Weekly Update - Defi and Layer 1 & Layer 2 News (Week 33, 17/08/2022 - 23/08/2022)

Decentralised stablecoin Fei may cease operations. HUSD depegs following the closure of market maker accounts. Attacker loses 5 ETH after trying to exploit Near Protocol’s Rainbow bridge.

Weekly DeFi Index

This week's price, volume, and volatility indices were negative at-9.59%, -12.41%, and -27.80%, respectively.

Check the latest prices on Crypto.com/Price

DeFi Index Tokens

*DeFI index tokens: AAVE, BAL, CAKE, COMP, CRV, CVX, FXS, JOE, LDO, LINK, MKR, OSMO, REN, SNX, SPELL, SUSHI, UNI, VVS, YFI.

News Highlight

FEI, one of the largest decentralised stablecoins, may cease operations. Fei Labs Founder Joey Santoro announced that the Fei (FEI) architecture will be shutting down because of "technical, financial and potential future regulatory risks." FEI maintains the peg using protocol controlled value (PCV), a mechanism to algorithmically manage a reserve of tokens. Santoro also published a proposal to redeem FEI tokens to DAI and to distribute protocol controlled value between TRIBE (the governance token of Fei Protocol) holders.

HUSD, a dollar-backed stablecoin issued by Stable Universal (a Huobi Capital invested company) broke from its peg on 17 August and traded at a low of US$0.85. This came after FTX CEO Sam Bankman-Fried and TRON Founder Justin Sun were revealed to be in talks to purchase a majority stake in the Huobi Global crypto exchange. However, HUSD clarified that the depeg was connected to liquidity issues after several account closures, including market maker accounts. It has since recovered the peg.

An attacker tried to exploit Near Protocol’s Rainbow bridge by submitting a fabricated block, but failed and lost 5 ETH. Rainbow validators’ automated security processes blocked the transaction and took away the safe deposit of 5 ETH put up by the attacker.

DEX Protocols Metrics

Sources: CoinGecko, DeFi Llama, Nomics, Crypto.com Research

Lending Protocols Metrics

*LDR (Loan to Deposit Ratio) = Total Borrowed / TVL

Sources: CoinGecko, DeFi Llama, Crypto.com Research

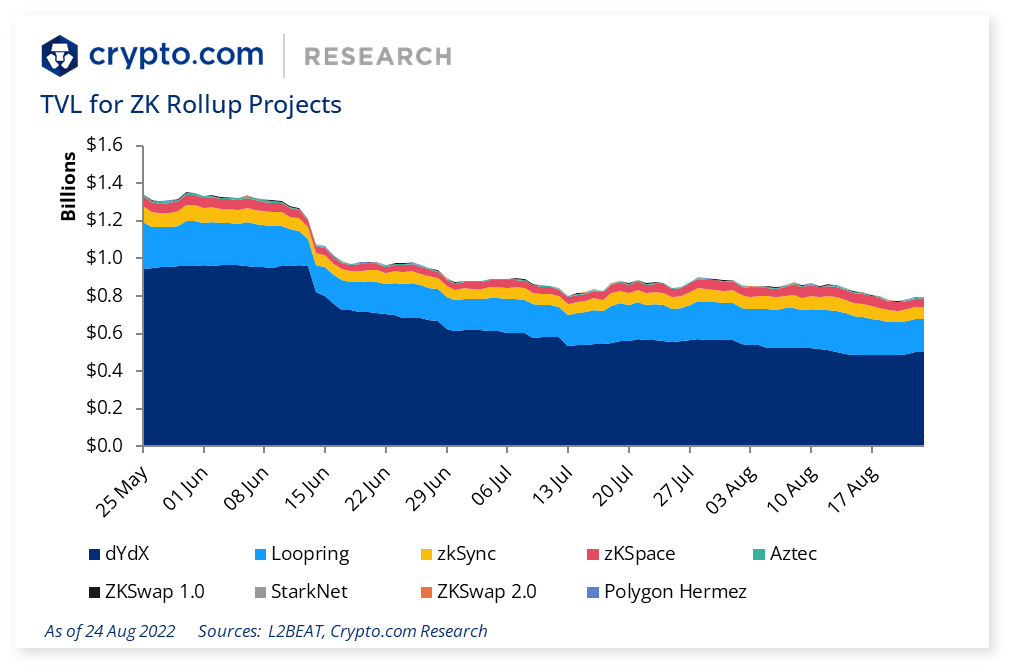

Charts on Layer 2 Projects

Overall, the L2 market dropped by -3.06% in the last 7 days. The TVL of all L2 categories followed the downtrend. Optimistic rollup projects fell by -4.10% and zero-knowledge rollup projects by -1.16%. Ethereum’s TVL plunged by -9.84%.

The TVL for all optimistic rollup projects were negative last week, and Boba Network dropped the most at -10.06%.

Similarly, almost all ZK rollup projects’ TVL plummeted except dYdX, which grew +14.07%.

Further Reading

Gnosis Safe to airdrop 50 million Ethereum tokens to wallets

Tether reveals 58% decrease in commercial paper holdings in latest attestation

BendDAO hit by insolvency crisis as Ethereum reserves drained

Ronin bridge hackers used ChipMixer to launder over $73M of stolen funds

Ethereum community splits over solutions for transaction censorship

Acala recovers 2.97 billion of aUSD stablecoin minted during exploit

Thank you for reading! We hope you find our Weekly Defi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!