DeFi & L1L2 Weekly — 💸 14.6% of Polymarket wallets have profited; Uniswap Labs unveils its own Layer-2 network

14.6% of Polymarket wallets have made profits. Uniswap Labs unveils its own Layer-2 network. Avalanche negotiates to repurchase 1.97 million AVAX from Terra's LFG.

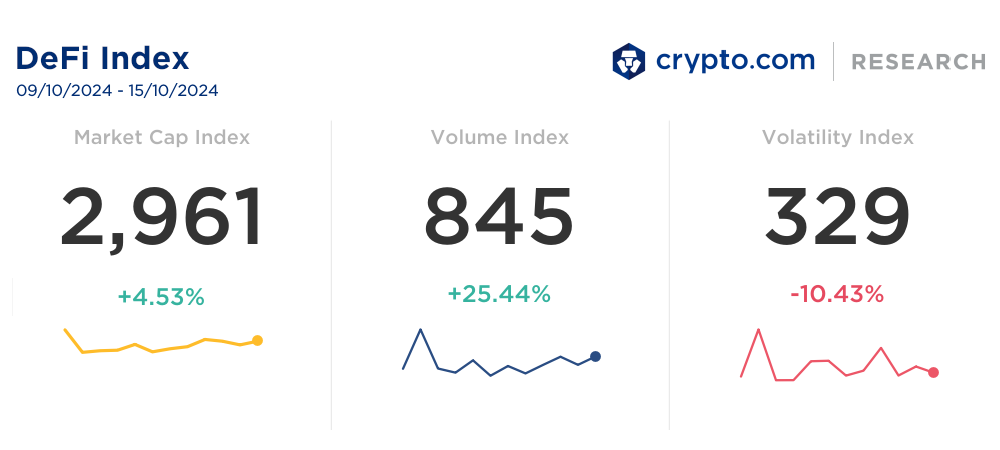

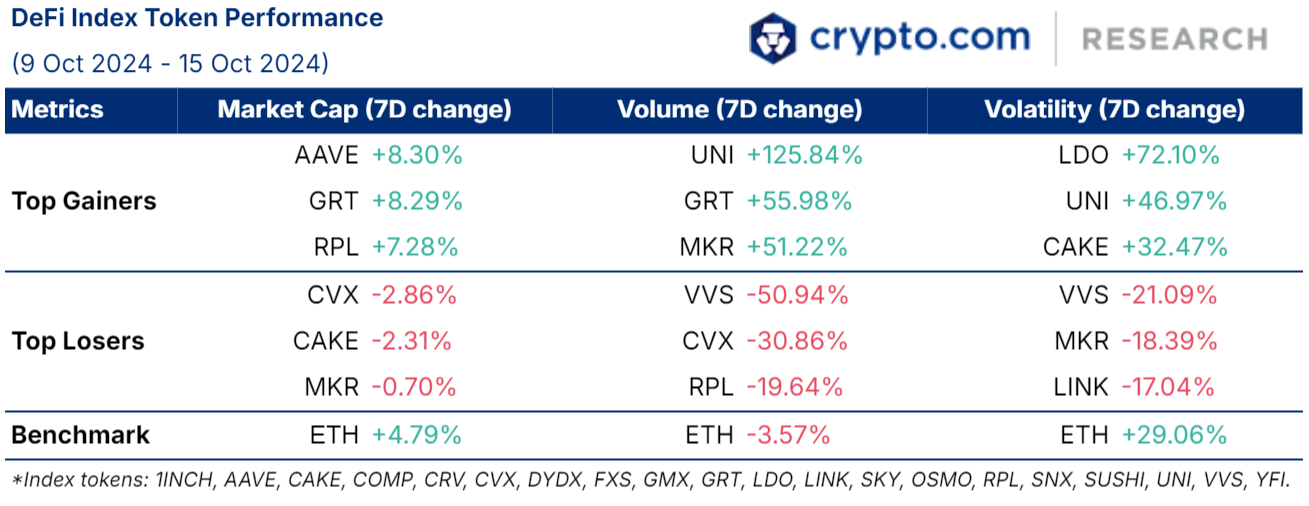

Weekly DeFi Index

The market capitalisation and volume indices were positive at +4.53% and +25.44%, respectively, while the volatility index dropped by -10.43%.

