🚀 Cronos launched the Cronos zkEVM Pioneer Program; Solana's liquid staking ecosystem saw notable growth

Cronos launches the Cronos zkEVM Pioneer Program. Solana's liquid staking ecosystem sees notable growth. Circle becomes the first stablecoin issuer to comply with EU's MiCA rules.

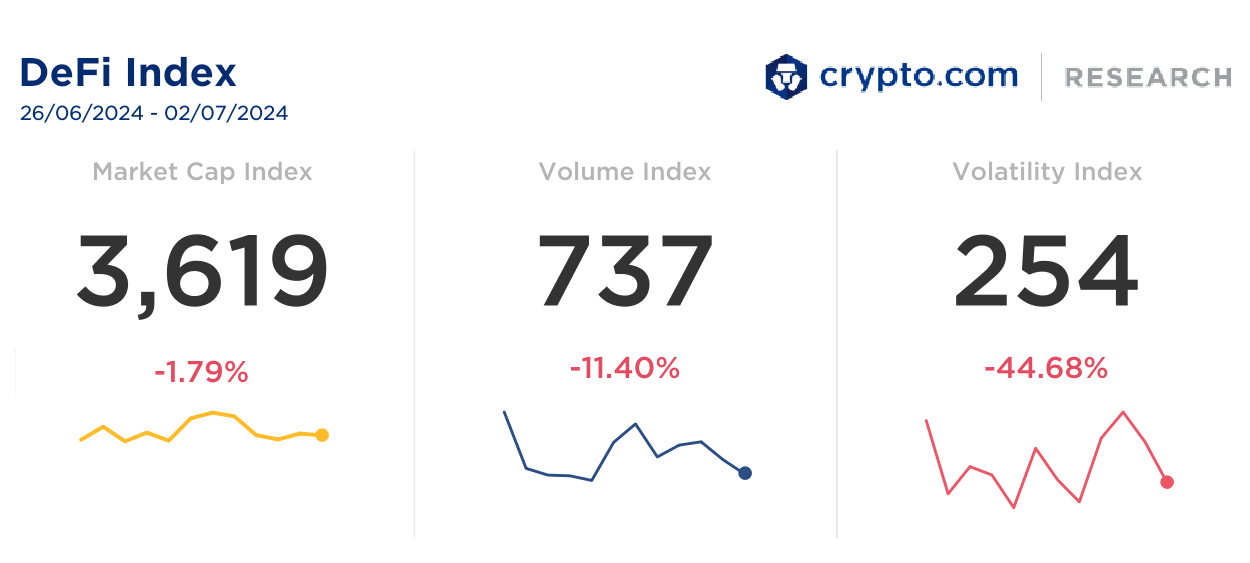

Weekly DeFi Index

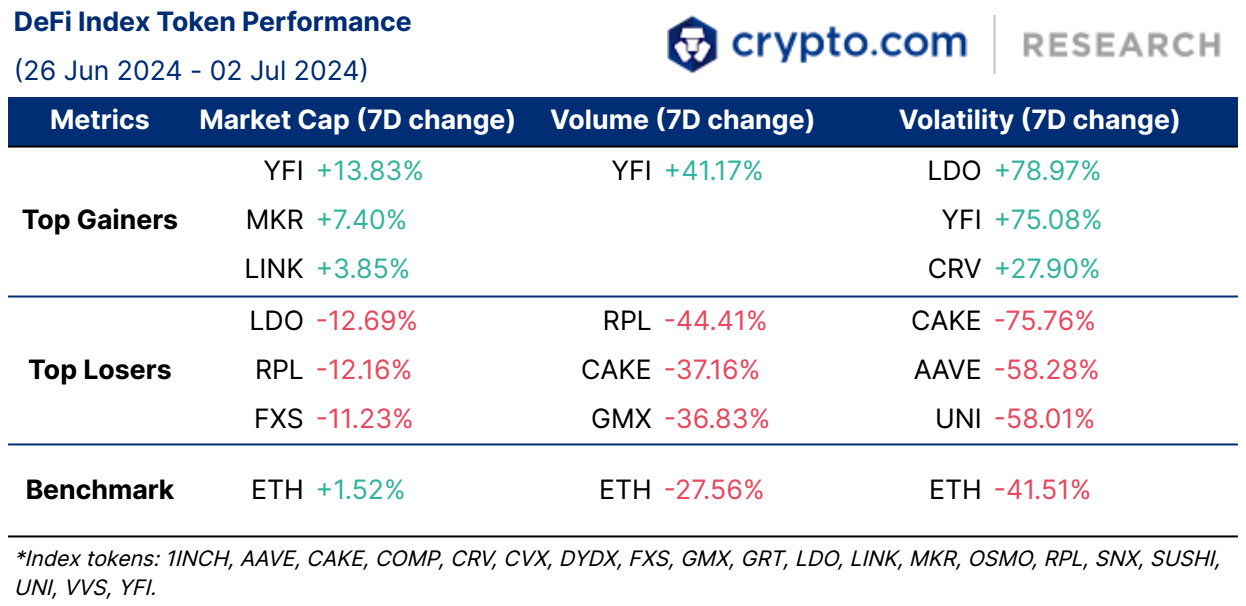

All indices fell this week. The market capitalisation, volume, and volatility indices were negative at –1.79%, -11.40%, and -44.68% respectively.

