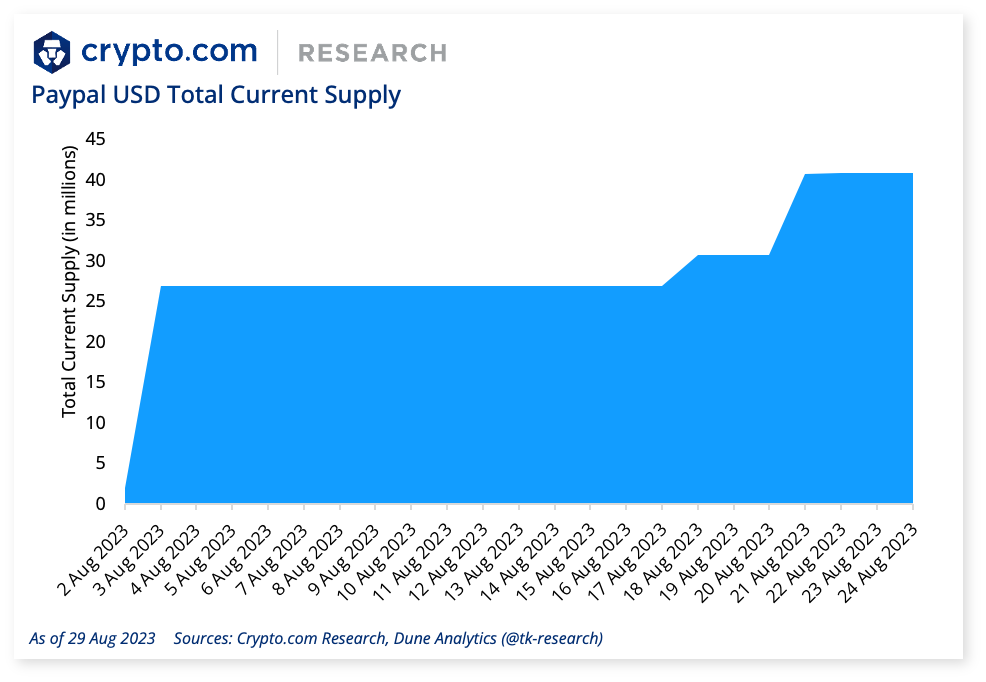

Chart of the Week

Payment titan PayPal introduced its Paxos-issued stablecoin PYUSD earlier this month as a contender to existing stablecoins. It is fully backed by US Dollar deposits, short-term Treasuries and similar cash equivalents.

Data from Crypto.com Price shows that PYUSD’s market cap has reached approximately US$43.2 million at the time of writing. Other recently launched stablecoins such as Aave’s GHO and Curve’s crvUSD have also gained substantial market capitalisation, standing at $23.4 million and $116.4 million respectively.

News Highlights

Tether’s latest reserves report disclosed that it currently maintains a $3.3 billion liquidity buffer, spread across 15 blockchain ecosystems, to ensure stability within the USDT ecosystem.

Minting new GHO stablecoins has been temporarily paused after a technical issue was identified in GHO’s integration with the Aave V3 GHO pool. A governance proposal has been submitted to fix the issue. Additionally, Aave confirmed that no funds are at risk and all other markets are operating as normal.

Token withdrawals from Shiba Inu’s Layer-2 Shibarium Network bridge are now available, following a public restart due to software bugs. The withdrawal process for SHIB, LEASH, and WETH will take anywhere from 45 minutes to three hours, while BONE withdrawals can take up to seven days.

DeFi liquidity protocol Balancer suffered an exploit after identifying a critical vulnerability in its “v2” pools last week. Blockchain security firm Beosin reported that the exploit was carried out through multiple flash loan attacks, with total losses reaching approximately $979,420.

Magnate Finance, a DeFi lending platform on Base, has reportedly initiated an exit scam, pulling $6.4 million worth of funds hours after some members of the community issued a preventive warning. The project team deleted its Telegram group and took down its website, then manipulated the price oracle of the protocol and removed all assets.

Recent Research Reports

Research Roundup Newsletter [July 2023]: We present to you our latest issue of Research Roundup, featuring trending market insights in July, charts of the month, and our latest research exploring real-world assets.

Crypto Market Sizing Report H1 2023: Global crypto owners reached 516 million by the first half of 2023.

Real-World Assets: Bridging Real-World Value to DeFi: Real-World Assets is a promising application for blockchain technology that is gaining traction. We explore notable projects like Centrifuge, Ondo, Tangible, and Toucan.

Alpha Navigator: Quest for Alpha [July 2023]: Risk assets continued their positive price action in July, although BTC dipped slightly. The macro calendar was quiet up until mid-August, when US CPI data and FOMC minutes were released.

Recent University Articles

Top NFT Tokens to Know in 2023: Discover the top NFT tokens making waves in 2023. Learn how to use them for blockchain gaming and for actively participating in shaping NFT platforms.

Top Web3 Tokens to Know in 2023: Discover promising Web3 tokens in the cryptocurrency landscape that may redefine the decentralised ecosystem in the coming years.

10 Bearish Crypto Trading Indicators to Know: Discover 10 popular bearish cryptocurrency trading indicators that, when combined with other indicators, can help enhance the trading experience.

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!