Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 41, 12/10/2022 - 18/10/2022)

Proposal for Uniswap to be deployed on zkSync passes with 100% of votes. Aptos Foundation mainnet rollout draws criticism. Ethereum launches ‘Shandong’, its pre-Shanghai upgrade testnet.

Weekly DeFi Index

This week's market cap, volume, and volatility indices were positive at +3.29%, +13.50%, and +73.12%, respectively.

Check the latest prices on Crypto.com/Price

DeFi Index Tokens

*DeFI index tokens: AAVE, BAL, CAKE, COMP, CRV, CVX, FXS, JOE, LDO, LINK, MKR, OSMO, REN, SNX, SPELL, SUSHI, UNI, VVS, YFI.

News Highlight

Uniswap, a decentralised exchange protocol operating on Ethereum, will soon be deployed on privacy-focused Layer-2 tool zkSync. The proposal was put forth by Matter Labs, the developer behind zkSync, and was passed following a 100% community vote in favour of the move. According to Matter Labs, deploying to zkSync will allow Uniswap to offer lower transaction costs compared to the Ethereum blockchain without compromising security. This also follows Uniswap Labs’s latest announcement that it raised US$165 million in Series B funding led by Polychain Capital.

Aptos finally hit the mainnet after years of development, but the rollout so far has been met with criticism. Months prior to launch, Aptos claimed that it can handle 130,000 transactions per second (TPS) — significantly more than other layer-1 solutions like Ethereum and Solana — but it was observed to only have reached a speed of 4 TPS at launch. A pseudonymous user tweeted: “majority of these transactions are not actual transactions, they are merely validators communicating and setting block checkpoints and writing metadata to the blockchain”. There were also concerns around the lack of publicity of its tokenomics, despite the fact that most centralised exchanges already announced listing Aptos’s native token on their platforms.

On Friday, The Ethereum Foundation announced the launch of ‘Shandong’, an early pre-Shanghai testnet that will serve as a testing ground for numerous Ethereum Improvement Proposals (EIPs). Shanghai is Ethereum’s next major upgrade post-Merge, and will introduce code that will allow network validators to withdraw their staked Ether.

DEX Protocols Metrics

Sources: CoinGecko, DeFi Llama, Nomics, Crypto.com Research

Lending Protocols Metric

*LDR (Loan to Deposit Ratio) = Total Borrowed / TVL

Sources:CoinGecko,DeFi Llama,Crypto.com Research

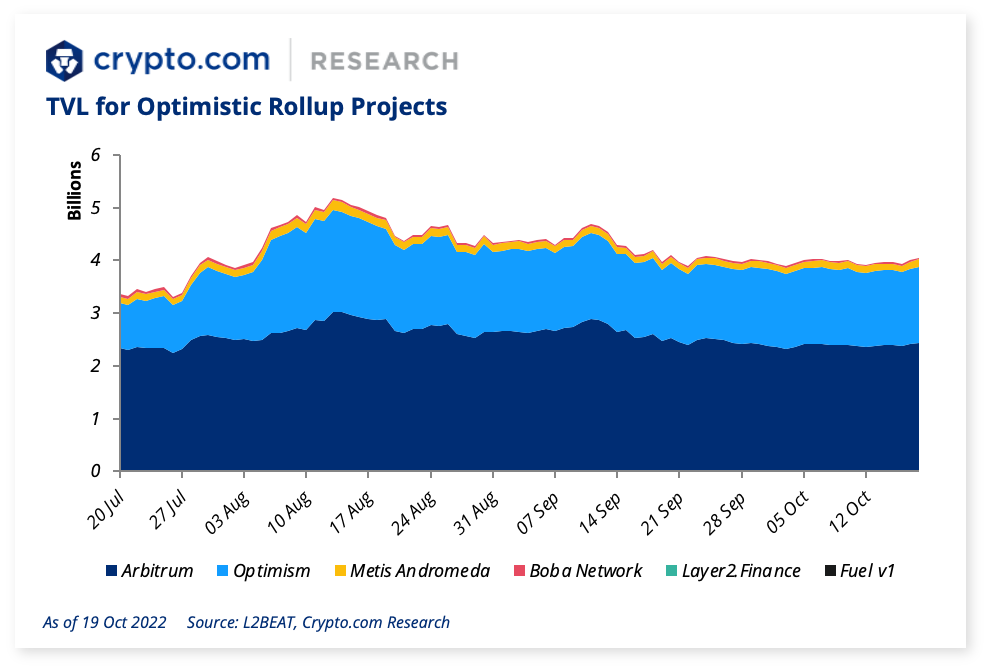

Charts on Layer-2 Projects

The overall L2 market saw positive growth last week, as its TVL rose by +0.78%. Optimistic rollup projects jumped by +3.29%, while zero-knowledge rollup projects fell by -5.63%. Ethereum’s TVL change was positive at +0.61%.

The TVL changes for all optimistic rollup projects were all positive except for Layer 2.Finance (-0.45%). Metis Andromeda surged the most at +12.90%.

ZK rollup projects’ TVL movement was a mixed bag: StarkNet saw the highest growth at +8.24%, while Loopring plummeted the most at -9.09%.

Further Reading

BlockTower launches $150M fund to Invest in blockchain infrastructure and DeFi

Crypto market maker Wintermute pays off $96M TrueFi debt weeks after being hacked

Mango Market's DAO forum set to approve $47M settlement with hacker

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!