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Consensys, the company behind MetaMask, alleging that MetaMask's swaps and staking products violated federal securities laws. The SEC claims MetaMask acted as an unregistered securities broker and that its staking feature, powered by third-party services Lido (LDO) and Rocket Pool (RPL), involves the sale of unregistered securities, specifically the stETH and rETH tokens.

Chart of the Week

Solana's liquid staking ecosystem has seen notable growth, with the liquid staking ratio increasing from 4.89% to 6.76% quarter-over-quarter. The number of Liquid Staking Tokens (LSTs) on Solana has doubled, indicating a more diversified market landscape. The dominance of the top three liquid staking providers has fallen from 93% to 68%.

Data shows that over 23 million SOL, worth over US$3.9 billion, are staked on liquid staking platforms. Solana has a higher overall staking ratio (~65%) compared to Ethereum (~27%), but the liquid staking ratio is still relatively low at 6.76%.

Notably, Jupiter Exchange’s jupSOL has seen a 21% growth in market share monthly. Additionally, jupSOL was the most supplied LST with $212 million in Kamino Finance, a lending, liquidity, and leverage protocol on Solana.

News Highlights

Cronos launched the Cronos zkEVM Pioneer Program to foster community engagement and growth within its ecosystem. The program enables users to earn points by completing quests. In the future, users will be able to claim these points from participating dapps to earn extra yield when they use the Cronos zkEVM network and participating dapps. Cronos zkEVM is a next-generation blockchain network developed by Cronos in collaboration with Matter Labs (the team behind ZKsync), Crypto.com, and other partners. It is designed to be a high-performance blockchain integrated with the ZK Chain ecosystem.

Circle, the stablecoin issuer, became the first global stablecoin provider to secure an Electronic Money Institution (EMI) license from the French banking regulatory authority. This license allows Circle to issue its euro-denominated EURC stablecoin and its USDC stablecoin in compliance with the new Markets in Crypto Assets (MiCA) regulatory framework in the European Union.

Following a vote from the Aave DAO, Aave’s GHO stablecoin has been launched on the Arbitrum Layer-2 network to take advantage of the network's lower transaction costs and increased throughput.

Curve Finance changed its fee distribution mechanism, transitioning from the 3crv token to its native stablecoin, crvUSD. The goal is to improve crvUSD's utility and further integrate it into the Curve Finance ecosystem to better incentivise user engagement. By distributing fees in crvUSD rather than 3crv, it simplifies the process for users as they no longer need to convert the fees into a more usable form of currency.

Worldcoin announced a partnership with Alchemy, a Web3 development platform, to provide the infrastructure for Worldcoin's new blockchain, World Chain.

Chainlink launched its Data Streams product on the Avalanche network. This is a “pull-based” oracle model that retrieves off-chain market data on demand with low latency. GMX, a decentralised perpetual futures trading platform, will be a launch partner for Chainlink Data Streams on Avalanche.

Sui Network partnered with digital assets provider Copper to expand its custody services to institutional investors. Copper's custody support is already available for Sui-native tokens like the Ondo USD Yield (USDY) stablecoin. New custody features for staking and other DeFi functions will be rolled out to enhance options for clients issuing stablecoins and real-world assets on Sui.

Recent Research Reports

Points Farming – Development, Significance and Controversies: Points farming has become ubiquitous in crypto recently. The report looks into its development and case studies, Friend.tech and EigenLayer, before delving into its significance and controversies.

SocialFi – Business Models and New Developments: SocialFi in Web3 empowers users with enhanced data control and direct creator compensation without intermediaries, leveraging blockchain for better user engagement and innovative monetisation methods.

Research Roundup Newsletter [May 2024]: We present to you our latest issue of Research Roundup, featuring our deep dives into points farming and SocialFi, and many more.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT.

Recent University Article

What Are Yield-Bearing Stablecoins and How Do They Work?: Yield-bearing stablecoins sound like the best of both worlds — earning interest without volatility. Here’s how they work and how much yield holders can earn.

What Is CorgiAI (CORGIAI) and How to Buy CORGIAI: Find out why CorgiAI, the cryptocurrency blending meme culture with AI on the Cronos blockchain, is catching the attention of crypto traders.

How to Trade With Time-Weighted Average Price (TWAP) in the Crypto.com App: Retail investors can now set Time-Weighted Average Price (TWAP) orders in the Crypto.com App. Here’s how to give it a try for better price averages.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!