DeFi & L1L2 Weekly – 📦 Ethereum blob usage shifted; Paxos launched a new stablecoin USDL

Ethereum blob usage shifts with Taiko becoming one of the biggest consumers. Paxos launches a yield-bearing stablecoin USDL. ZKsync announces its airdrop plan.

Weekly DeFi Index

This week's market capitalisation index was negative at -16.25%, while the volume and volatility indices were positive at +14.37% and +210.63% respectively.

Chart of the Week

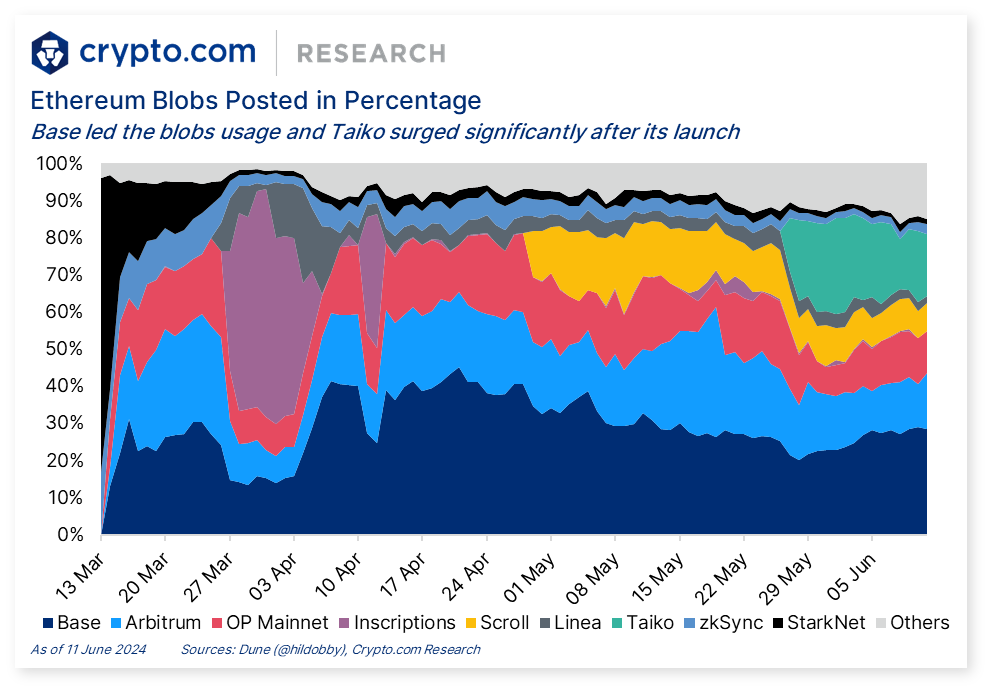

Since the Ethereum Dencun upgrade’s successful launch in March, the usage of the blobs has changed. After the first month of the Dencun upgrade, Base, Arbitrum, and OP Mainnet dominated the blob space.

In the second month, Scroll, a Zero-Knowledge-based rollup, surged significantly and held a notable position.

Taiko, a base rollup that relies on Ethereum block validators to sequence transactions, emerged as the runner-up for blob consumption after its mainnet launch. It also dominated the blob fee market, generating over US$1 million in fees since its launch.

News Highlights

Paxos International announced the launch of an interest-bearing stablecoin, Lift Dollar (USDL). USDL will be regulated by the Abu Dhabi Global Market and backed 1:1 by liquid U.S. government securities and cash equivalents. At launch, USDL will be available in Argentina, but will not be available in the United States.

The ZKsync announced to airdrop 3.675 billion ZK tokens, which represents 17.5% of the total 21 billion ZK token supply, to eligible wallets next week. The airdrop will reward 695,232 wallets selected based on their activity on the ZKsync Era and ZKsync Lite platforms, with 89% of the airdrop tokens going to users and 11% going to contributors who supported the ZKsync ecosystem. The remaining token supply will be distributed through ecosystem initiatives (49.1%), allocated to investors (17.2%), and the Matter Labs team (16.1%). The airdropped tokens will be fully liquid and unlocked on the first day, with a cap of 100,000 tokens per address to prioritise "real people" over whales.

OP Mainnet implemented ‘fault proofs’ on the network. This enables users to challenge and remove invalid withdrawals without needing to trust third parties. Fault proofs serve as a mechanism for Ethereum Layer 2 (L2) networks to allow users to contest potentially fraudulent or incorrect transactions. Previously, OP Mainnet required users to trust operators to submit accurate state roots onto the mainnet.

The decentralised social media platform Friend.tech, which is built on L2 network Base, announced plans to develop its own blockchain called Friendchain. This decision has left many users confused and questioning the rationale behind the move. The announcement led to volatile on the price of its FRIEND token.

Uniswap Labs acquired the on-chain game ‘Crypto: The Game’. The acquisition was a mixed cash-token-and-equity deal, and the co-founders of ‘Crypto: The Game’ will be joining Uniswap Labs to continue developing the game.

Cosmos Hub, the main blockchain of the Cosmos ecosystem, recently experienced a four-hour downtime due to a major v17 upgrade. The upgrade was described by Cosmos co-founder Ethan Buchman as the biggest one within the Cosmos ecosystem in the past year.

Loopring, an Ethereum ZK roll-up protocol, suffered a breach that resulted in the loss of $5 million in user funds from its smart wallets. Loopring stated that “the attack succeeded by compromising Loopring's 2FA service, allowing the hacker to impersonate the wallet owner and gain approval for the Recovery from the Official Guardian”.

The Ethereum-based lending protocol Uwulend has suffered a $20 million exploit. The attack involved three transactions that converted WBTC and DAI into ETH. The exploit occurred due to an issue with a price oracle across five different tokens.

Recent Research Reports

Points Farming – Development, Significance and Controversies: Points farming has become ubiquitous in crypto recently. The report looks into its development and case studies, Friend.tech and EigenLayer, before delving into its significance and controversies.

Tokenisation of RWAs & Yield-Bearing Stablecoins: RWA tokenisation signifies a bridge between TradFi and the digital asset space. We explore the tokenisation of securities and its application in yield-bearing stablecoins, which have both gained much attention recently.

SocialFi – Business Models and New Developments: SocialFi in Web3 empowers users with enhanced data control and direct creator compensation without intermediaries, leveraging blockchain for better user engagement and innovative monetisation methods.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT.

Recent University Article

What Is Arweave and How to Buy AR: Arweave utilises blockweave architecture and Proof of Access consensus to ensure permanent and sustainable data storage. Here’s how it works.

Crypto Fear & Greed Index: What It Is and How to Use It: Learn all about the crypto Fear & Greed Index that measures how human emotions affect and interfere with market dynamics.

What Is Internet Computer Protocol and How to Buy ICP Token: Internet Computer Protocol aims to revolutionise how blockchains and dapps interact. Here’s how the popular ICP crypto token works.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!