Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 18, 27/04/2023 - 03/05/2023)

Cronos Labs partners with AWS for its AWS Activate programme. Bitcoin’s transaction volume hits all-time high thanks to Ordinals. Circle launches USDC transfer protocol for Ethereum and Avalanche.

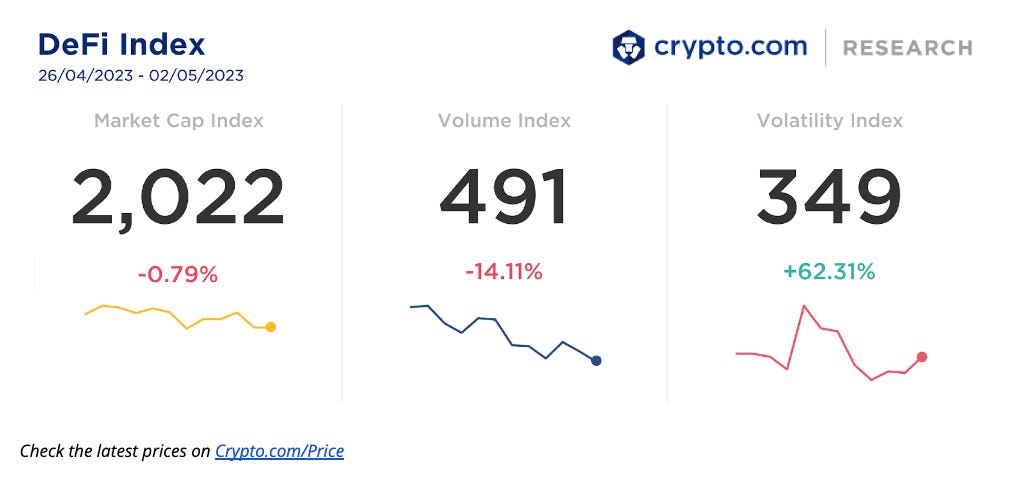

Weekly DeFi Index

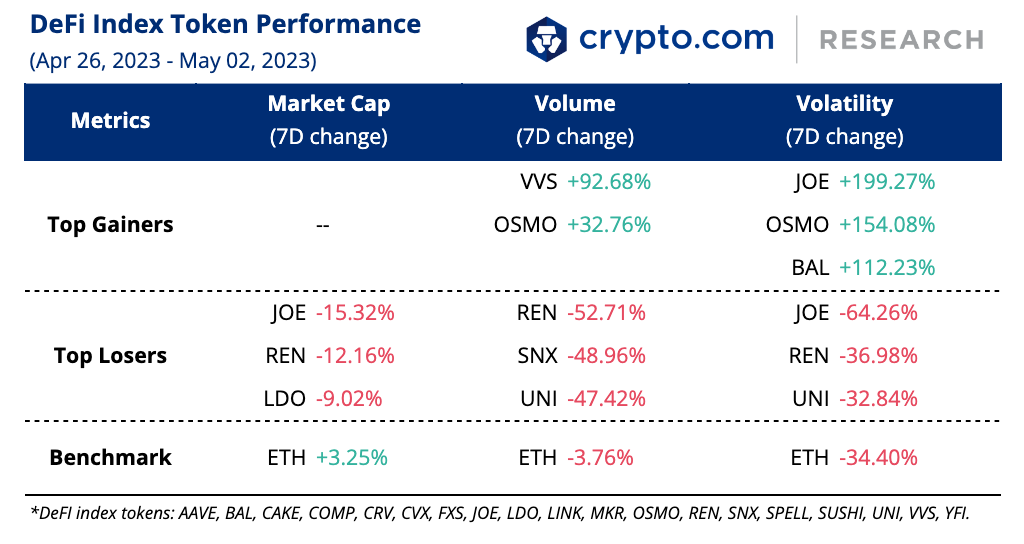

This week's market cap and volume indices were negative at-0.79%and -14.11%, respectively, while the volatility index is positive at +62.31%.

New Project Spotlight

Crypto.com announced a collaboration with Samsung for the most recent Crypto.com App update, Version 3.158.1, to feature an optimised experience for Samsung Galaxy Z Fold devices, including the latest Galaxy Z Fold4. Crypto.com is the first cryptocurrency platform to deliver a tailored experience for Galaxy Z Fold devices.

News Highlights

Blockchain startup accelerator Cronos Labs is collaborating with Amazon Web Services via its AWS Activate programme to support developers in building the next generation of Web3 applications in the Cronos ecosystem, with a focus on the DeFi, GameFi, SocialFi, and infrastructure verticals.

Bitcoin recently processed more transactions in a single day than at any point in its 14-year history. The daily number of Bitcoin transactions surpassed 568,300 on 30 April — nearly 78,000 more than its previous peak during the 2017 bull run. Over 307,000 transactions were of Ordinal NFTs.

USDC stablecoin issuer Circle launched a mainnet protocol that allows USDC transfers between Ethereum and Avalanche, eliminating the need for users to deposit their coins with a USDC partner or use a third-party bridge.

Decentralised exchange Curve Finance deployed smart contracts for the crvUSD decentralised stablecoin on the Sepolia testnet. Sepolia serves as one of two testnets used by Ethereum developers to test code before mainnet deployment.

Layer-1 blockchain Avalanche deployed the Cortina upgrade on its mainnet, which aims to optimise the network for developers.

Uniswap Foundation unveiled Uniswap Agora, a unified delegate and delegation portal built to improve the Uniswap governance experience and to give its community a chance to identify delegates that they align with.

Decentralised exchange Level Finance experienced a security breach after 214,000 of its LVL tokens (worth over US$1 million) were drained and stolen. According to blockchain security firm Peckshield, the exploit took place via Level Finance’s ‘LevelReferralControllerV2’ smart contract, which included a bug that allowed for “repeated referral claims” from the same epoch.

zkSync-powered decentralised exchange Merlin was reportedly hacked for $1.82 million immediately after receiving a code audit from blockchain security firm CertiK. CertiK is launching a compensation plan to cover the lost funds, and offering the rogue developer 20% of the total stolen funds as a white hat bounty.

Recent Research Reports

Monthly Research Roundup (March 2023): In this issue, we feature trending market insights, our latest Crypto.com Visa Card Consumer Spending Insights for 2022, and our research reports on liquid staking derivatives.

Liquid Staking Derivatives: Money Legos in DeFi: Liquid staking is now the second largest sector in crypto after DEXes, replacing DeFi lending. Today the liquid staking narrative remains strong in anticipation of Ethereum’s Shanghai upgrade, and this report explores its current landscape.

Alpha Navigator: Quest for Alpha [March 2023]: Bitcoin shines amid banking sector turmoil. The market expects a pause in rate hikes, potentially setting up a new tailwind for risk assets.

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!