Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 40, 5/10/2022 - 11/10/2022)

BNB Chain temporarily halted after suffering a $566 million exploit. Solana-based DeFi protocol Mango was hacked for $100+ million. MakerDAO passed the plan to invest $500 million in U.S. government.

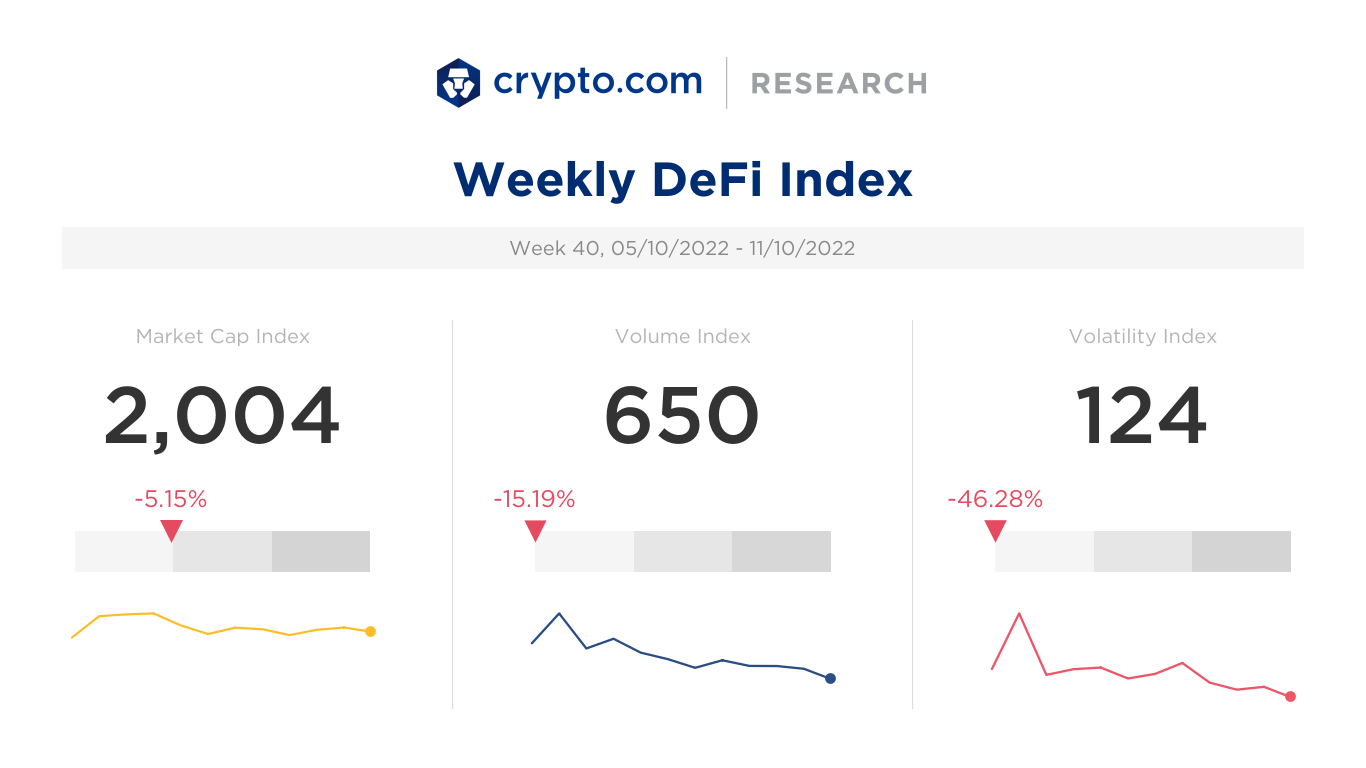

Weekly DeFi Index

This week's market cap, volume, and volatility indices were negative at -5.15%, -15.19%, and -46.28%, respectively.

Check the latest prices on Crypto.com/Price

DeFi Index Tokens

*DeFI index tokens: AAVE, BAL, CAKE, COMP, CRV, CVX, FXS, JOE, LDO, LINK, MKR, OSMO, REN, SNX, SPELL, SUSHI, UNI, VVS, YFI.

