Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 16, 13/04/2023 - 19/04/2023)

Ethereum’s Shapella upgrade goes live. Uniswap community approves proposal to launch on Polygon’s zkEVM. Arbitrum proposal to return 700M ARB tokens fails.

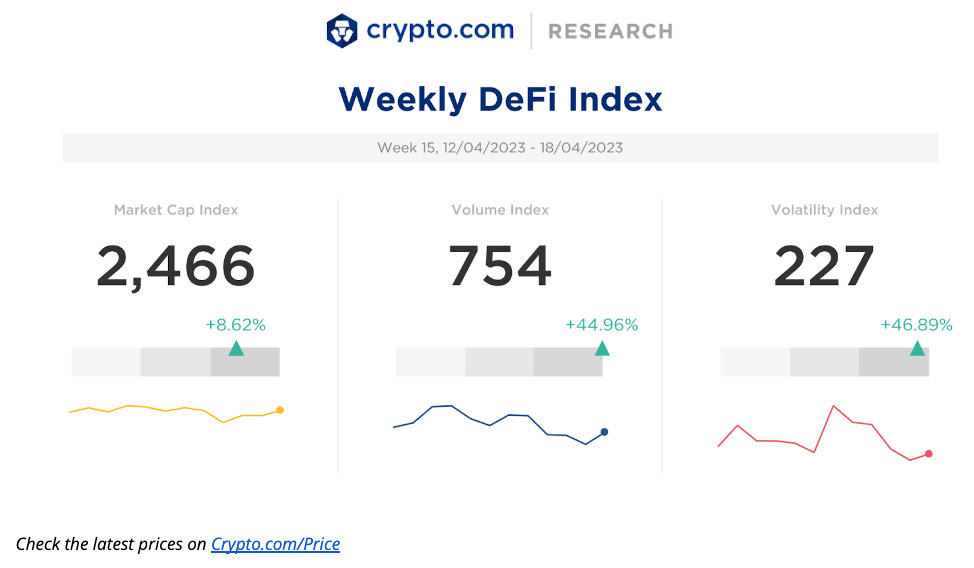

Weekly DeFi Index

This week's market cap, volume, and volatility indices were positive at +8.62%, +44.96%, and+46.89%, respectively.

News Highlights

Ethereum successfully completed the Shapella upgrade on 12 April, and validators can now withdraw their staked ETH. Over 1 million ETH have been withdrawn since Sunday, with some token holders opting to restake their ETH withdrawn since the upgrade.

The Uniswap DAO approved the proposal to launch v3 on Polygon zkEVM after a unanimous governance vote. This move will allow users to access the decentralised exchange from Polygon’s newly released zkEVM Layer 2 network.

Arbitrum Improvement Proposal (AIP) 1.05, which aims to return 700 million ARB governance tokens to Arbitrum’s DAO Treasury, has failed to secure approval by an overwhelming majority.

A recent vulnerability that affects Ethermint and the Cosmos ecosystem was discovered by crypto trading firm Jump Crypto, which could have resulted in an eight-figure exploit. The Evmos core development team confirmed that it blocked the vulnerability before it could cause any impact to networks.

An older version of the DeFi protocol Yearn Finance was exploited for US$11.6 million in a flash loan attack on 13 April, due to a vulnerability in Yearn’s USDT token yUSDT.

DeFi protocol Kyber Network discovered a vulnerability in KyberSwap Elastic, and asked its liquidity providers to withdraw their funds immediately. Only KyberSwaP Elastic funds were reported to be affected, and so far no funds have been lost.

Consensys confirmed that an unnamed third-party service provider was a victim in a cyber security incident, which resulted in an unauthorised third party gaining access to 7,000 MetaMask users’ data.

Recent Research Reports

Liquid Staking Derivatives: Money Legos in DeFi: Liquid staking is now the second largest sector in crypto after DEXes, replacing DeFi lending. Today, the liquid staking narrative remains strong in anticipation of Ethereum’s Shanghai upgrade, and this report explores its current landscape.

Crypto.com Visa Card Consumer Spending Insights 2022: A full breakdown of what our community across the globe liked to spend their crypto on in 2022.

Alpha Navigator: Quest for Alpha [March 2023]: Bitcoin shines amid banking sector turmoil. The market expects a pause in rate hikes, potentially setting up new tailwinds for risk assets.

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!