Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 10, 02/03/2023 - 08/03/2023)

Ethereum developers delay ETH staking withdrawals to April. Optimism announces its latest hard fork, Regolith upgrade. Aave plans to deploy its Aave V3 MVP on Polygon’s zkEVM.

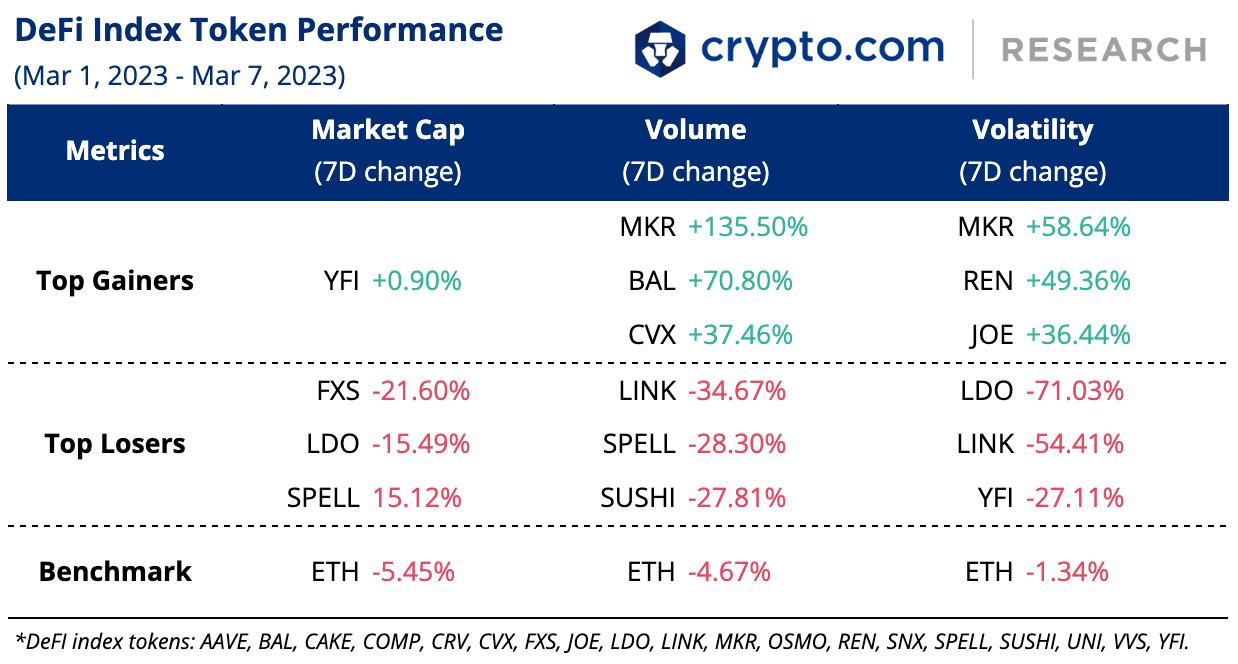

Weekly DeFi Index

This week's market cap, volume, and volatility indices were negative at -6.11%, -10.97%, and -30.37%, respectively.

DAI stablecoin creator MakerDAO is reviewing a proposal that would allocate an additional US$750 million to invest in U.S. Treasurys. If passed, the resolution would help “take advantage of a favourable yield environment” and increase the $500 million authorised in October to $1.25 billion.

New Project Spotlight

Cronos has integrated with Pyth Network, bringing valuable financial market data into the Cronos ecosystem. This partnership will allow developers on Cronos to tap into Pyth’s over-200 price feeds for equities, commodities, FX pairs, and cryptocurrencies. Fulcrom Finance, a decentralised perpetuals exchange built in Cronos, is now also powered by the Pyth Network.

News Highlights

ETH staking withdrawals have been pushed back to April, according to Ethereum core developers. At their latest meeting, the developers announced that Goerli testnet will deploy on or around March 14, and the real Shanghai upgrade will launch in the middle of April if all goes according to plan.

Layer 2 scaling solution Optimism announced its latest hard fork, Regolith upgrade, which aims to enhance deposit transaction ordering. This follows its announcement that the Bedrock upgrade vote has been rescheduled to Cycle 11, which runs from 2 March to 5 April.

Aave is considering a proposal to put a minimal viable product (MVP) of Aave V3 on Polygon's planned zkEVM Layer-2 network, which will be deployed after its mainnet beta launch on March 27, if approved.

Uniswap Labs’s plans to release a new self-custodial mobile wallet have been blocked by Apple after the latter rejected the wallet’s final build without any explanation as to why.

Ethereum software developer ConsenSys announced that its zkEVM testnet will be open to the public starting 28 March. Consensys first launched a private zkEVM testnet in December, but will soon open it up for anyone to try and stress-test the network.

A white hat hacker received a bounty reward of $97,000 from DeFi lending platform Tender.fi after returning stolen funds from its recent exploit on the platform. The hacker was able to borrow $1.59 million in assets despite depositing only one GMX token worth $71.

Recent Research Reports

Research Roundup Newsletter [February 2023]: In this issue, we feature trending market insights and our analyses of the current state of the decentralised derivatives market.

Alpha Navigator: Quest for Alpha [February 2023]: Asset classes took a breather in February and sold off, although crypto bucked the trend. BTC and ETH options implied volatilities remain at subdued levels.

Overview of Decentralised Derivatives: Crypto derivatives dominate the industry, representing about 70% of the entire market. In this report, we shed light on derivatives in DeFi, their market overview, and some innovations in the space.

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!