Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 36, 07/09/2022 - 13/09/2022)

Coinbase proposes to move 1.6 billion USDC from MakerDAO’s DAI collateral. The last Ethereum shadow fork upgrade is deployed on the mainnet. Mysten Labs raises $300 million to accelerate Sui adoption.

Weekly DeFi Index

This week's market cap index was negative at -1.84%, while the volume and volatility indices were positive at +19.43% and +30.62%, respectively.

Check the latest prices on Crypto.com/Price

DeFi Index Tokens

*DeFI index tokens: AAVE, BAL, CAKE, COMP, CRV, CVX, FXS, JOE, LDO, LINK, MKR, OSMO, REN, SNX, SPELL, SUSHI, UNI, VVS, YFI.

News Highlight

Coinbase has proposed an investment line with MakerDAO, the organisation behind DAI, the largest decentralised stablecoin. The proposal would move one third, or around US$1.6 billion of USDC backing DAI, to Coinbase for a 1.5% yield. According to the data, MakerDAO is the largest single USDC holder and the stablecoin accounts for 35% of DAI’s collateral, which is roughly $4.8 billion.

The 13th and last Ethereum shadow fork upgrade has been deployed on the mainnet. A shadow fork is a test fork run by developers to check whether the network is equipped to handle the network alterations that the final upgrade will deploy. Additionally, EthereumPoW (ETHW), a proof-of-work version of Ethereum (ETH) created by the community, revealed its mainnet launch plan. Per this roadmap, ETHW will go live 24 hours after The Merge.

Mysten Labs, the company behind the in-development layer-1 blockchain Sui, has raised $300 million to build its core infrastructure and accelerate the adoption of the Sui blockchain ecosystem.

DEX Protocols Metrics

Sources: CoinGecko, DeFi Llama, Nomics, Crypto.com Research

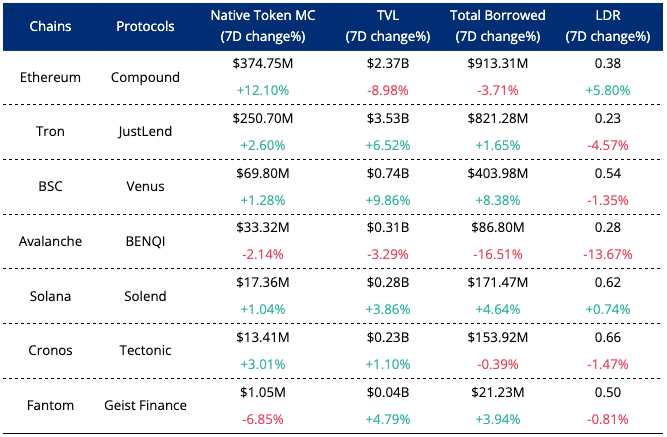

Lending Protocols Metrics

*LDR (Loan to Deposit Ratio) = Total Borrowed / TVL

Sources:CoinGecko,DeFi Llama,Crypto.com Research

Charts on Layer-2 Projects

After the L2 market TVL increased to over $7.6 billion on 10 September, it dropped by -3.70% in the last week. Optimistic rollup projects dropped by -3.05% and zero-knowledge rollup projects decreased by -3.42%, while Ethereum’s TVL increased by +5.07%.

The TVL changes for all major optimistic rollup projects were negative last week, and Arbitrum declined the most at -3.15%.

Similarly, ZK rollup projects’ TVL all declined, and ZKSwap 2.0 plummeted most at -29.48%.

Further Reading

Crypto startup Mysten Labs raises $300M from industry heavyweights at $2B valuation

Uniswap Dex fully backs Ethereum PoS upgrade, no support for ETHPoW forks

DeFi protocol Curve Finance posts code for upcoming stablecoin

NEAR Protocol forms working group to promote DeFi governance

Algorand upgrade boosts speed, adds trustless cross-chain communication

Algorand foundation discloses $37 million USDC exposure to Hodlnaut

DeFi protocol token NFD crashes by 99% after a flash loan attack

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!