DeFi & L1L2 Weekly — 📈 X and Polymarket partnered to launch a market tracking tool; Circle upsized its IPO to US$1.05 billion

X and Polymarket plans to launch a real-time market insights tool; Circle upsized its IPO to $1.05 billion during its NYSE debut; the US SEC is seeking an exemption to fast-track on‑chain products.

Quick Take

X teamed up with Polymarket to launch a real-time tool that provides insights into market-moving news.

Circle upsized its initial public offering (IPO) to US$1.05 billion, pricing each share at $31 ahead of its New York Stock Exchange (NYSE) debut.

The crypto arm of French bank Société Générale launched USDCV, a US dollar-pegged stablecoin on Ethereum and Solana, with BNY Mellon as acting custodian.

The US Securities and Exchange Commission (SEC) is seeking to provide temporary exemptions to firms to fast-track on-chain products in the US.

The EU plans to regulate decentralised finance (DeFi) in 2026, but the Markets in Crypto-Assets Regulation (MiCA) currently lacks a clear definition for decentralisation, while regulations around DeFi remain ambiguous.

Sui-based decentralised exchange (DEX) Cetus relaunched after a $220 million exploit and is moving towards being fully open source with a new bounty programme.

Weekly DeFi Index

This week, the market capitalisation and volatility indices grew by +9.62% and +54.85%, respectively, while the volume index dropped by -9.40%.

DeFi lending protocol Aave launched on Soneium, an Ethereum Layer-2 solution developed by Sony and Startale Group. The partnership includes liquidity incentives and plans to integrate GHO, Aave’s decentralised stablecoin, for real-world use cases in payments and savings.

Chart of the Week

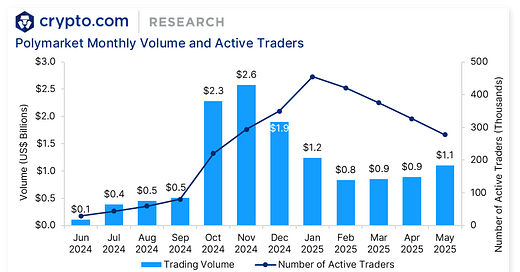

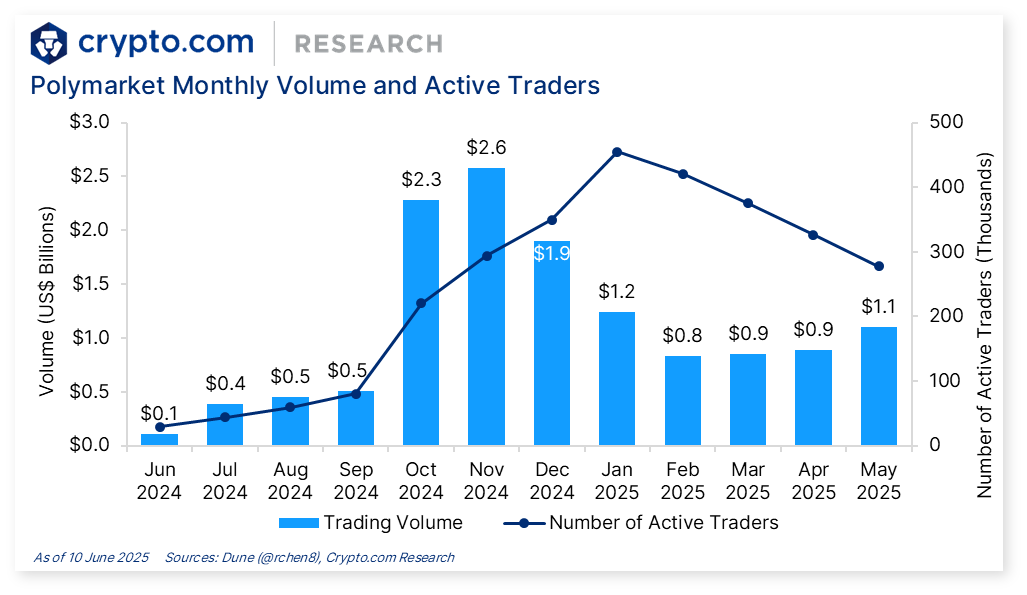

X partnered with crypto prediction market Polymarket to launch a real-time tool that tracks and explains market-moving events. The tool combines data from X, Polymarket’s forecasts, and xAI’s chatbot Grok.

Polymarket's trading activity surged in 2024 with its monthly volume peaking around $2.6 billion in November 2024, which was mainly driven by the US elections. Although the monthly volume dropped after the election, the platform maintained momentum as the number of monthly active traders continued to increase and surpassed 450,000 in January 2025. The monthly volume and number of active traders averaged $984 million and 371,000 from January to May 2025, respectively.

News Highlights

USDC issuer Circle Internet Group, Inc. upsized its IPO to $1.05 billion, pricing 34 million shares at $31 each during its 5 June debut on the NYSE. The funds will go towards product development, expansion, and tax obligations. Operating under the ticker CRCL, the stock’s price closed at $105.91 on 10 June, soaring by 2.4 times since the IPO.

The crypto arm of French bank Société Générale, Société Générale-Forge, launched USDCV, a US dollar-pegged stablecoin on Ethereum and Solana, with BNY Mellon acting as custodian for assets backing the token. USDCV is designed to facilitate trading, settlement, and cross-border payments, and the move follows the firm’s launch of its euro-pegged stablecoin, EUR CoinVertible (EURCV), in April 2023.

The US SEC is working on an “innovation exemption” framework to boost crypto innovation in the US. The initiative will provide temporary exemptions on specific regulatory requirements for firms, allowing them to innovate and bring on-chain products and services to market more quickly.

The EU will begin regulating DeFi in 2026 despite the lack of a clear definition of decentralisation under MiCA. A provision in the initial framework states that fully decentralised crypto asset services should not fall under MiCA, but the term “fully decentralised” remains ambiguous, and the broader crypto category may even be considered exempt.

Sui-basedDEX Cetus has officially relaunched and is moving towards being fully open source with a new bounty programme. The protocol previously suffered a $220 million exploit, but it has replenished its affected liquidity pools with recovered funds, cash reserves, and a $30 million USDC loan from the Sui Foundation.

Recent Research Reports

Research Roundup Newsletter [May 2025]: We present to you our latest issue of Research Roundup, featuring our deep dives into ‘Crypto Options’ and ‘Interest Rate Derivatives and Pendle’.

Alpha Navigator: Quest for Alpha [May 2025]: The value of most asset classes increased in May with crypto taking the lead. Ethereum’s Pectra upgrade went live on 7 May, and BTC reached an all-time high on 22 May. These coincided with multiple tariffs in the same month.

Interest Rate Derivatives and Pendle: Pendle Finance allows users to tokenise and trade future yields, unlocking new liquidity and yield management strategies.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT. The latest crypto market insights are also available via the dashboard.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.

L1/L2 analysis like this is essential as we move deeper into modular blockchain design. Too many overlook the security debt created by rapid Layer 2 growth. Great write-up—I'm tracking these shifts closely for threat modeling and Zero Trust adaptation in DeFi.

📌 Definitely adding to the weekly #TLDRSecurityDrop.

Find Me 😎👉🏾: https://solo.to/0xObsidianEnoch

#DeFiSecurity #ObsidianEnoch #SmartContractSecurity #Layer2 #BlockchainSecurity #CodeBlackTech #Web3Builders #ZeroTrust