DeFi & L1L2 Weekly - 🚀 Ethereum on-chain stablecoin volume reaches all-time high; Sky launches SKY and USDS

Ethereum on-chain stablecoin volume reaches all-time high. USDC launches on Sui blockchain and is available in Brazil and Mexico. Sky launches new tokens SKY and USDS.

Weekly DeFi Index

The market capitalisation and volume indices were negative at -3.32% and -12.85%, respectively, while the volatility index grew by +46.29%.

Osmosis (OSMO) launched a new cross-chain token portal called Polaris, designed for seamless trading across multiple blockchains from a single interface. The introduction of Polaris shifts the platform’s strategy from the Cosmos ecosystem towards a multi-chain approach that taps into Ethereum and Solana.

Sky, formerly MakerDAO, launched a new decentralised application (dapp) alongside two new tokens, SKY and USDS, which users can migrate MKR and DAI tokens to, respectively. The token migration is part of Sky’s ‘Endgame’ overhaul, which aimed to simplify the existing protocol structure.

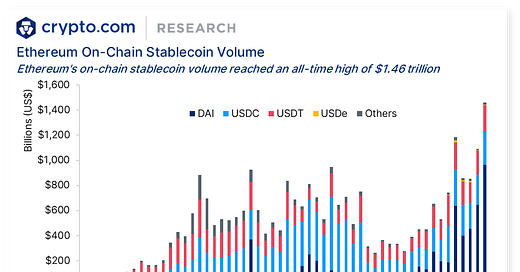

Chart of the Week

Ethereum's on-chain stablecoin volume reached an all-time high of US$1.46 trillion in August according to data from The Block. DAI's volume took the lead with $962 billion, followed by USDT and USDC with $266 and $210 billion, respectively. PayPal’s PYUSD also saw significant growth since its launch, with its on-chain volume increasing from $500 million to $2.4 billion. Newer stablecoins are creating competition, improving business models, designs, and use cases.

News Highlights

Circle announced a series of partnerships:

It is launching USDC on the Sui blockchain, marking its fifteenth network integration.

Direct conversion of Brazilian Reais and Mexican Pesos to USDC is now available in Brazil and Mexico, eliminating the need to convert local currencies into USD.

It partnered with Sony Block Solutions Labs to expand USDC adoption on Soneium, Sony's Layer-2 blockchain. Circle’s Bridged USDC Standard will be integrated on Soneium, serving as a proxy for native USDC on Ethereum.

Global banking communications network Society for Worldwide Interbank Financial Telecommunication (SWIFT) launched a new global infrastructure aimed at enhancing the transfer of tokenised assets. Key features include testing multi-ledger Delivery-versus-Payment (DvP) and Payment-versus-Payment (PvP) transactions to facilitate real-time asset exchanges.

Ethereum developers are considering splitting the Pectra upgrade into two parts because of the complexity of the upgrade, with the first phase to be launched as early as early 2025. One of the expected improvements is EIP-3074, which allows normal crypto wallets to work like smart contracts.

The TON Foundation and Curve Finance partnered to develop a new TON-based stable swap project. It will utilise Curve Finance's Constant Function Market Maker (CFMM) technology to minimise price impact on stablecoin and equivalent asset swaps, reducing price volatility and slippage.

Chainlink launched its Cross-Chain Interoperability Protocol (CCIP) on the ZKsync Era mainnet as part of the Chainlink Scale programme. This integration aims to enhance interoperability between different blockchain networks, enabling seamless communication and data transfer.

Wintermute, an algorithmic cryptocurrency trader and liquidity provider, launched the OutcomeMarket, a US presidential election prediction market. It will feature Chaos Labs’s Edge Proofs Oracle support, and offer HARRIS and TRUMP tokens. The market will be accessible on Ethereum, Base, and Arbitrum, and tokens will be tradeable on Bebop, WOO network, and Backpack.

The Starknet community approved a proposal for dynamic staking, improving the network's flexibility and scalability. This new staking model allows users to adjust their stakes based on network conditions, potentially increasing rewards and participation.

Cross-chain interoperability protocol Wormhole integrated World ID into the Solana blockchain, enhancing the platform's capabilities with identity verification functionality. The integration allows users to prove their identity without revealing personal information, promoting privacy and security in decentralised applications.

Sky (formerly MakerDAO) is set to vote on removing wrapped Bitcoin (wBTC) from its ecosystem because of concerns surrounding Justin Sun's involvement with its asset custodian. The proposal, initiated by BA Labs, suggests offboarding wBTC gradually, potentially affecting approximately $200 million in DeFi loans.

Recent Research Reports

Research Roundup Newsletter [August 2024]: We present to you our latest issue of Research Roundup, featuring our deep dives into asset allocation with crypto, the decentralised perpetuals market, and the prediction market.

Alpha Navigator: Quest for Alpha [August 2024]: Cryptocurrencies were down in August; Fixed Income and Equities were up. New Zealand and Canada reduced interest rates; China and Australia kept interest rates unchanged.

Asset Allocation With Crypto: Adding BTC to portfolios helps increase yield by up to 2% annually without significant impact on volatility. The Modern Portfolio Theory is adopted to compile portfolios including TradiFi, BTC, and ETH.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT.

Recent University Article

Tap-to-Earn With These 5 Telegram Games: Telegram’s crypto games have been taking off. Here’s how to play them and earn Toncoin (TON), Notcoin (NOT), and other cryptocurrencies.

How to Make Withdrawals and Deposits in the Crypto.com App: Your guide to cryptocurrency and fiat deposits and withdrawals in the Crypto.com App.

Bitcoin Resistance and Support Levels — What They Are and How to Trade Them: Learn how resistance and support levels for Bitcoin and other cryptocurrencies are formed, and how to trade with them.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.