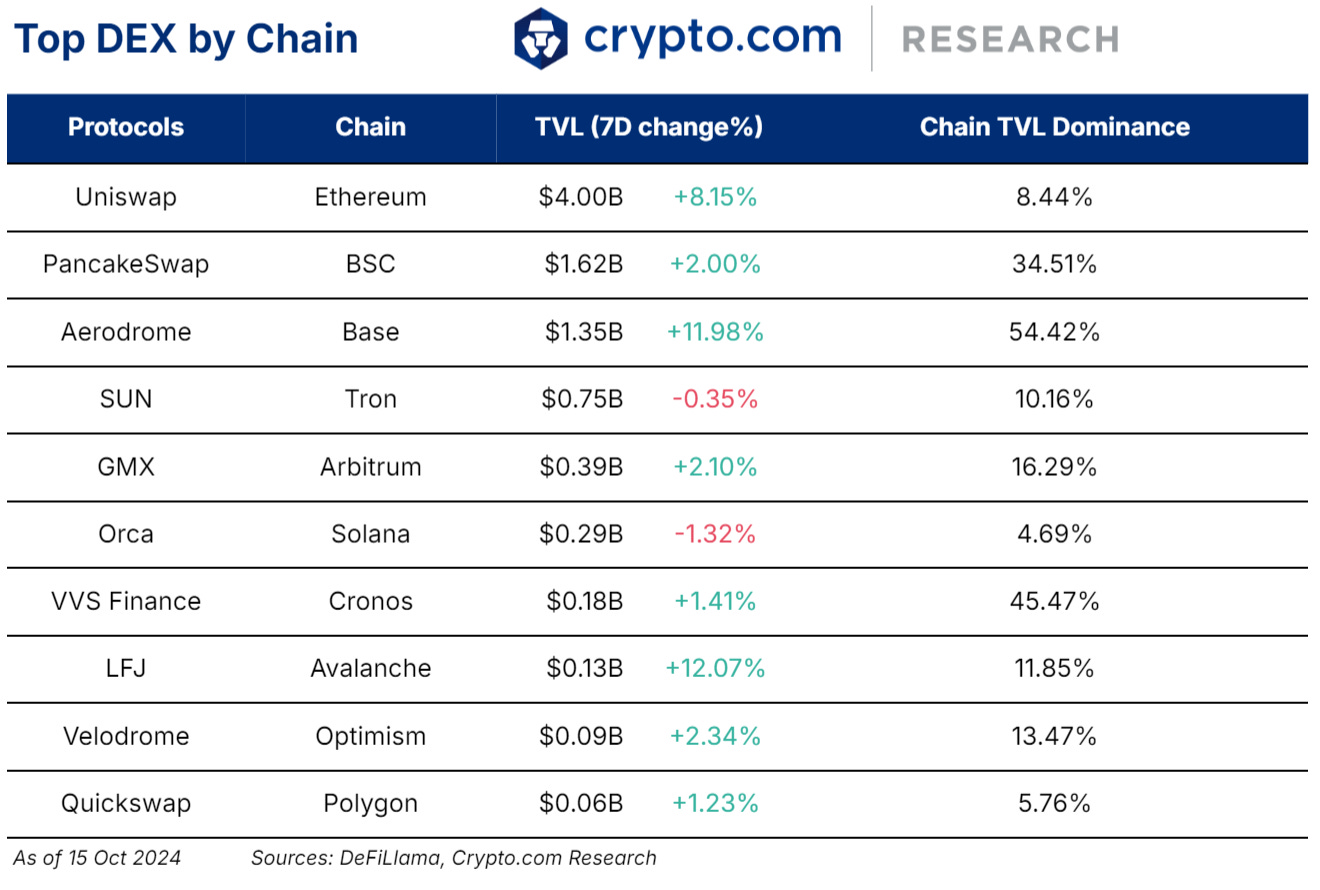

Uniswap Labs unveiled its own Layer-2 network, Unichain, built on Optimism's OP Stack technology. Set to debut on a private testnet, Unichain aims to enhance transaction speed and reduce costs while improving liquidity. Uniswap CEO Hayden Adams emphasised that the network could serve as a DeFi hub across multiple chains, similar to how Uniswap functions on Ethereum. Unique features include a trusted execution environment for secure block building and a community validation network planned for 2025.

