DeFi & L1L2 Weekly — 🔒 Over 40% of total volume on Jupiter was routed through private AMMs; the US SEC clarified that liquid staking does not constitute securities offerings

46% of the volume on Jupiter was routed via private AMMs. The US SEC clarified that certain liquid staking activities aren't securities offerings. Chainlink delivers the price of US equities on-chain.

Quick Take

Over 40% of total trading volume on Jupiter flows through private or proprietary AMMs.

The US Securities and Exchange Commission (SEC) clarified that liquid staking activities do not constitute securities offerings.

Chainlink launched its Data Streams market data service which delivers real-time pricing for major US equities and exchange-traded funds (ETFs) directly on-chain.

Hyperliquid experienced a temporary outage on 30 July and announced refunds for affected users.

Circle is planning to deploy its Cross-Chain Transfer Protocol (CCTP) v2 and native USDC to Hyperliquid.

World Liberty Financial (WLFI) invested US$10 million in Falcon Finance to support the development of stablecoin infrastructure to improve liquidity and interoperability between Falcon USD (USDf) and World Liberty Financial USD (USD1).

BounceBit partnered with Franklin Templeton to bring the latter’s tokenised money market fund into BounceBit's structured yield platform, BB Prime.

Phantom acquired on-chain trading terminal SolSniper.

Solana-based DeFi lender Credix suffered a $4.5 million exploit after a hacker took over an administrator's wallet and drained liquidity pools.

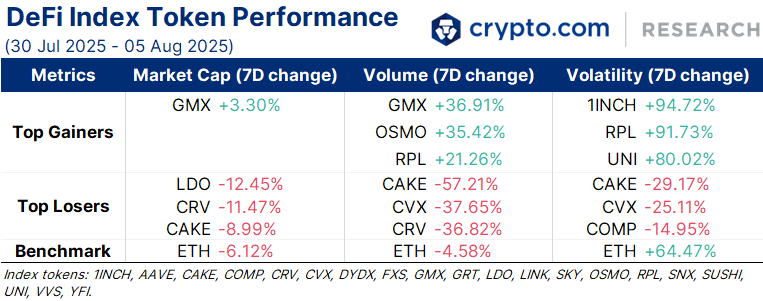

Weekly DeFi Index

This week, the market capitalisation and volume indices dropped by -8.44% and -19.06%, respectively, while the volatility index grew by +25.41%.

Chainlink (LINK) launched its Data Streams market data service to deliver real-time, low-latency pricing for major US equities and ETFs directly on-chain. The service is now live on 37 blockchain networks and has been integrated by decentralised finance (DeFi) protocols GMX and Kamino.

1inch Network (1INCH) introduced a new token warning system designed to enhance user protection on its decentralised exchange (DEX) platform.