News Highlight

BNB Chain suffered a US$566 million exploit last Thursday. A hacker tricked the BSC Token Hub, a cross-chain bridge protocol, into sending two million BNB. BNB Chain halted the network temporarily in response to the attack. However, the attacker still managed to drain around $110 million of crypto using a novel approach, syphoning the funds across other networks. Under half of the stolen funds were deposited to a lending protocol on BNB Chain and borrowed centralised stablecoins, including USDT, USDC, and BUSD. The suspension of the BNB Chain network also led to the argument on its decentralisation.

Mango, a decentralised spot margin, perpetual futures, borrowing, and lending protocol on Solana was exploited for over $100 million. According to the report, the attacker managed to inflate the value of the protocol’s governance token MNGO, take out large loans against it, and drain Mango's liquidity pools.

MakerDAO, the lending protocol behind the DAI stablecoin, announced a plan to invest $500 million in short-term U.S. treasury bonds and investment-grade corporate bonds. The plan has been approved by the community, and will see $400 million of the organisation’s asset reserves put towards U.S. treasury bonds, and $100 million invested in corporate bonds.

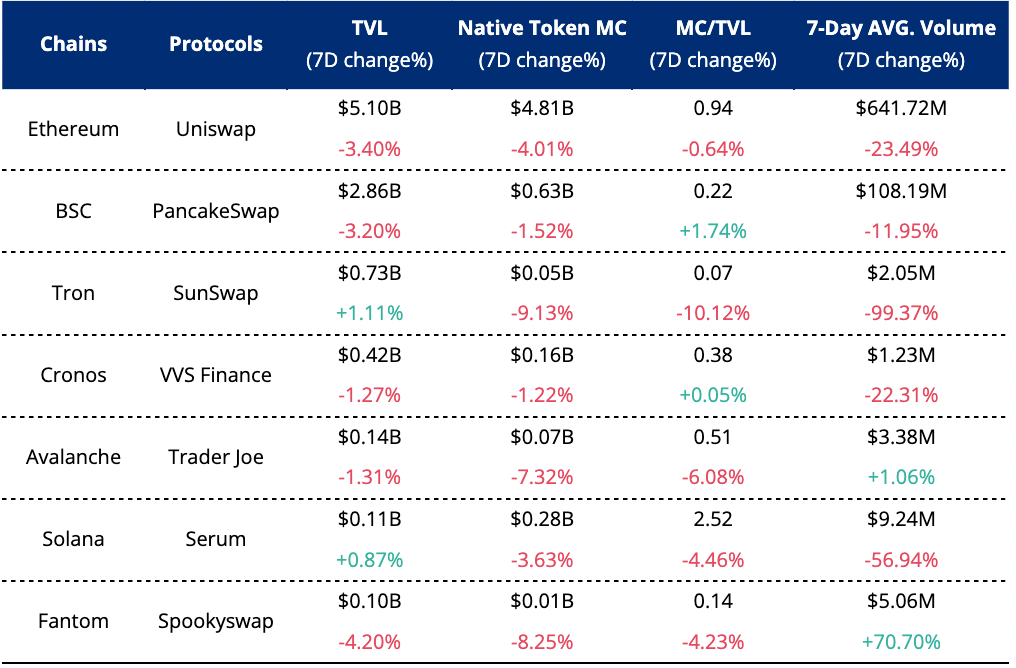

DEX Protocols Metrics

Sources: CoinGecko, DeFi Llama, Nomics, Crypto.com Research

Lending Protocols Metric

*LDR (Loan to Deposit Ratio) = Total Borrowed / TVL

Sources:CoinGecko,DeFi Llama,Crypto.com Research

Charts on Layer-2 Projects

The overall L2 market saw negative growth last week, as its TVL dropped by -2.33%. Optimistic rollups and zero-knowledge rollups projects fell by -1.80% and -1.06%, respectively. Ethereum’s TVL change was negative at -2.86%.

The TVL changes for all optimistic rollup projects were negative except Metis Andromeda (+4.45%). Optimism fell the most by -2.87%.

ZK rollup projects’ TVL movement was all negative except dYdX (+1.46%). Loopring plummeted the most at -6.01%.

Further Reading

Asset management giant GoldenTree discloses $5.2M investment in SushiSwap

Terra: Luna Foundation Guard shares update on distribution of remaining assets

Transit Swap DeFi hacker bags $690,000 bounty after returning $2.75M

Bitcoin mining difficulty sees sharpest increase since May 2021 despite slow price gains

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!