Weekly Update - Defi and Layer 1 & Layer 2 News (Week 32, 10/08/2022 - 16/08/2022)

Acala Network suffered a security breach and aUSD depegged. Curve Finance’s website was hacked. Crypto users were hit with a “dust attack” after being sent a small amount of $ETH from Tornado Cash.

Weekly DeFi Index

This week's price index dropped by -7.26%, while volume and volatility indices were positive at +11.26% and +3.16%, respectively.

Check the latest prices on Crypto.com/Price

DeFi Index Tokens

*DeFI index tokens: AAVE, BAL, CAKE, COMP, CRV, CVX, FXS, JOE, LDO, LINK, MKR, OSMO, REN, SNX, SPELL, SUSHI, UNI, VVS, YFI.

News Highlight

Acala, the “DeFi hub” of the Polkadot network, suffered a major security breach. The exploit allowed the attackers to mint an additional 1.2 billion aUSD, the native stablecoin of the network, in its iBTC/aUSD liquidity pool. Following the exploit, aUSD depegged and plunged to a low of US$0.009 on 14 August. In response to the incident, Acala passed a proposal to burn US$1.28 billion aUSD to regain the peg. At the time of writing, aUSD is trading around US$0.88.

Decentralised exchange Curve Finance experienced a frontend attack on 10 August. Hackers compromised the Curve website to redirect unwitting users or their transactions to a malicious destination. The thieves made off with US$570,000 of ETH and part of the stolen funds were frozen.

DeFi protocols banned users following OFAC sanctions on Tornado Cash. However, this derives a so-called ‘dust attack’. Crypto users reported being blocked by major DeFi protocols after attackers sent a small amount of Ether (usually 0.01 ETH) via Tornado Cash. More than 600 addresses were hit with the same 0.01 ETH ($19.25) ‘dust attack’, including crypto exchanges and public figures.

Ethereum’s third and final testnet merge was completed on Goerli. This is one step closer to Ethereum's mainnet upgrade, which is expected to happen this year.

DEX Protocols Metrics

Sources: CoinGecko, DeFi Llama, Nomics, Crypto.com Research

Lending Protocols Metrics

*LDR (Loan to Deposit Ratio) = Total Borrowed / TVL

Sources: CoinGecko, DeFi Llama, Crypto.com Research

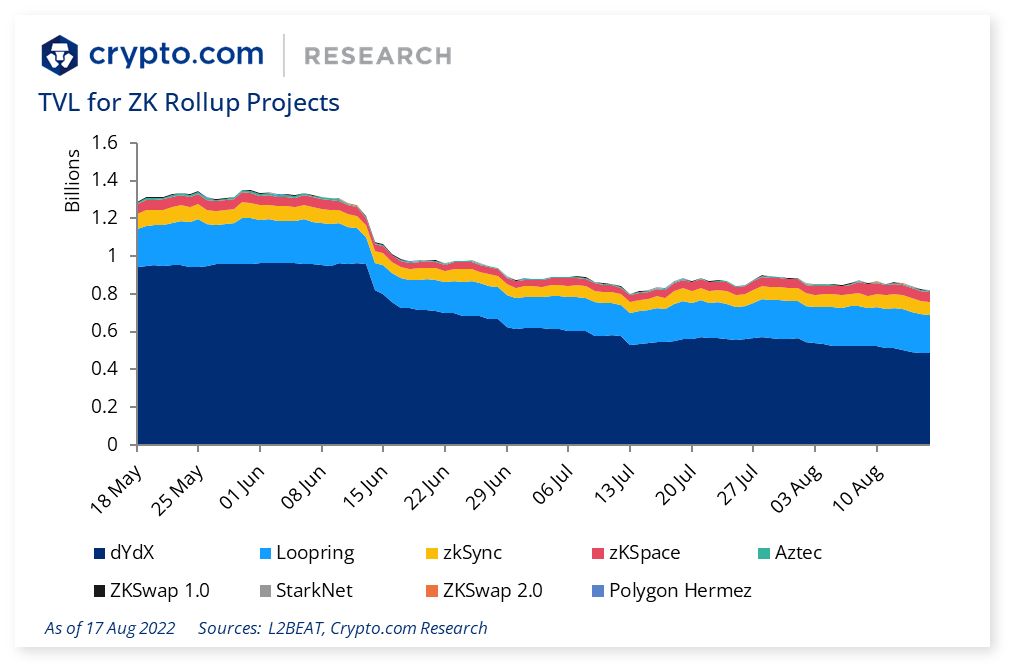

Charts on Layer 2 Projects

Overall, the L2 market saw +6.99% growth over the past week. Optimistic rollup projects rose +4.15% and zero-knowledge rollup projects dropped -4.61%. Sidechain projects gained traction with +18.02% growth, mainly driven by Polygon (+20.50%). Ethereum’s TVL rose +1.17%.

The TVL for almost all of optimistic rollup’s projects were negative last week except Arbitrum (+7.75%) and Optimism (+0.04%).

Although the overall TVL of ZK rollups fell, StarkNet was under the spotlight as its TVL grew +14.07%.

Further Reading

Arbitrum launches gaming and social App-focused layer 2 chain Arbitrum Nova

DeFi protocols Aave, Uniswap, Balancer, ban users following OFAC sanctions on Tornado Cash

Tornado Cash DAO shuts down as it “can’t fight the US” and keep contributors safe

BlueBenx fires employees, halts funds withdrawal citing $32M hack

Interlay launches Bitcoin-backed stablecoin iBTC on Polkadot network

DeFi firms Iron Bank, Yearn Finance join layer 2 protocol Optimism

Cross-chain bridge RenBridge laundered $540M in hacking proceeds: Elliptic

Thank you for reading! We hope you find our Weekly Defi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!