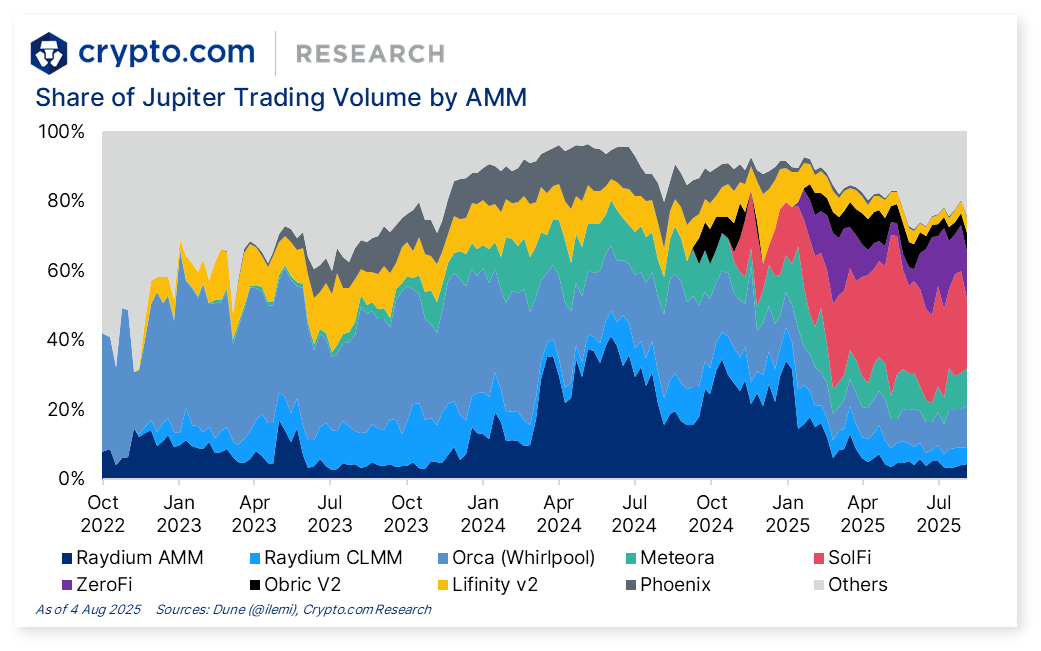

Chart of the Week

There is a significant shift in Solana’s DeFi landscape, showing that private automated market makers (AMMs) are quickly gaining market share over traditional public pools. Based on a four-week average, 46% of total trading volume on Jupiter, the current leading DEX aggregator on Solana, now flows through private or proprietary AMMs such as SolFi, ZeroFi, and Obric.

Private AMMs have gained significant market share in the past six months despite being closed-source and less transparent. They provide private, off-chain price quotes combined with on-chain trade execution, relying on vault-based liquidity and executing trades through aggregators without public frontends.

This trend raised concerns about centralisation as the control over liquidity and flow is in the hands of a few actors, weakening DeFi’s decentralisation.

News Highlights

The US SEC clarified that certain cryptocurrency liquid staking activities do not constitute securities offerings. This clarification aims to provide clearer guidance on digital asset regulations.

Derivatives DEX Hyperliquid experienced a temporary outage on 30 July due to a significant spike in traffic. The team announced that they will refund affected users and are working on improvements.

Circle is planning to deploy its Cross-Chain Transfer Protocol (CCTP) v2 and native USDC to Hyperliquid. This move aims to improve liquidity quality, reduce bridge risk, and streamline treasury rebalancing and cross-chain onboarding for users and builders. The rollout will occur on HyperEVM, enabling deposits to HyperCore and integration across HyperEVM apps.

World Liberty Financial (WLFI), a DeFi platform affiliated with US President Donald Trump, invested US$10 million in Falcon Finance to support the development of stablecoin infrastructure aimed at improving liquidity and interoperability between Falcon USD (USDf) and World Liberty Financial USD (USD1) stablecoins.

Crypto infrastructure provider BounceBit partnered with Franklin Templeton to bring the latter’s tokenised money market fund into BounceBit's structured yield platform, BB Prime. This collaboration combines US Treasury yields with crypto funding and basis arbitrage strategies, allowing investors to reap Treasury yields while adding additional return sources.

Solana-based wallet Phantom acquired SolSniper, an on-chain trading terminal for meme coins and NFTs. SolSniper’s automated sniping and wallet tracking features will be integrated into the Phantom wallet.

Solana-based DeFi lending protocol Credix suffered a $4.5 million exploit after a hacker took over an administrator's wallet and drained liquidity pools. Credix pledged to reimburse affected users within 24 to 48 hours.

Recent Research Reports

Digital Asset Treasury Strategy: This report focuses on the rise of altcoin treasury strategies. We examine the motivations behind these new allocations, and the potential opportunities and risks that differentiate altcoin strategies from their bitcoin counterparts.

Market Update (July 2025): Both the traditional and crypto markets exhibited a combination of policy-driven stability and increased risk appetite in July. This report provides an overview of market updates in July, highlights new developments, and provides our latest market outlook.

Research Roundup Newsletter [Jul 2025]: We present to you our latest issue of Research Roundup, featuring our deep dives into ‘InfoFi’ and ‘Crypto Credit Market’.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT. The latest crypto market insights are also available via the dashboard.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.