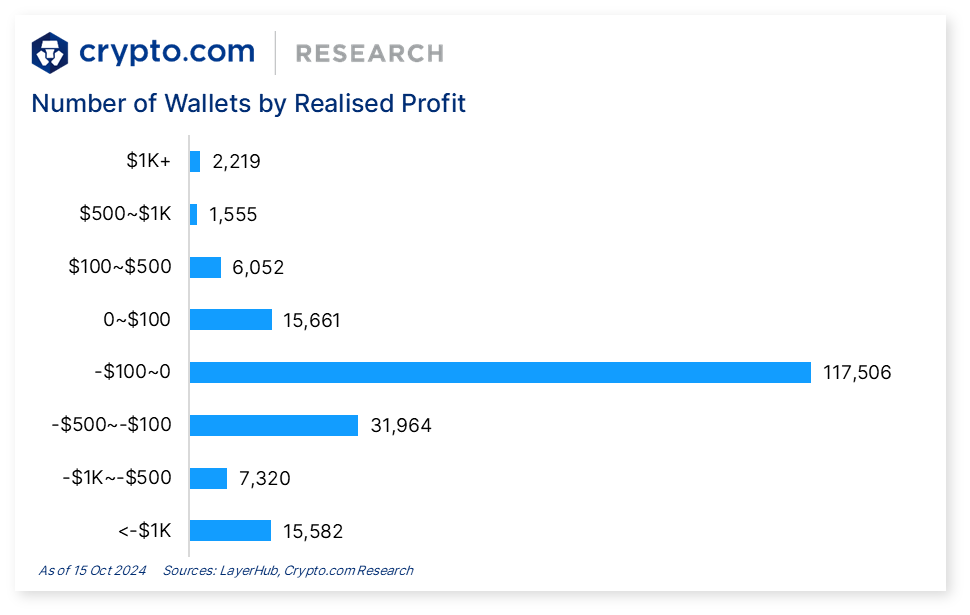

Chart of the Week

Polymarket has facilitated over 13 million betting trades to date, recording more than 300,000 daily trades on average between 6 and 15 October. The platform’s rising popularity is due to ongoing regional conflicts, as well as the upcoming United States presidential election.

To date, only 14.6% of Polymarket wallets have profited, with a majority winning less than US$100.

News Highlights

The Avalanche Foundation is negotiating a deal to repurchase 1.97 million AVAX tokens from Terraform Labs's bankrupt estate. In 2022, the foundation sold AVAX to the Luna Foundation Guard, a nonprofit organisation that supported the defunct Terra ecosystem, for $100 million, and now plans to buy it back. The repurchase is pending approval from the court overseeing Terraform Labs's estate.

The Ethena Protocol announced its intention to invest $46 million into real-world assets (RWA). This includes an allocation of $18 million into BlackRock’s BUIDL fund, $13 million into Sky’s USDS stablecoin, $8 million into Mountain’s USDM stablecoin, and $7 million into Superstate's USTB.

Ethena Labs proposed adding SOL to its treasury as collateral for its USDe synthetic stablecoin. This move aims to enhance USDe's stability, which is maintained through a combination of collateralised stablecoins and hedged trades. If approved by Ethena Lab's independent Risk Committee, SOL will be gradually integrated into the treasury with an initial allocation target of $100 to $200 million.

Hyperliquid, a decentralised perpetuals trading platform, is preparing to launch its native token, HYPE, in a genesis distribution conducted by the Hyper Foundation. HYPE will play an important role in Hyperliquid’s Proof of Stake consensus and Ethereum Virtual Machine (EVM).

Circlelaunched a native version of its USDC stablecoin on the SUI blockchain.

Recent Research Reports

Research Roundup Newsletter [September 2024]: We present to you our latest issue of Research Roundup, featuring our deep dives into AI Agent in Crypto and Pair Trading.

Asset Allocation With Crypto: Adding BTC improves portfolios by up to 2% annually. The ‘Modern Portfolio Theory’ is able to accommodate portfolios that hold a mix of TradFi, BTC, and ETH.

AI Agent in Crypto: This report looks into AI agents in the cryptocurrency realm. The landscape in crypto includes Agent Creation, Trading, Smart Wallets/Payments, Gaming, Social, Art/NFT, and Security.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT.

Recent University Article

Top Solana Projects: A Guide to the Blockchain’s Ecosystem: The Solana ecosystem has rapidly become a thriving hub for innovation, boasting a diverse range of projects. Here are ten projects to watch.

Popcat: What It Is and How to Buy POPCAT: Find out how POPCAT, a cryptocurrency based on a popular cat meme, became one of the best-performing meme coins in the Solana ecosystem.

Solana vs Ethereum: An In-Depth Comparison: Ethereum or Solana? In this detailed comparison, find out which of the chains excels at transaction speeds, fees, dApp ecosystems, and interest from investors.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.