DeFi & L1L2 Weekly — 🚀 Tokenised treasuries reached a record market cap of US$4.6B; The Ethereum Foundation launched the Hoodi testnet

The market cap of tokenised treasuries reached a record of US$4.6B; The Ethereum Foundation launched the Hoodi testnet for the Pectra upgrade; Sony's public blockchain Soneium partnered messaging app.

Weekly DeFi Index

This week, the market capitalisation index rose by +6.07%, while the volume and volatility indices dropped by -14.35% and -43.46%, respectively.

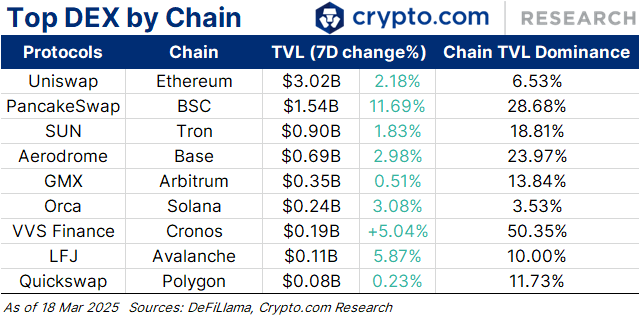

PancakeSwap’s 24-hour volume reached US$1.64 billion on 17 March, surpassing Uniswap's volume of $1 billion in the same period. This surge is mostly driven by increased meme coin activity on BNB Chain.

Chart of the Week

The combined market capitalisation of tokenised US Treasury products reached a record of $4.6 billion on 17 March, with a 15% growth year-to-date. This surge in tokenised treasuries is attributed to investors seeking safer, yield-bearing assets. Ondo Finance's OUSG, Superstate's USTB, and BlackRock's BUIDL saw growths of 140%, 97%, and 92%, respectively, while Hashnote's USYC declined by 49%.

News Highlights

The Ethereum Foundation launched a new testnet, Hoodi, to test the Pectra upgrade once more before deployment. New smart contract features, such as the ability to pay fees in currencies other than ETH, will be introduced if it succeeds; the Hoodi testnet will run the upgrade on 26 March.

Sony Block Solutions Labs, the team behind Sony's public blockchain Soneium, partnered with instant messaging app LINE to integrate LINE’s mini apps into the ecosystem. The collaboration aims to improve user experiences and will bring four mini games on-chain in the coming months.

Ethena Labs and Securitize launched Converge, a blockchain that is compatible with the Ethereum Virtual Machine (EVM) and designed for the adoption of real-world assets (RWA) and decentralised finance (DeFi) products. Both parties aim to provide retail investors with access to standard DeFi applications and institutional-grade offerings.

EOS Network rebranded to Vaulta as it shifts focus to Web3 banking services. The rebranding is scheduled for the end of May and includes the new Vaulta Token and the establishment of an advisory council. Vaulta will inherit EOS Network's underlying infrastructure and integrate with the Bitcoin digital banking solution, exSat.

A proposal to dynamically adjust Solana's inflation rate based on staking participation, known as SIMD-228, failed to pass with a 43.6% approval from validators. The change would have reduced inflation by up to 80% and adjusted it dynamically based on staking levels, but it raised concerns about increased complexity and potential instability.

Hyperliquid faces lower user confidence because of increased selling pressure from HYPE stakers and a $4 million loss from its HLP vault. The loss occurred when a trader withdrew the margin, prompting liquidation that Hyperliquid was forced to cover. In response, Hyperliquid is changing its margin design to prevent similar attacks while implementing a seven-day wait before users can unstake assets.

Recent Research Reports

Research Roundup Newsletter [February 2025]: We present to you our latest issue of Research Roundup, featuring our deep dives into ‘Will Be Another Asset’ and ‘Institutional Crypto Market: From Liquidity to Global Adoption’.

Wall Street On-Chain Part 1 – Will Bitcoin be Another Asset?: Bitcoin has made a solid run in the past year to widen the gap between its performance against altcoins. It is also often described as ‘digital gold’ for being seen as a store of value and potential hedge against inflation. Based on its recent developments and adoption in institutions, this report explores if BTC could become another new asset and examines potential contenders to bitcoin.

The Evolution of the Institutional Crypto Market: From Liquidity to Global Adoption: This article presents the institutional crypto market, focusing on liquidity and global adoption.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT.

Recent University Article

Ethereum vs Cardano: Comparing Two Leading Programmable Blockchains: Explore the differences between Ethereum and Cardano, two leading programmable blockchains.

How Does Inflation Influence the Cryptocurrency Market?: Discover how inflation impacts the cryptocurrency market, from Bitcoin's role as ‘digital gold’ to central bank policies.

APY vs APR — What Do They Mean?: Learn the differences between Annual Percentage Yield (APY) and Annual Percentage Rate (APR) in the crypto market.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.