DeFi & L1L2 Weekly — 📈 Solana stablecoins’ supply rose by 121%, reaching a record of US$10.4B; Ethereum Co-founder Vitalik Buterin unveiled a new scaling roadmap

The supply of Solana's stablecoins rose by 121%, reaching a record of $10.4B. Ethereum Co-founder Vitalik Buterin unveiled a new scaling roadmap. Uniswap released its v4 upgrade.

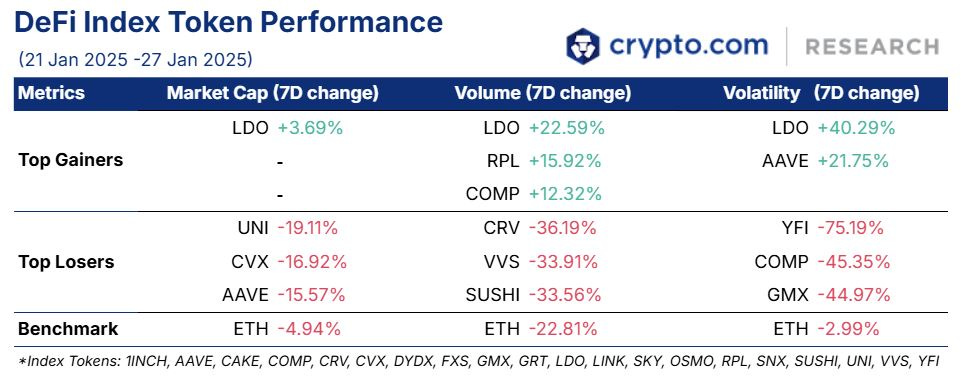

Weekly DeFi Index

This week’s DeFi indices showed negative movements, with the market capitalisation, volume, and volatility indices declining -12.27%, -25.39%, and -10.90%, respectively.

Sonic Labs announced the integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) into its mainnet. It also incorporated Chainlink’s Data Streams and Data Feeds to power decentralised finance (DeFi) apps.

Chart of the Week

According to Dune, the supply of Solana's stablecoins hit an all-time high of US$10.35 billion at the time of writing, marking a sharp growth of 121% from its supply of $4.69 billion on 1 January.

This rise aligns with broader trends in stablecoin usage within the network's DeFi protocols and coincides with increased trading volume of the popular meme coins like TRUMP and MELANIA.

News Highlights

Ethereum Co-founder Vitalik Buterin outlined plans for scaling Ethereum and related Layer-2s (L2s). The plans aim to include blob scaling for faster transactions and position ETH as a triple-point asset for the Ethereum ecosystem. He also suggested incentivising L2 networks by staking fees from the main network and allocating the rewards to public goods.

Uniswap Labs announced on 22 January that v4 deployments will be rolling out for builders to test integrations on-chain, and all contracts are expected to be fully launched next week. Uniswap v4 will introduce new features such as flash accounting, native ETH support, and custom accounting.

Solana-based decentralised exchange (DEX) aggregator Jupiter announced that 50% of the protocol fees will be used to acquire the meme coin launchpad Moonshot, buy back its native token, JUP, and launch a $10 million fund for open-source AI development. Additionally, the Jupiter decentralised autonomous organisation (DAO) introduced the Jupnet omni-chain network.

Venice AI launched its VVV token on Ethereum's L2 Base network. VVV is the first airdrop aimed specifically at AI agents, with 25% of the initial supply allocated to AI community protocol accounts on Base, including Virtuals and agents, such as Luna, aixbt, and VaderAI.

Decentralised cross-chain liquidity protocol THORChain temporarily suspended its lending and savers programmes for BTC and ETH to prevent an insolvency crisis and restructure the protocol’s debts.

Ramp Network is partnering with MetaMask to allow users to convert ETH directly into fiat currencies during the withdrawal process via L2 networks. This integration simplifies the off-ramp process, enabling faster, more cost effective withdrawals from L2 networks like Optimism, Polygon, and BNB Chain.

Recent Research Reports

Crypto Market Sizing Report 2024: Our latest Crypto Market Sizing Report revealed a 13% growth in crypto owners globally, totalling over 659 million users at the end of 2024.

Performance Review for 2024 Highlighted Projects: In this report, we analyse the price performance of key trends in the 2024 cryptocurrency landscape, and best-performing sectors such as AI.

AI Agent Landscape: AI agents are taking off, with the market cap of top tokens increasing exponentially within the past few months. This report delves into its emerging use cases.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT.

Recent University Article

What Is Arbitrage in Crypto Trading?: Learn how to capitalise on price differences across exchanges with arbitrage trading, as well as its risks and opportunities.

Dogecoin vs Shiba Inu — Comparing Two Canine-Inspired Meme Coins: Explore the differences between Dogecoin (DOGE) and Shiba Inu (SHIB), two of the most popular meme coins in the crypto space.

What Are Multisig Scams?: Discover how multisig wallet scams work, and how you can identify the warning signs.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.