DeFi & L1L2 Weekly — 📈 The DeFi lending TVL reached a record of US$56 billion; the US Senate passed the GENIUS Act to regulate stablecoins

The DeFi lending TVL reached a record of US$56 billion; the US Senate passed the GENIUS Act to regulate stablecoins

Quick Take

The Total Value Locked (TVL) of DeFi lending platforms reached US$56 billion; Aave dominates the market with a share of over 50%.

The US Senate passed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, setting strict compliance rules for issuers of US stablecoins.

XRP Ledger will launch an Ethereum Virtual Machine (EVM)-compatible sidechain in Q2 2025, merging Ethereum smart contracts with XRPL.

Uniswap introduced smart wallet functionality with gasless, maximal extractable value (MEV)-resistant swaps via EIP-7702.

Maple Finance partnered with Lido to offer stablecoin loans backed by staked Ether (stETH) collateral.

Polkadot’s community is debating a proposal to convert 500,000 DOT into Threshold Bitcoin (tBTC) through a year-long dollar-cost average (DCA) strategy.

Cardano’s co-founder Charles Hoskinson proposed converting $100 million in ADA to stablecoins and BTC to boost DeFi liquidity.

Ondo Finance launched tokenised US treasuries on the XRP Ledger, targeting institutional users with 24/7 access.

Weekly DeFi Index

This week, the market capitalisation and volatility indices decreased by -13.29% and -6.33%, respectively, while the volume index increased by +14.99%.

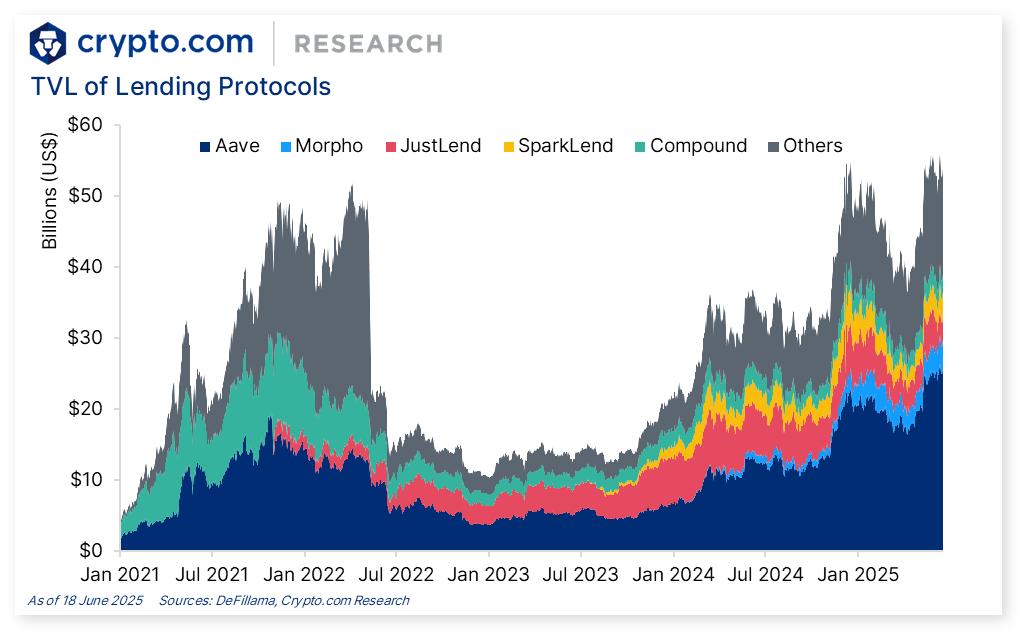

Chart of the Week

The DeFi lending market reached a record high of $56 billion in TVL on 11 June, surging by 16.6% year-to-date. This growth followed remarks by the Chair of the US Securities and Exchange Commission (SEC), Paul Atkins, about exempting DeFi platforms from regulatory barriers to accelerate on-chain product launches. Aave dominates the market with a 50% share in TVL, and the platform saw a 31.13% increase from $19.71 billion in early May to $25.84 billion in mid-June, followed by Morpho (7.9% share in TVL) and JustLend (6.3% share in TVL).

News Highlights

The US Senate passed the GENIUS Act, a bill setting strict reserve, transparency, and compliance rules for US stablecoin issuers. It also opens the door to a broader range of financial institutions including banks, fintechs, and major retailers. The bill is now headed to the House of Representatives for voting. Meanwhile, the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act, its companion bill in the House, is under consideration.

Ripple’s XRP Ledger will introduce an EVM-compatible sidechain in Q2 2025, merging Ethereum smart contracts with the XRP Ledger ecosystem. The sidechain is live on a testnet and is pending a mainnet launch after testing and validator integration. Using Axelar as a bridging solution, it will support asset transfers with gas fees paid in wrapped XRP.

Uniswap Wallet launched smart wallet functionality which uses EIP-7702 smart contracts to enable one-click swaps and batched transactions that include both swaps and approvals to reduce transaction costs and complexity. Built on the Uniswap Trading API, the integration offers gasless, MEV-resistant trading to enhance user experience.

Maple Finance partnered with Lido Finance to offer stablecoin loans backed by stETH collateral. This collaboration allows institutions to borrow funds without selling stETH and retaining Ethereum staking rewards.

Polkadot’s community is split on a proposal to convert 500,000 DOT tokens into tBTC via a year-long dollar cost average strategy to create a BTC reserve. Aiming at diversification and long-term stability, the plan faces scepticism as the value of DOT would face additional pressure on its current price. The community will ultimately decide on the proposal through a vote.

Cardano’s co-founder Charles Hoskinson proposed converting $100 million in ADA from the project’s $1.2 billion treasury into stablecoins and BTC to enhance Cardano’s DeFi liquidity. This move aims to improve Cardano’s low stablecoin-to-TVL ratio from below 10% to around 33 to 40%. The proposal will be addressed at the upcoming Rare Evo event.

Ondo Finance launched its tokenised US treasuries OUSG on the XRP Ledger, targeting institutional users with 24/7 access via Ripple’s $389 million RLUSD stablecoin.

Recent Research Reports

Research Roundup Newsletter [May 2025]: We present to you our latest issue of Research Roundup, featuring our deep dives into ‘Crypto Options’ and ‘Interest Rate Derivatives and Pendle’.

Alpha Navigator: Quest for Alpha [May 2025]: The value of most asset classes increased in May with crypto taking the lead. Ethereum’s Pectra upgrade went live on 7 May, and BTC reached an all-time high on 22 May. These coincided with multiple tariffs in the same month.

Interest Rate Derivatives and Pendle: Pendle Finance allows users to tokenise and trade future yields, unlocking new liquidity and yield management strategies.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT. The latest crypto market insights are also available via the dashboard.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.